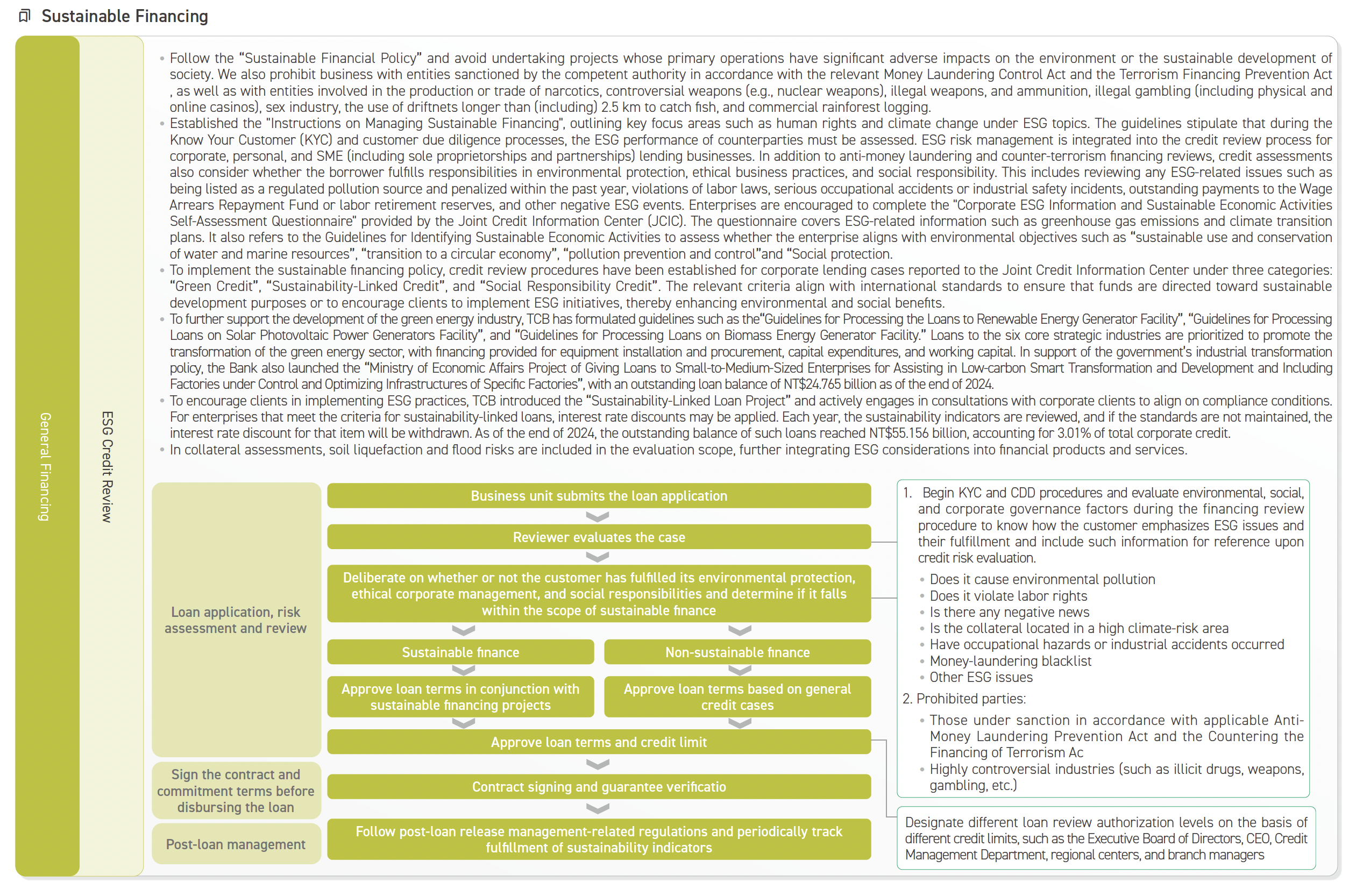

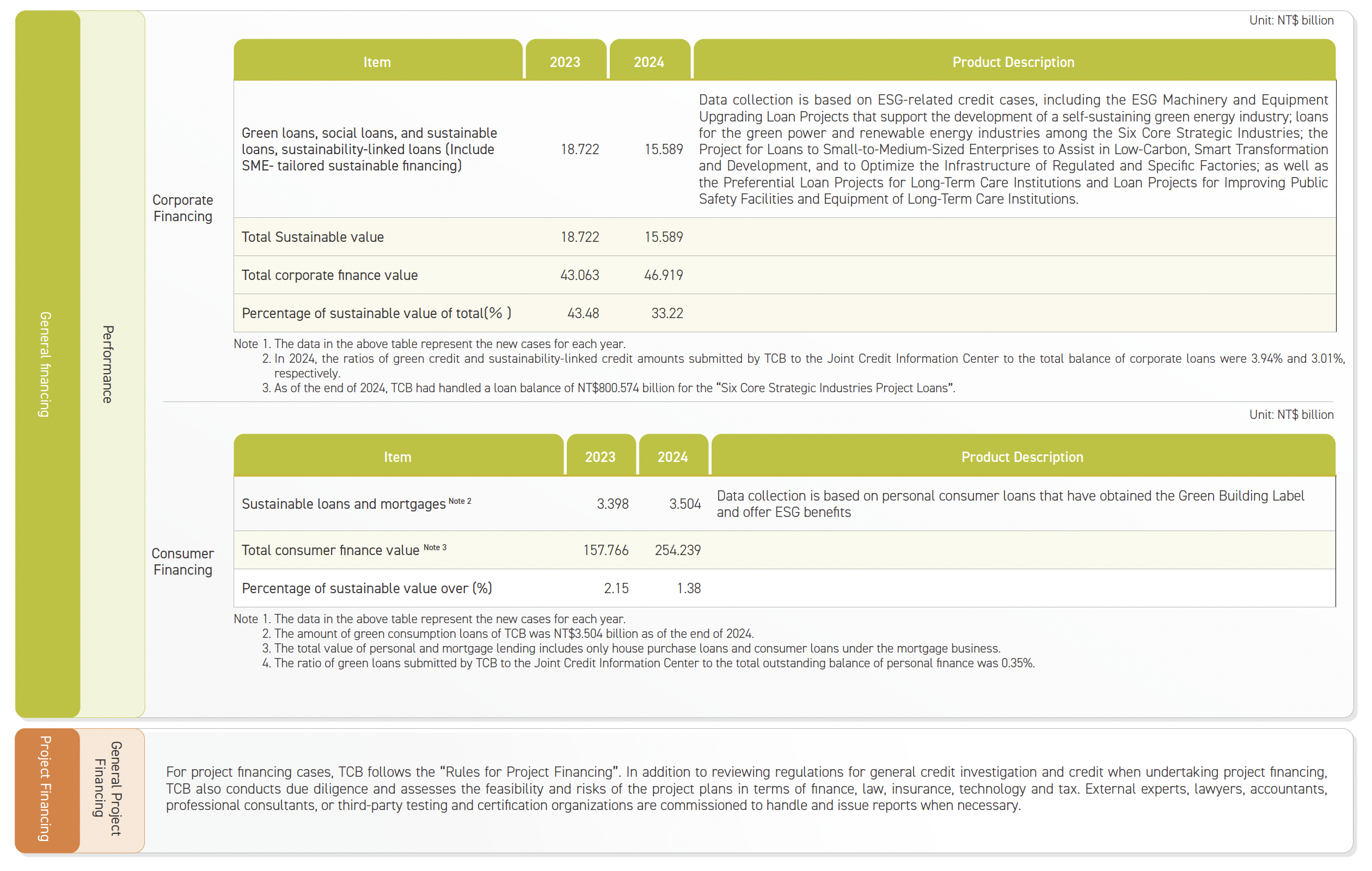

Sustainable Finance Management Framework

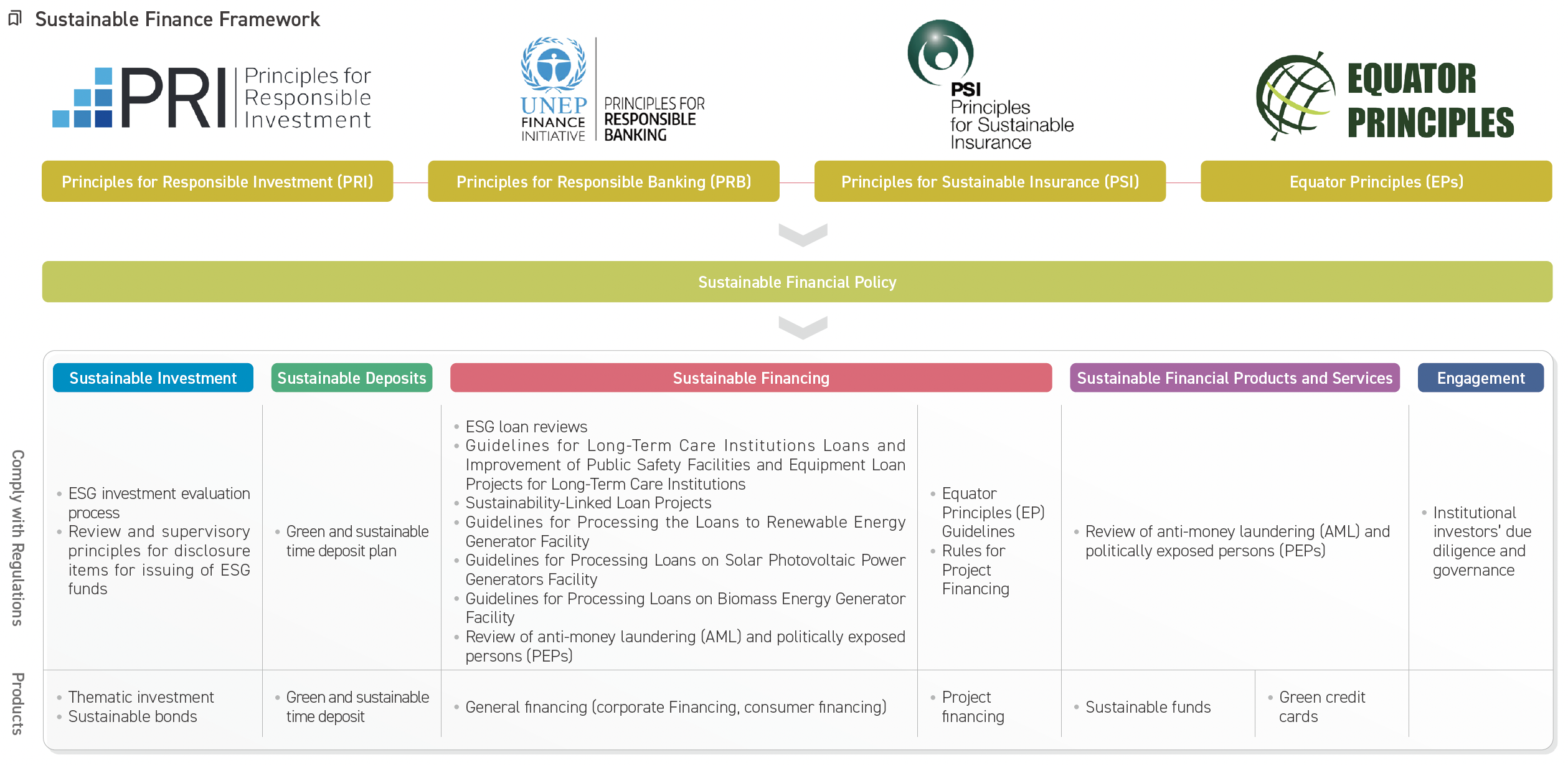

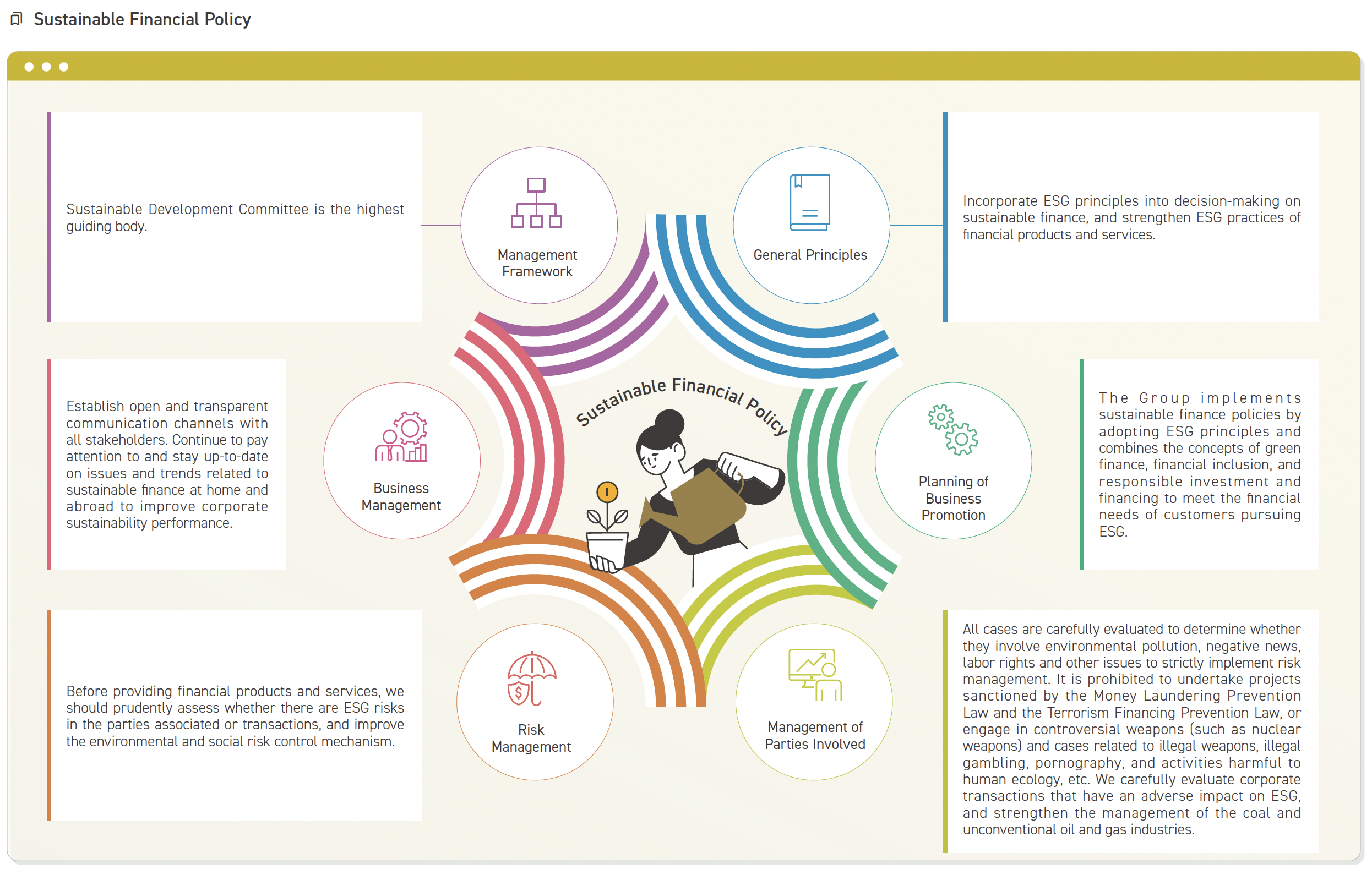

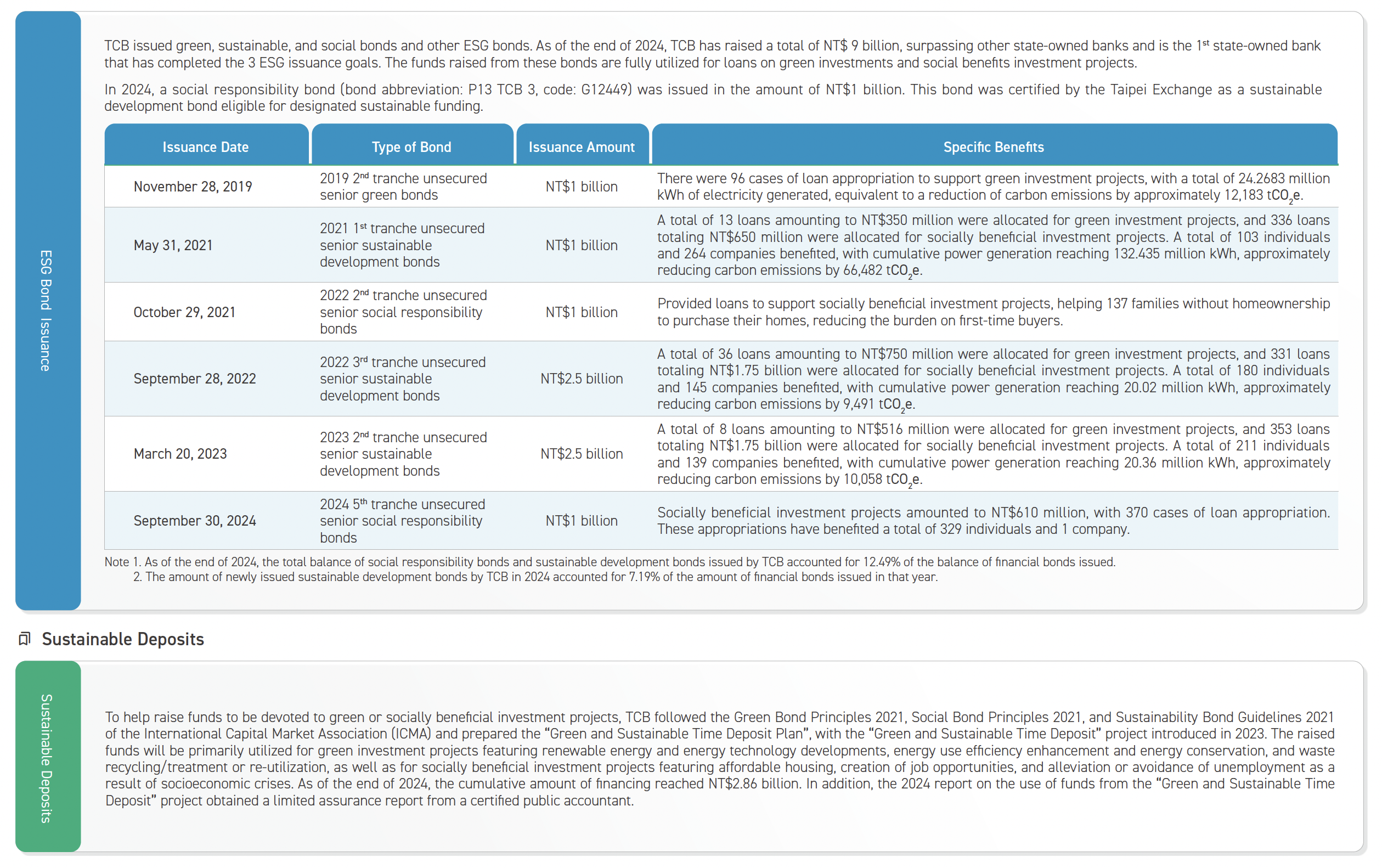

Financial institutions can use the power of investment and financing to guide the transformation of enterprises on the net-zero path. To leverage the core influence of the financial industry, the Group actively aligns with international standards to promote sustainable finance, following principles and guidelines such as the PRI, PRB, and PSI. It has also signed the Equator Principles (EPs), set medium- and long-term carbon reduction targets, and passed the SBTi review. Following the above international standards and initiatives, the Company has formulated the “Sustainable Financial Policy” and incorporated ESG factors into the development strategies and operating procedures of core businesses such as investment, financing, underwriting, and insurance, to achieve the Group’s long-term goals of low-carbon transitions in investments and financing.

