Corporate governance is the 1st step toward corporate sustainability and a key benchmark for measuring sustainable development. Sound corporate governance is embodied when the Board of Directors and management operate under the premise of serving the best interests of the company and its stakeholders, effectively overseeing and assisting corporate management and operations to achieve business goals. Meanwhile, it encourages the enterprise to utilize resources and become more efficient, thereby strengthening competitiveness and promoting the wellbeing of the public and society.

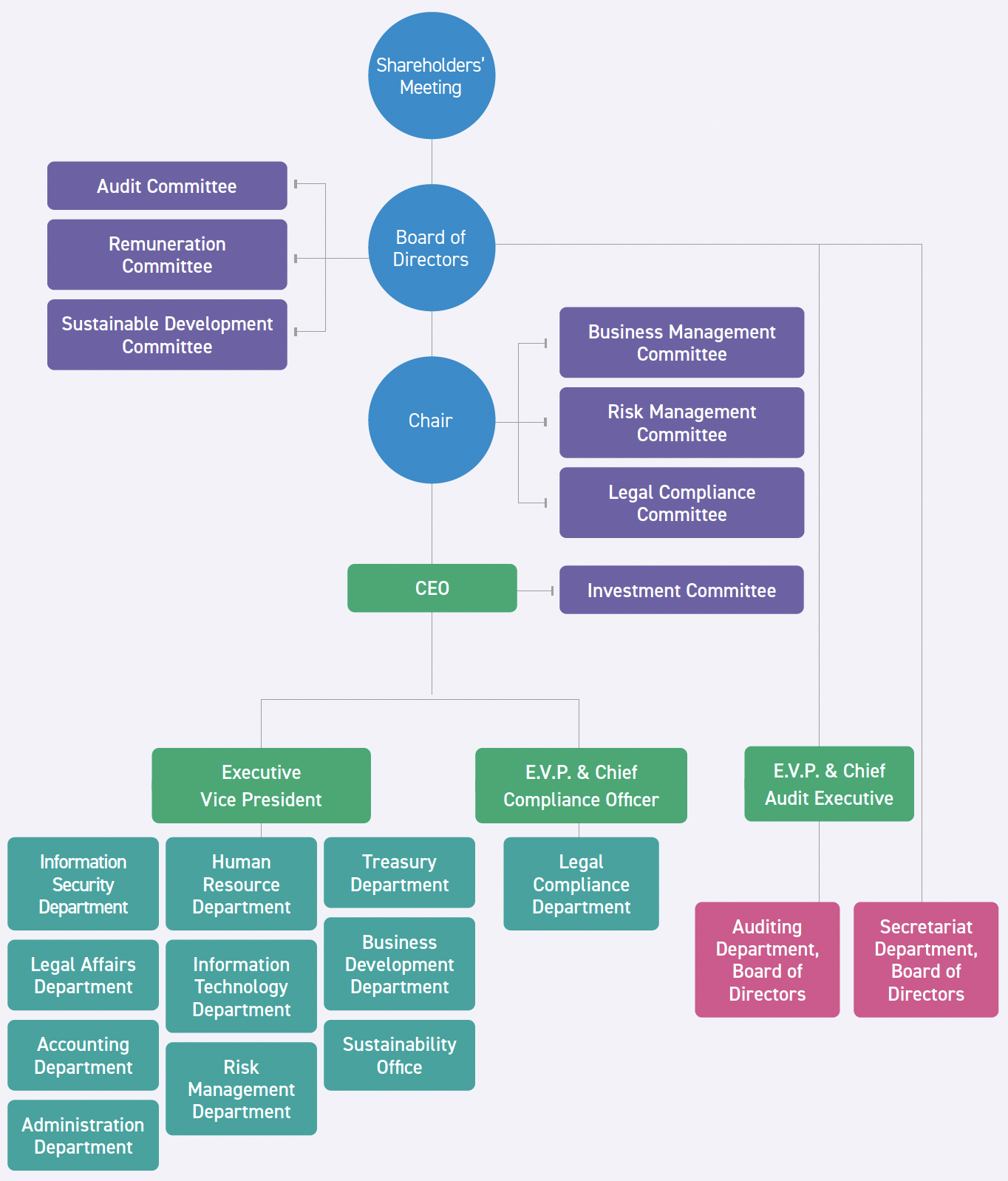

Corporate Governance Framework

TCFHC follows the FSC’s “Corporate Governance 3.0 – Sustainable Development Roadmap” and the TWSE and SFI’s “Corporate Governance Evaluation of TWSE/TPEx-Listed Companies” in enforcing corporate governance, in order to effectively promote corporate governance and business performance, boost organizational operations, and protect the rights of shareholders, employees, customers, and other stakeholders.