Each subsidiary of the Group follows the "Sustainable Finance Policy" as the highest guiding principle and formulates relevant procedures for sustainable investment, sustainable financing, and sustainable financial products in accordance with international sustainable finance standards to ensure effective implementation. The Company has established the “Investment and Financing Business Standards for Coal Phase-Out and Unconventional Oil and Gas Exploration” for industries related to coal-fired power generation, coal mining, coal trading, and unconventional oil and gas. These standards define thresholds for investment and financing cases as well as divestment deadlines (there is currently no investment in arctic oil and gas). Before the divestment period ends, the Company seeks to understand the investee’s carbon reduction actions or net-zero plans and engages in ongoing dialogue with clients to support their low-carbon transition.

To promote joint sustainable development with investee companies, TCB, TCS, BNP TCB Life, and TCSIT have all signed the “Stewardship Principles for Institutional Investors” declaration. Through dialogue with investee companies and participation in shareholders’ meetings, the Group continues to monitor the implementation of ESG practices. The Group also regularly discloses stewardship reports, annual voting records, and engagement records, actively practicing shareholder activism.

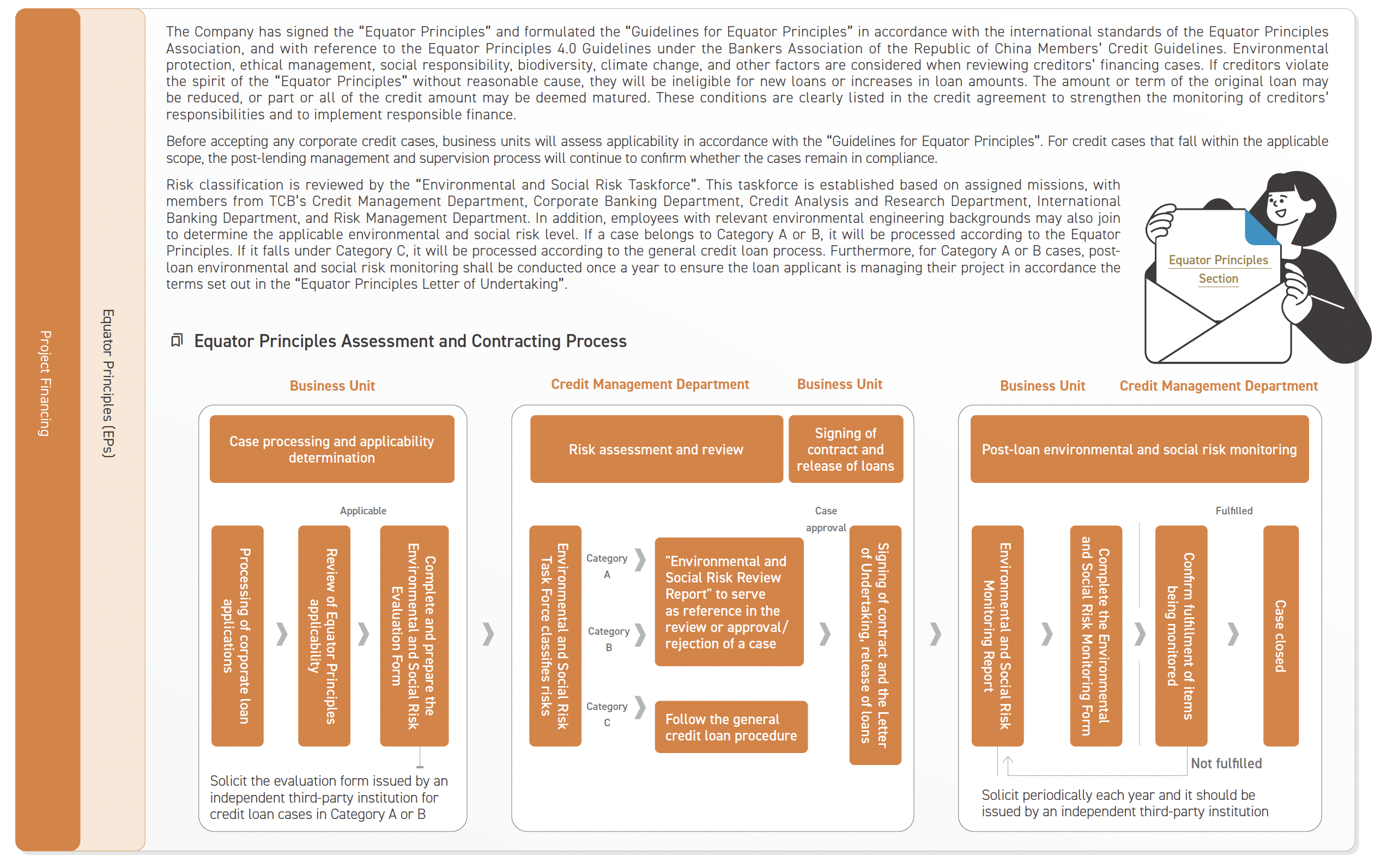

Introduction to the Equator Principles

The Equator Principles (EP) which are issued by The Equator Principles Association in 2003, are intended to serve as a common baseline and risk management framework for financial institutions to assure, assess and manage environmental and social risks when financing projects. To fulfill its commitments to corporate sustainable development, Taiwan Cooperative Financial Holdings Company became an Equator Principles Financial Institution (EFPI) on March 30, 2022. See more information on The Equator Principles Association Website: https://equator-principles.com/