Board Structure and Operating Mechanism

Operations of the Board of Directors

TCFHC has a well-defined corporate governance framework and complies with governance-related regulations, including the “Articles of Incorporation”, “Corporate Governance Best Practice Principles”, “Ethical Corporate Management Best Practice Principles”, and “Sustainable Development Best Practice Principles”. Based on these, the Board of Directors is entrusted with the highest authority in corporate governance and is responsible for making sustainable development decisions on economic, social, and environmental aspects.

Since 2021, directors and independent directors have been elected through a candidate nomination system, with shareholders selecting from a list of nominees for directors and independent directors. They serve a term of 3 years. In 2024, 14 Board of Directors meetings were held, with an attendance rate of 95.71% for all 5th term directors.

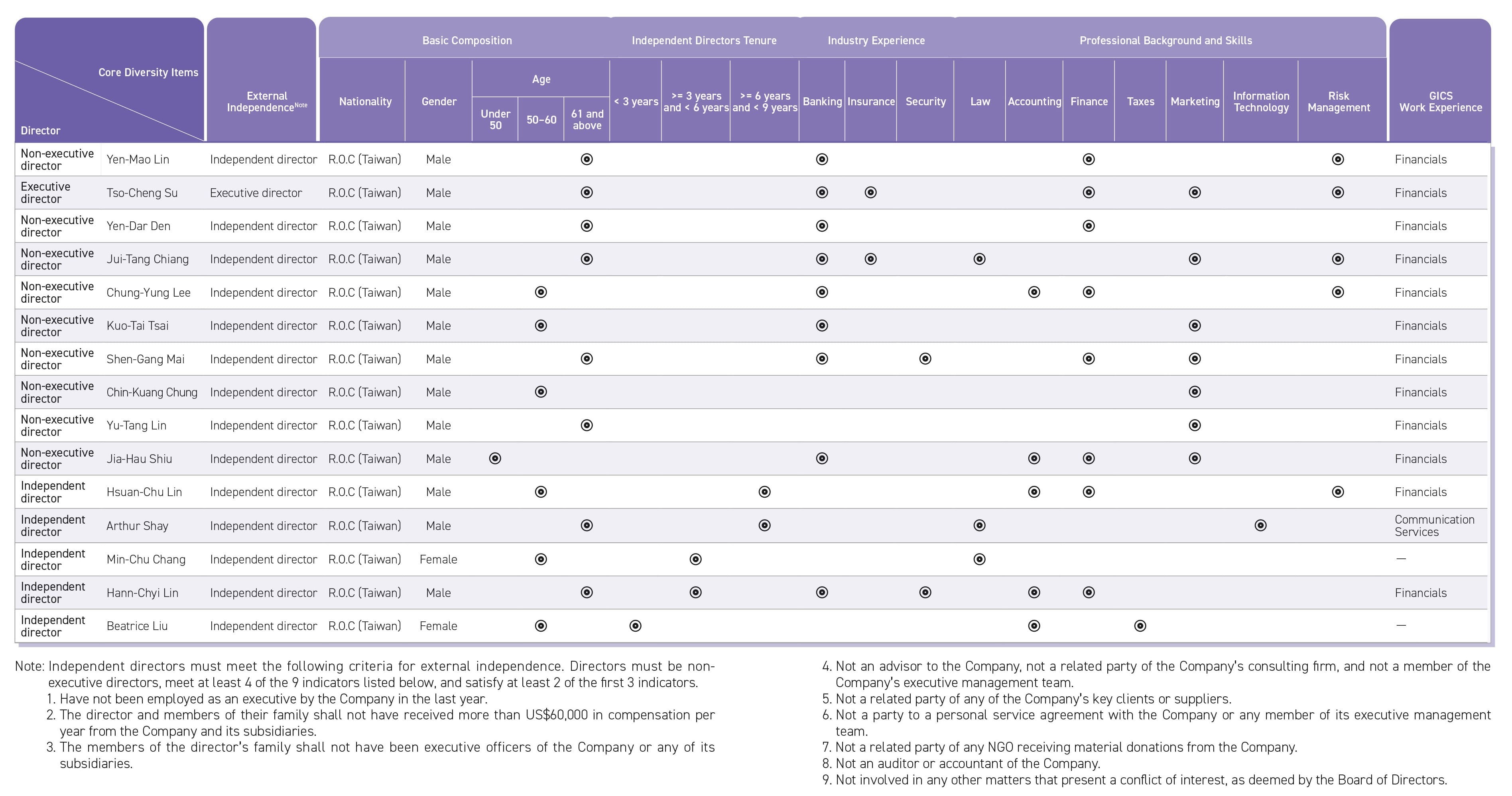

The Board of Directors has 15 members, consisting of 1 executive director, 5 independent directors, and 9 non-executive directors. The chair of the Board and the CEO are not the same person, nor are they spouses or close relatives within the 1st degree of kinship. There are no spousal or familial relationships within the 2nd degree of kinship among the directors, and independent directors may serve a maximum of 3 consecutive terms. These measures ensure the independence of the Company’s Board of Directors.

The members of the Company’s 5th Board of Directors possess rich experience and expertise in various fields, including business management, leadership and decision-making, industry knowledge, international perspectives, financial accounting and taxation, and law. Among them, 1 independent director has served for less than 3 years, 2 independent directors have served for more than 3 years but less than 6 years, 2 independent directors have served for more than 6 years but less than 9 years. The average tenure of the 5th-term Board members is 3 years. Currently, 3 directors of the Company are employees (including those from affiliates). The number of directors concurrently serving as the Company’s manager does not exceed one-third of the total number of directors. The age distribution of the directors is diverse, with 1 directors below the age of 50, 6 directors aged between 50 and 60, and 8 directors aged 61 or above,as of July 15, 2025. In terms of gender, there are 13 male directors (86.67%) and 2 female directors (13.33%). Regarding industry experience, 78.57% of the directors have relevant Global Industry Classification Standard (GICS) financial work experience (Tso-Cheng Su, as an executive director, is not included in this calculation). TCFHC places equal importance on gender equality and has set a goal of having at least 2 female members on the Board. At present, the number of female members on the Board of Directors for this term is 2, which meets the goal. The relevant implementations are listed as follows:

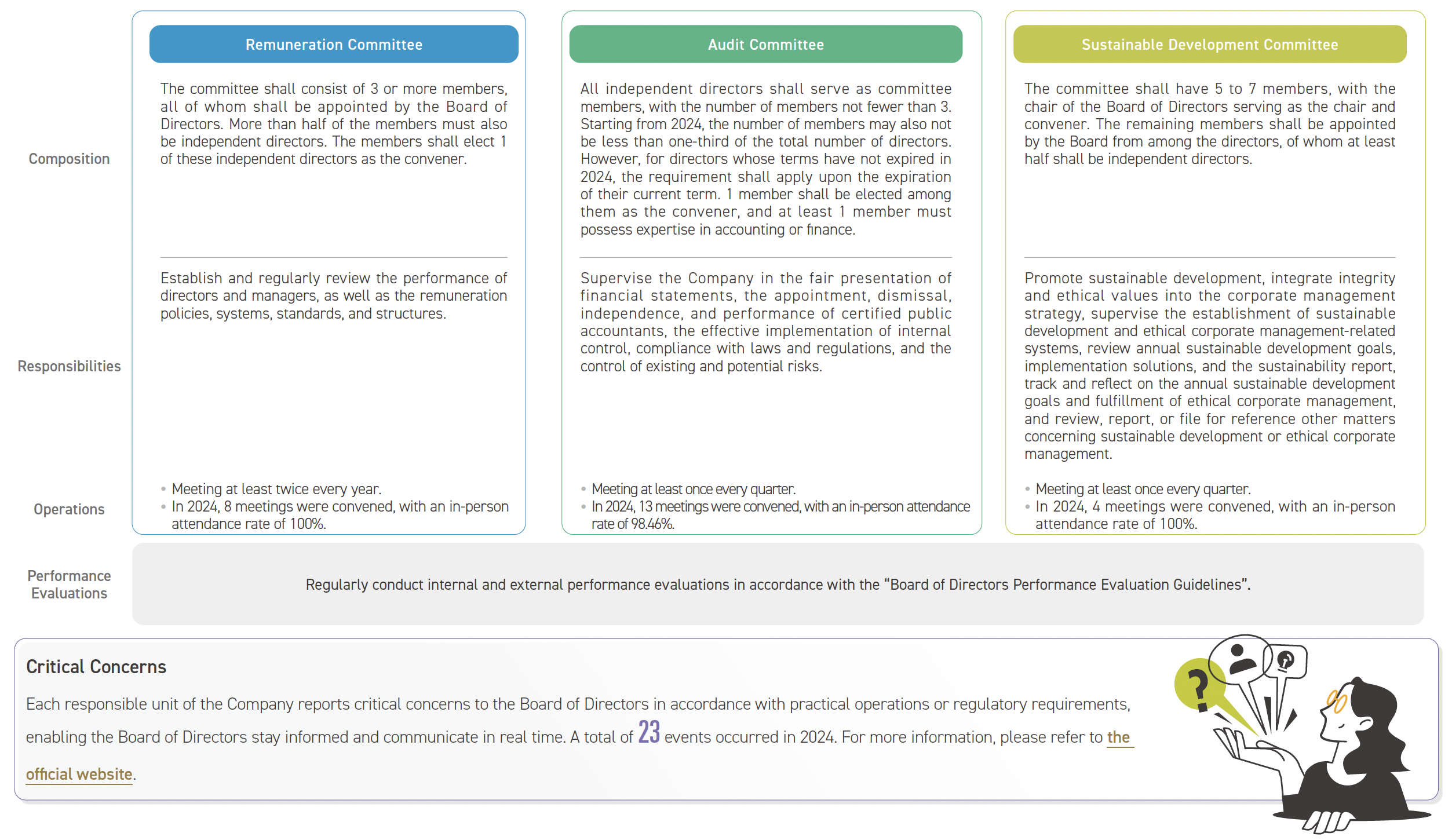

Functional Committees

To leverage the roles and strengthen the independence of the Board of Directors, the Company has established 3 functional committees under the Board which are the Remuneration Committee, the Audit Committee, and the Sustainable Development Committee. In addition, special committees have been established under the chair to enhance corporate governance and improve risk management and legal compliance systems.

Continuing Education for Directors

TCFHC follows the “Directions for the Implementation of Continuing Education for Directors and Supervisors of TWSE Listed and TPEx Listed Companies” and arranges training for directors to reinforce their professional capabilities, thereby facilitating corporate governance.

In 2024, directors completed a total of 186 hours of training encompassing corporate governance, fintech, IT security, anti-money laundering, risk management, and internal control and audit. In addition, to enable directors to effectively keep abreast of ESG issues and development trends, each director participated in 1 or more ESG-related courses. For details of the courses that TCFHC directors have participated in, please visit the TWSE Market Observation Post System website for inquiry.