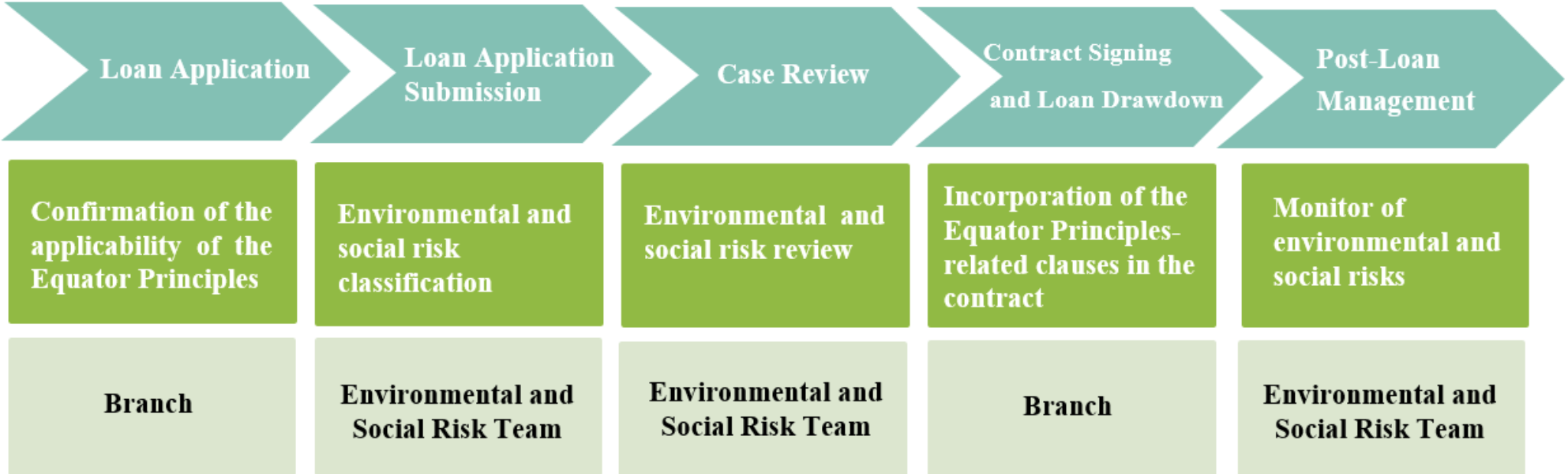

Implementation Procedure of the Equator Principles

In line with the Equator Principles, the subsidiaries of TCFHC have formulated the" Guidelines for Loans Applicable to the Equator Principles " and related operating procedures. The Taiwan Cooperative Bank set up an "Environmental and Social Risk Team,” responsible for evaluating the impact of the environmental and social risks on the case and composing the Environmental and Social Risk Review Report for the authority level to approve, to ensure that the case meets the requirements of the Equator Principles, the environmental and social regulations to fulfill the social responsibilities of the bank.

Education and training

To help all units familiarize with the mechanisms of the Equator Principles and the newly added forms for EP implementation, we appoint external consultants to provide training courses and materials to deepen employees’ understanding of environmental and social risks to fully comply with the Equator Principles.