Performance Policies Evaluation of the Board of Directors

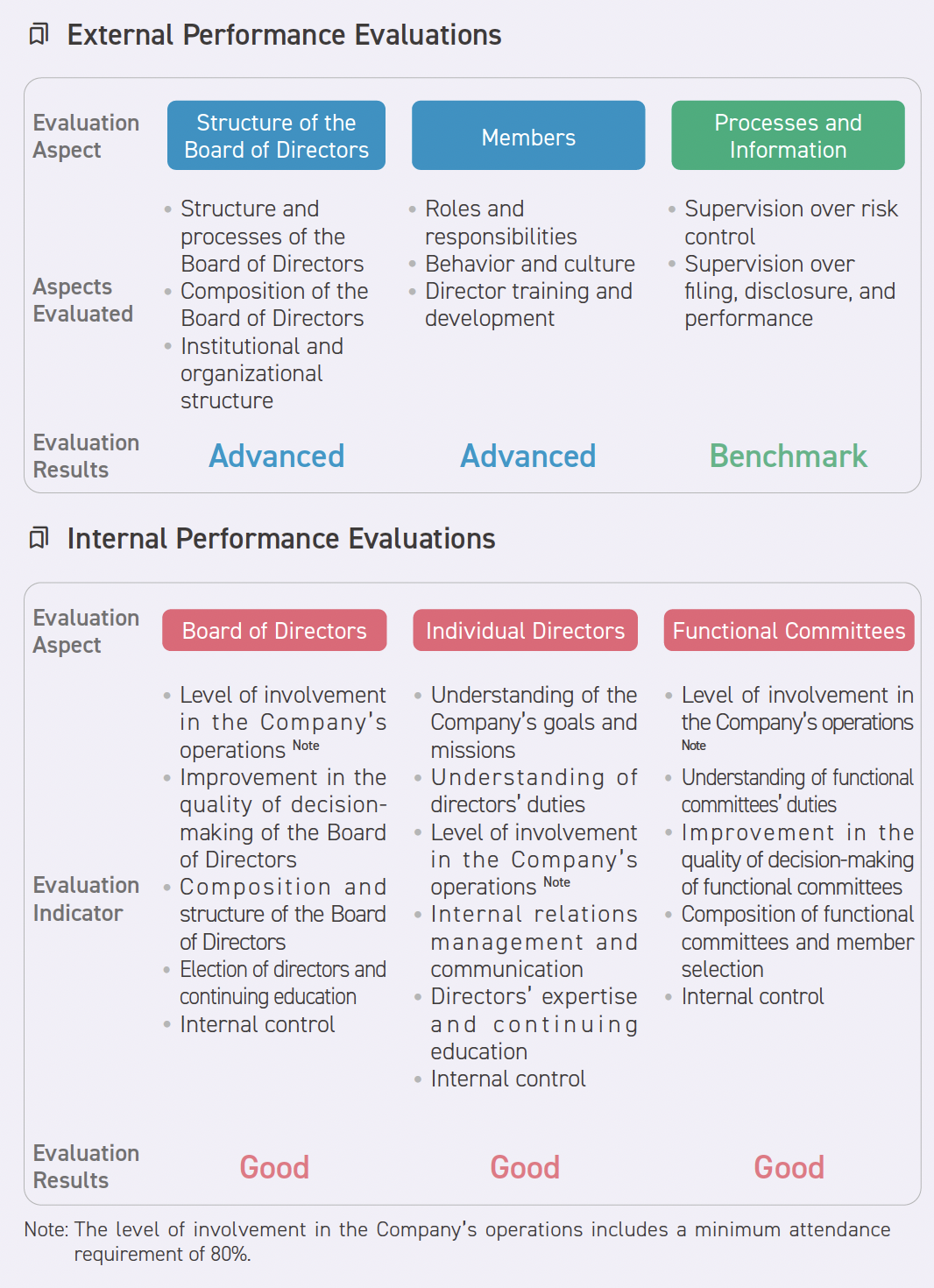

The “Board of Directors Performance Evaluation Guidelines” were established to enhance the operational effectiveness of TCFHC’s Board of Directors. The Board of Directors and functional committees shall conduct internal performance evaluations each year. They shall also engage external professional independent institutions or teams of external experts and scholars to conduct evaluations at least once every 3 years. The evaluation results shall be reported to the Board of Directors by the end of March of the following year. The result of such evaluations are used as a reference for appointing or nominating directors, while the results of each individual director’s evaluation serve as reference for determining their respective individual remuneration.

In 2023, the Company engaged a third-party institution to conduct an external performance evaluation of the Board of Directors. The overall performance in 3 major aspects, namely, “Structure”, “People”, and “Process and Information” was rated “Advanced”, “Advanced”, and “Benchmark”, respectively. The scope of the Board of Directors’ internal evaluation for 2024 included the Board as a whole, individual members of the Board, and functional committees. The evaluation methods consisted of internal self-assessments and self-assessments by directors and committee members. All evaluation results were rated as “Good”. The evaluation cycle, period, scope, methods, and results of the performance of TCFHC’s Board of Directors are all announced on the Company’s official website.

Remuneration of Directors and Senior Management

Directors

The Company’s directors’ remuneration includes monthly compensation, health check-up subsidies (on a reimbursement basis), and directors’ remuneration. The monthly compensation standard for directors (excluding the chair) is authorized by the Board of Directors based on the recommendations of the Remuneration Committee. It is determined with comprehensive consideration of their level of participation in the Company’s operations, the value of their contributions, the Company’s operating performance, and common industry standards. In addition, the Company conducts an internal performance evaluation of directors annually and an external evaluation every three years. The results are submitted to the Remuneration Committee and the Board of Directors as a reference for determining directors' compensation. Independent directors who serve as members of functional committees receive research fees based on the number of meetings attended. Directors’ compensation is based on the Company’s pre-tax profits before deducting employee and director compensation, and must not exceed the maximum limit (no more than 1%) set in the Articles of Incorporation. This is subject to review and approval by the Remuneration Committee and the Board of Directors and is then reported at the shareholders’ meeting. As for the Chair's compensation, it is specified in the Articles of Incorporation that it shall be 1.25 times the total income received by the General Manager.

Senior Management

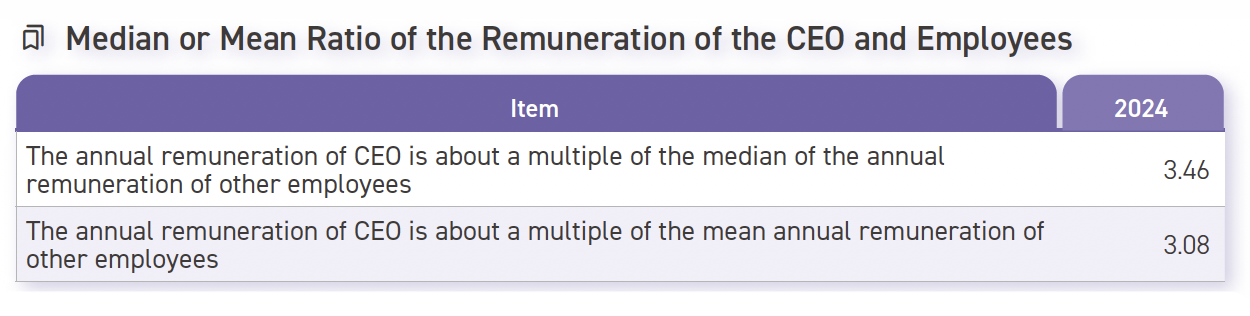

The Company has established its Articles of Incorporation and regulations governing salary, bonuses, and remuneration. Remuneration is determined based on managerial grade level, position, and individual performance evaluations. In order to ensure that remuneration remains aligned with general market standards, the Company regularly reviews the annual remuneration levels of comparable positions within the industry. Furthermore, the salaries and annual bonuses for all personnel at the managerial level and above are submitted annually to the Remuneration Committee and the Board of Directors for review and approval.