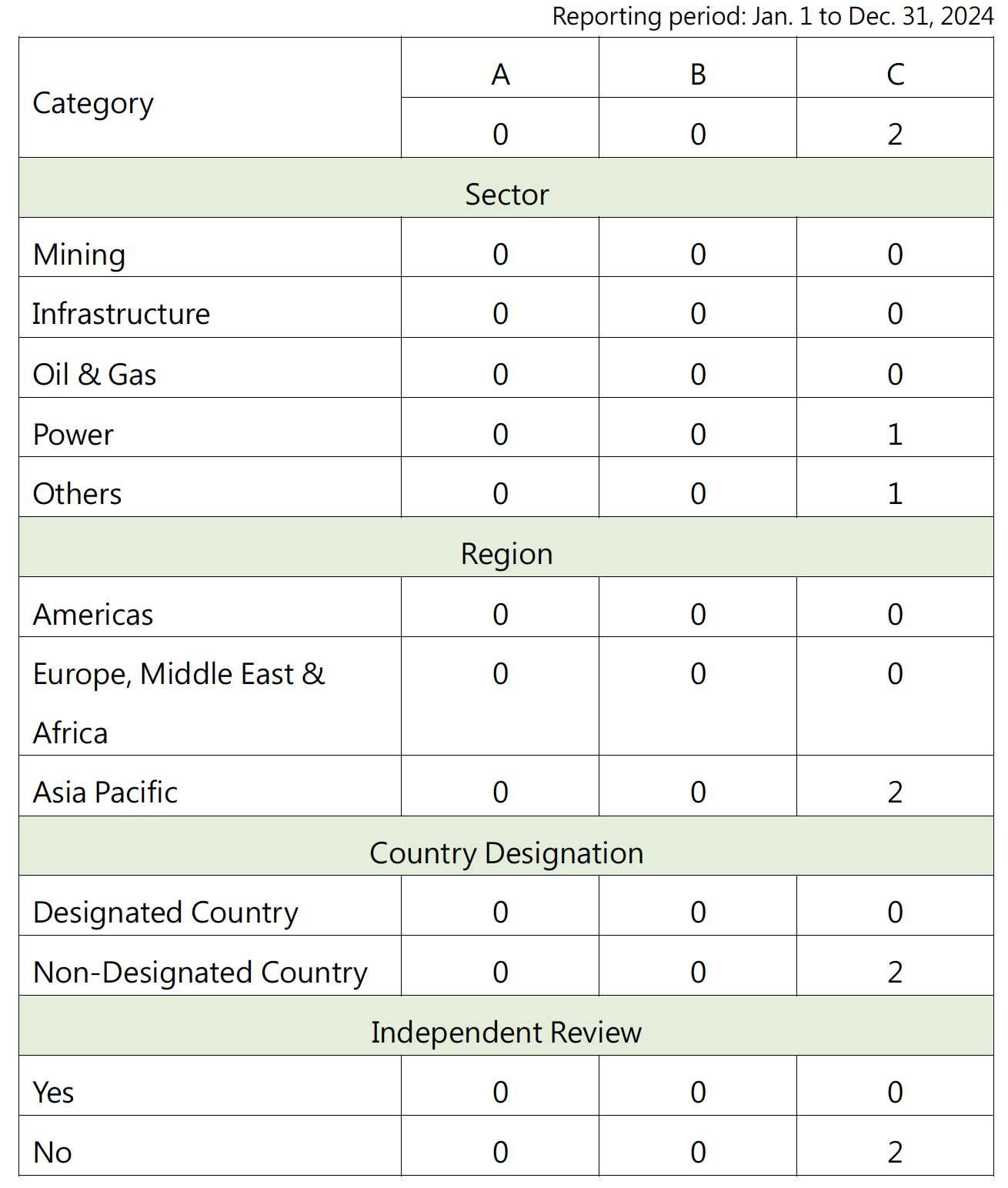

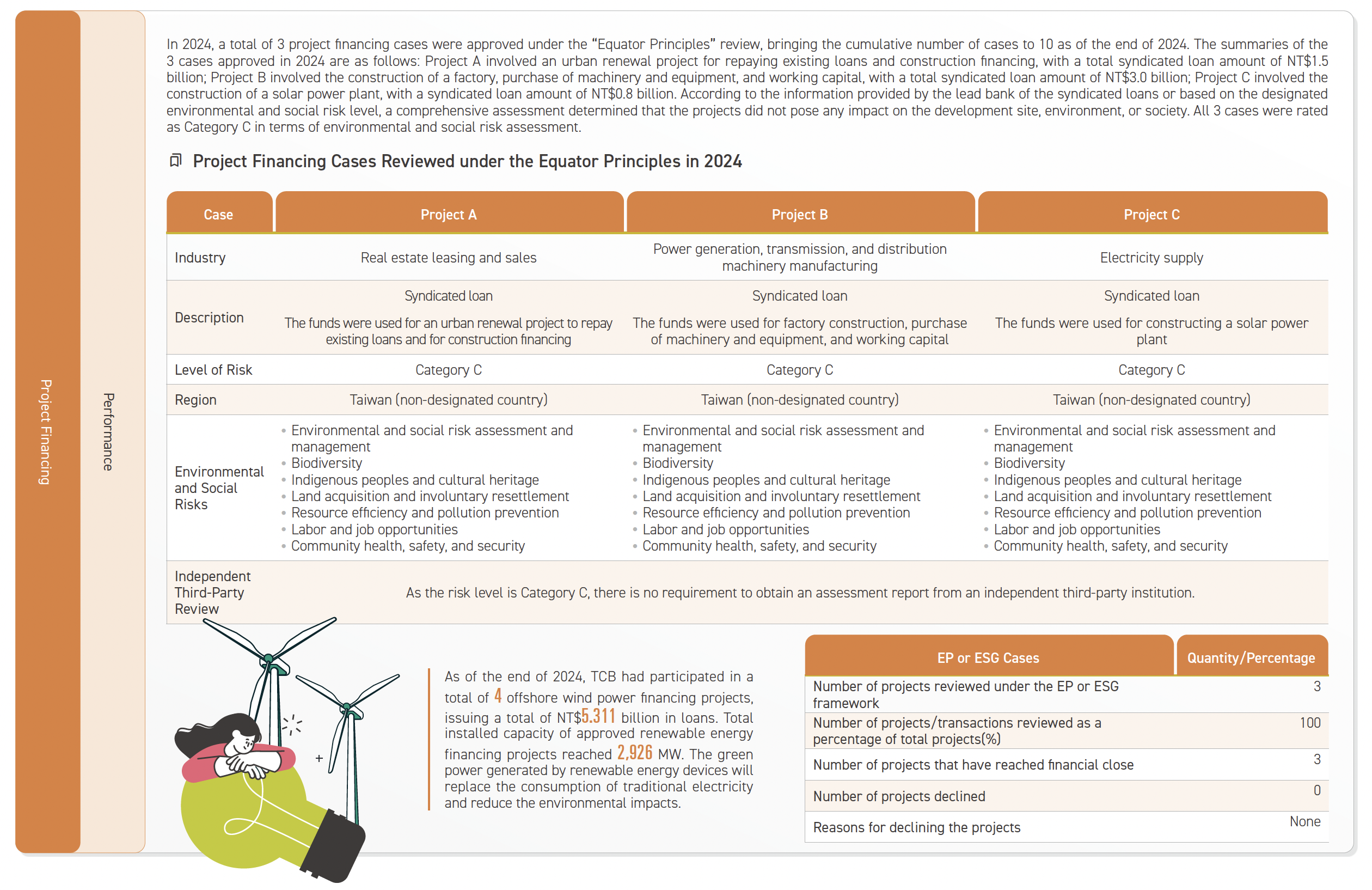

Annual Equator Principles Report

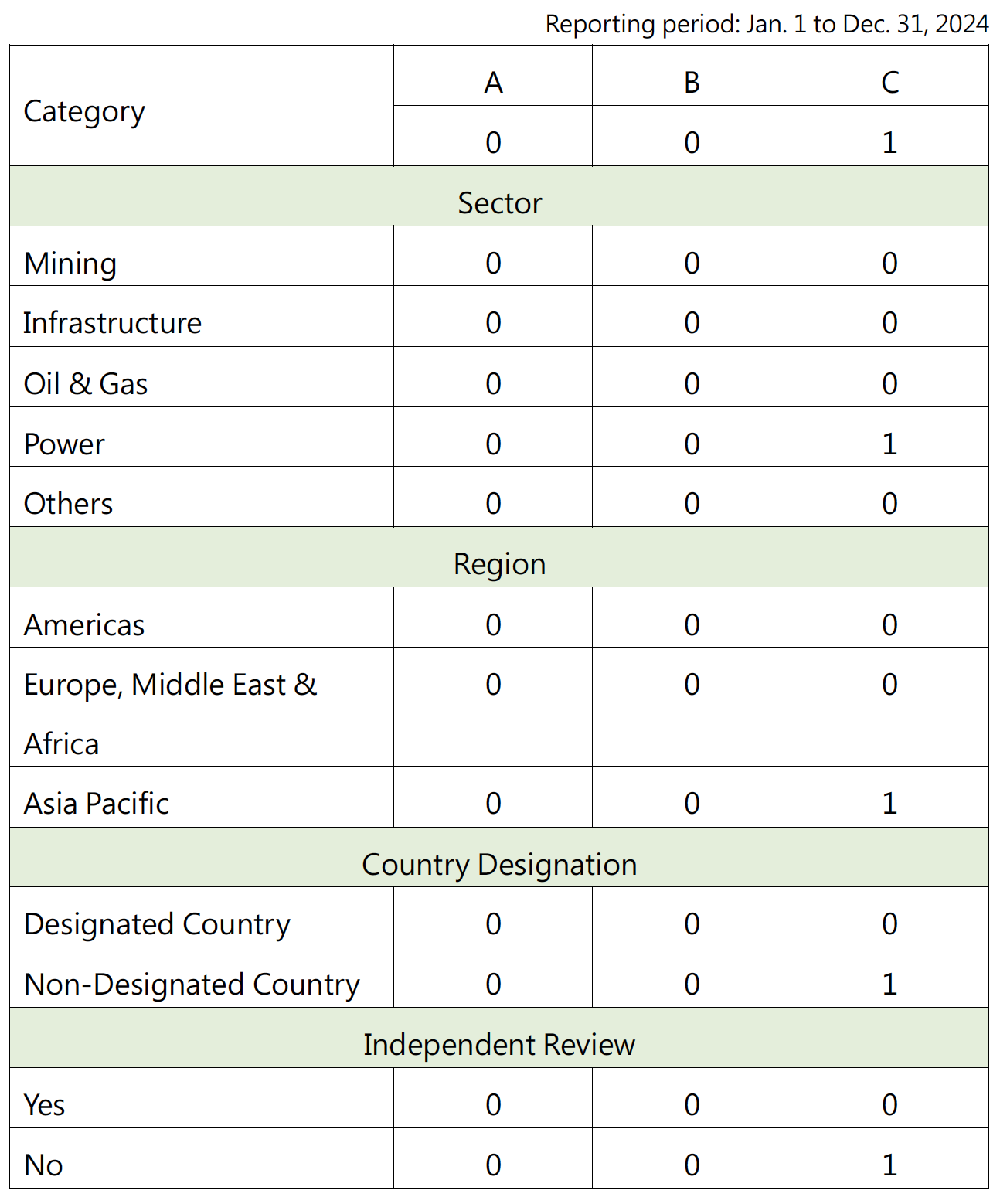

In 2024, 1 Project Finance transactions and 2 Project-Related Corporate Loans covered by the Equator Principles, reached financial close. No Project Finance Advisory mandated and no project-related refinance and acquisition finance was extended in 2024.

Project Finance (PF)

Project-related Corporate Loans (PRCL)