Fixed Remuneration

The salaries of the Company's senior management (excluding the CEO) are determined based on the corresponding grade and level in accordance with the Company’s “Employee Salary Scale”. Each year, the proposed salary standards for these positions are submitted to the Remuneration Committee for recommendation and then presented to the Board of Directors for approval. Any new or revised standards for supervisory position allowances and meal stipends follow the same procedure—first reviewed by the Remuneration Committee, then submitted to the Board of Directors for deliberation and approval before implementation. At the end of each year, in accordance with regulatory requirements, the Company also submits the remuneration policies for managerial personnel to the Remuneration Committee for review and evaluation.

The CEO remuneration standard is proposed annually by the Remuneration Committee and subsequently submitted to the Board of Directors for approval. Any adjustments to this compensation follow the same procedure.

Variable Remuneration

Variable remuneration mainly refers to management performance bonuses, including evaluation bonuses, performance bonuses, and employee remuneration, all of which are paid on a deferred basis.

The annual performance evaluation of the CEO includes both financial and non-financial indicators. Financial indicators encompass the goal attainment rate and growth rate of earnings before tax, return on equity (ROE) attainment rate and growth rate, output rate attainment and growth rate, non-performing loan ratio, and the loan coverage rate and expected loan coverage rate without including government loans. Non-financial indicators include the effectiveness of subsidiary management and business reform efforts, as well as comparisons with the financial performance of industry peers, including profit target achievement rate, return on equity (ROE), and return on total assets (ROA). These indicators are comprehensively considered to determine the amount of the CEO's annual variable compensation. In addition, the Company links part of the CEO's remuneration to a long-term retention scheme via an employee stock ownership trust, under which the public reserve portion is deferred for at least six years before it can be claimed. This deferred variable remuneration accounts for approximately 0.6% of the CEO's total annual remuneration. Furthermore, if any confirmed civil liabilities to the Company arise before bonus distribution, the bonus is subject to separate review and potential reduction or cancellation by the Board of Directors.

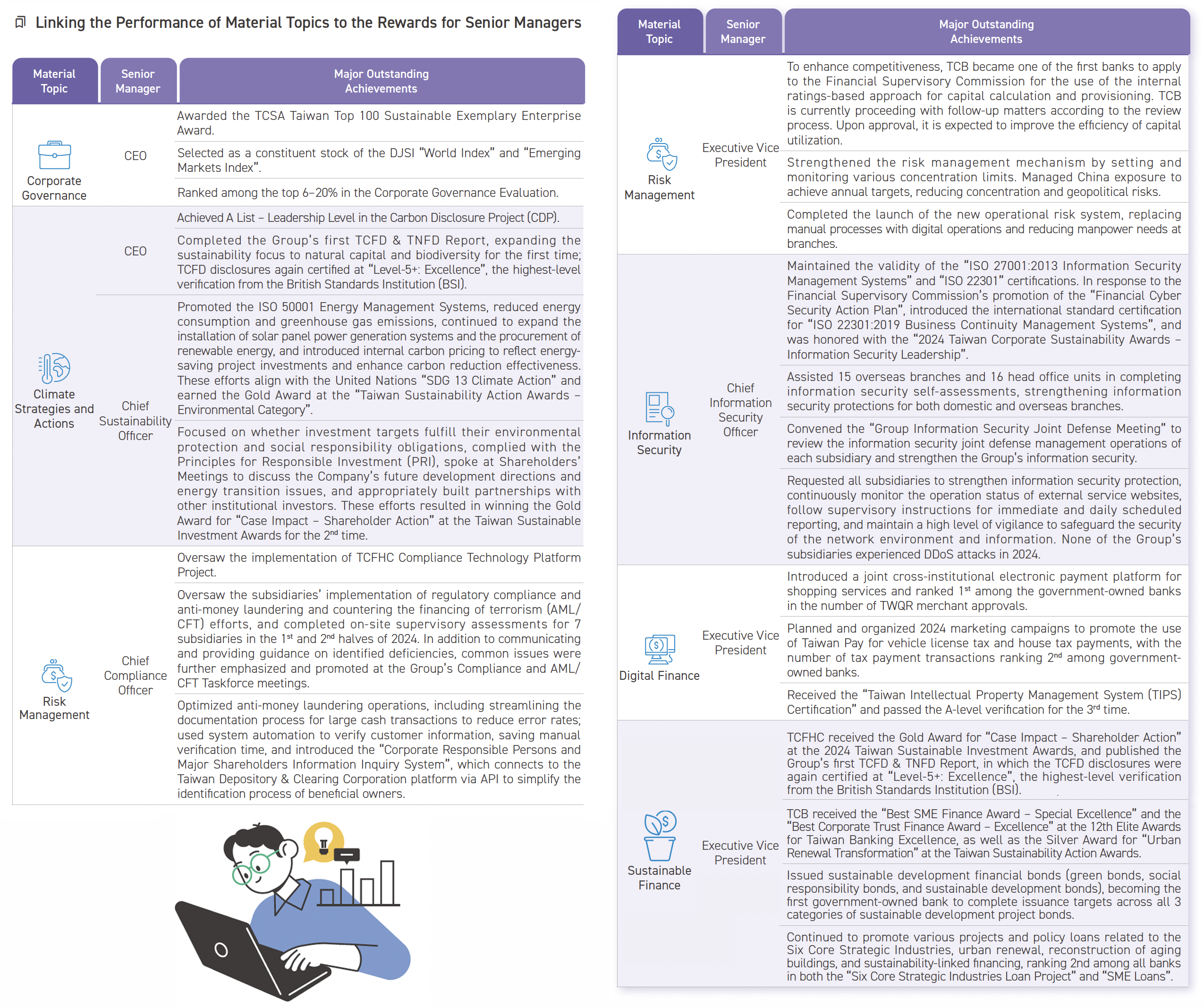

In recent years, to enhance the Group’s ESG performance and encourage senior management (including the CEO's) to prioritize corporate sustainability, a “Significant Achievements” section has been added to the senior management performance evaluation form. This section includes key evaluation criteria such as the execution of major annual ESG initiatives and significant positive achievements (including but not limited to corporate governance, business operations, environmental sustainability, and corporate social responsibility). These criteria are key components of the year-end assessment. Moreover, the Company has designated outstanding ESG contributions by managerial personnel as important indicators for determining annual remuneration, which are reviewed by the Remuneration Committee and submitted to the Board of Directors for final approval. Subsidiaries are also evaluated based on the execution of major ESG initiatives and key operational policies. Subsidiaries may submit relevant evidence and documentation to apply for additional performance evaluation points (up to a maximum of 10 points).

To encourage the implementation of sustainable operations, the Group not only links the annual bonuses of senior management but also the performance evaluations of subsidiaries to specific ESG initiatives, aiming to promote sustainable development through top-down efforts and create positive impacts for stakeholders.

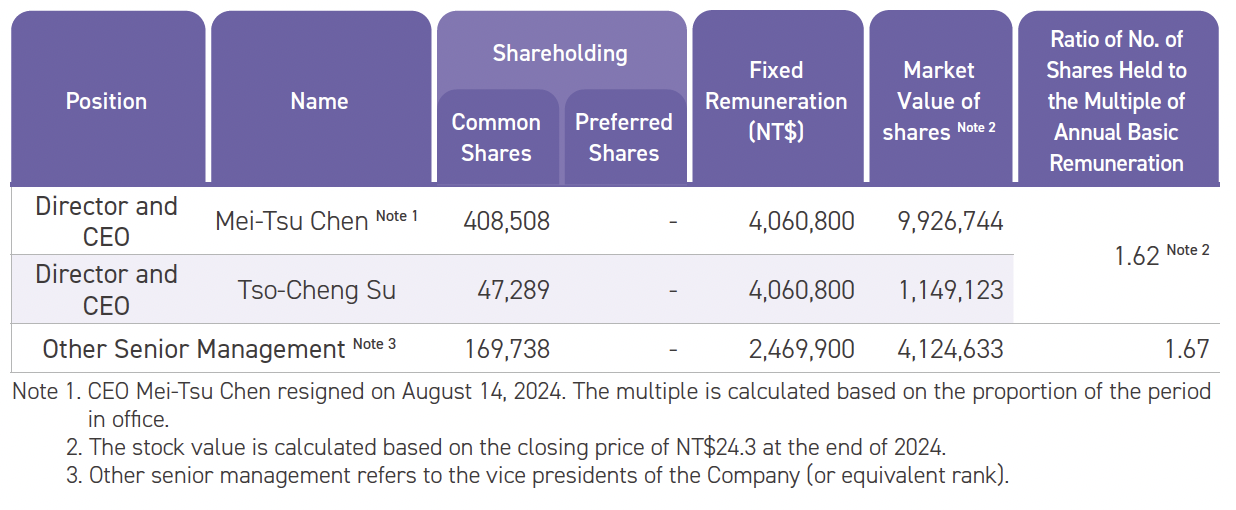

Shareholding

Although the Group has not yet stipulated relevant regulations regarding the shareholding of senior management, it has included the Company’s financial achievements as an evaluation indicator for business performance bonuses. The Group also links it to the employees’ performance evaluation and rewards, hoping that the long-term interests of the management and shareholders will gradually align. The shareholding of the president and other senior management has gradually increased over the years. In addition, to strengthen employees’ sense of belonging to the Company, starting from 2024, the “employee stock ownership trust” has been expanded to cover the Company and all subsidiaries within the Group. The Company allocates monthly subscription funds (company contributions) for employees participating in the trust, encouraging employees and senior management to regularly and systematically purchase and hold the Company’s shares during their tenure, thereby sharing the Company’s operational achievements as shareholders.

Board of Directors and Key Management Succession Plan

Succession Planning for Board Members

The Company’s Board of Directors is composed of 15 members, including 6 directors representing government shareholders—nominated by the Ministry of Finance, the largest shareholder—from among senior civil servants, professional managers, and industry experts; 4 directors representing private shareholders, and 5 independent directors with extensive management experience, academic expertise, or professional qualifications.

The government-appointed director representing public shareholdings was carefully selected by the Ministry of Finance based on merit. The director possesses strong expertise in business management, strategic decision-making, industry knowledge, global perspective, finance and taxation, as well as legal affairs. Under professional leadership and effective collaboration with the management team, the Company has achieved steady profit growth and consistent dividend payouts in recent years. Our operational performance has been well recognized and highly regarded by investors.

The election of independent directors in the Company is conducted through a candidate nomination system, whereby shareholders elect independent directors from a list of nominated candidates. The independent directors possess professional qualifications and practical experience in areas such as business, law, finance, accounting, or other fields relevant to the Company’s operations. Their expertise provides substantial support in safeguarding consumer and investor interests and in strengthening corporate governance.

A majority of the members of our Board of Directors are government-appointed directors representing public shareholdings, selected by the Ministry of Finance based on merit. The Company ensures that directors receive appropriate continuing education by encouraging their participation in seminars, workshops, forums, or training programs covering key corporate governance topics, including finance, risk management, business operations, legal affairs, accounting, and internal control systems. These efforts also contribute to the development of future leadership and succession planning.

Succession Planning for Key Management

Most of the senior management positions in the Company are concurrently held by executives at the department head level or above from the head office of TCB. The implementation status of TCB management development plan for the year 2024 is as follows:

Regular Training Programs for Management Personnel

To ensure continuity in leadership, regular training courses are provided for management personnel at all levels. Both internal and external experts are invited to deliver lectures, aiming to enhance professional competencies and soft skills, while expanding and enriching the talent pool. In addition, various departments conduct business-related training programs to continuously strengthen the financial expertise and professional knowledge of managers at all levels.

Specialized Programs for Management Personnel at All Levels:

Succession Planning for Senior Executives (Including CEO and Deputy General Managers)

- Selected deputy general managers participated in the “Executive Leadership Enhancement Program for Senior Financial Executives” held byTaiwan Academy of Banking and Finance, 2 participants attended in 2024.

- Selected department heads participated in the “Senior Talent Training Program for Public-Owned Enterprises” held by Ministry of Finance, 5 participants attended in 2024, with a total of 19 individuals being prepared for senior executive positions.

Newly Appointed General Managers

- Newly promoted managers participated in the “Training Program for New Managers”, with 2 sessions held in 2024 and a total of 41 participants. Course content included branch operations sharing, customer complaint handling, financial-friendly services, key business topics (credit, and foreign exchange), and performance enhancement techniques and leadership communication skills taught by expert instructors.

General Manager Candidates

- Deputy general managers were selected to attend the “Advanced Executive Management Development Workshop”. 2 sessions were held in 2024 with 73 participants, bringing the total pool of trained managerial candidates to 240. The program included branch experience sharing, discussions on key business issues by supervising departments, training on performance goal management, core leadership, and sales strategies.

Deputy General Manager Candidates

- Assistant general manager were selected to attend the “Intermediate Executive Management Development Workshop”. 2 sessions were held in 2024 with 101 participants, bringing the total number of trained assistant manager candidates to 288. Course topics included key business issues (credit, digital finance, and wealth management), complaint handling, and leadership training focused on team development.

Newly Appointed Assistant General Managers

- Outstanding employees who passed qualification assessments were promoted to managerial positions and enrolled in the “Junior Executive Seminar”. 1 session was held in 2024 with 142 participants. Topics included key business issues (AML, audit findings, deposits and remittances, complaints, wealth management, and digital finance) and foundational supervisory skills taught by professional instructors.

In alignment with business needs, an annual training plan was developed to offer a wide range of professional courses aimed at enhancing the functional competencies of management personnel. In 2024, a total of 60 training sessions were conducted for assistant manager-level personnel and above. The training topics were diverse, covering core business areas such as deposits and remittances, foreign exchange, loans, and wealth management, as well as regulatory compliance, anti-money laundering, environmental sustainability, and industry outlook. The total number of participants across all sessions reached to 5,725.

Regular Promotion Assessment

In accordance with the “Guidelines for Promotion Assessment of Current Employees ” and related regulations, the Company regularly evaluates workforce allocation at all levels to determine the number of eligible promotions. Promotion assessments are conducted on a regular basis. In 2024, a total of 1,510 employees were promoted, including 428 individuals promoted to assistant manager level and above.