Legal Compliance

The compliance system is an important part of internal control and serves the purposes of anti-money laundering, combating the financing of terrorism, and deterring other illegal activities. It also prevents key compliance failures that endanger the Company’s operations and cause disruption in the financial market. TCFHC implements relevant organizational frameworks, regulations, and rules to equip itself with the ability to address regulatory or environmental changes at any time and to supervise its legal compliance status. TCFHC also provides internal training in order to avoid legal risks arising from violations of law and to fulfill its role as a financial institution by protecting customers’ rights.

Regulatory Compliance Mechanism

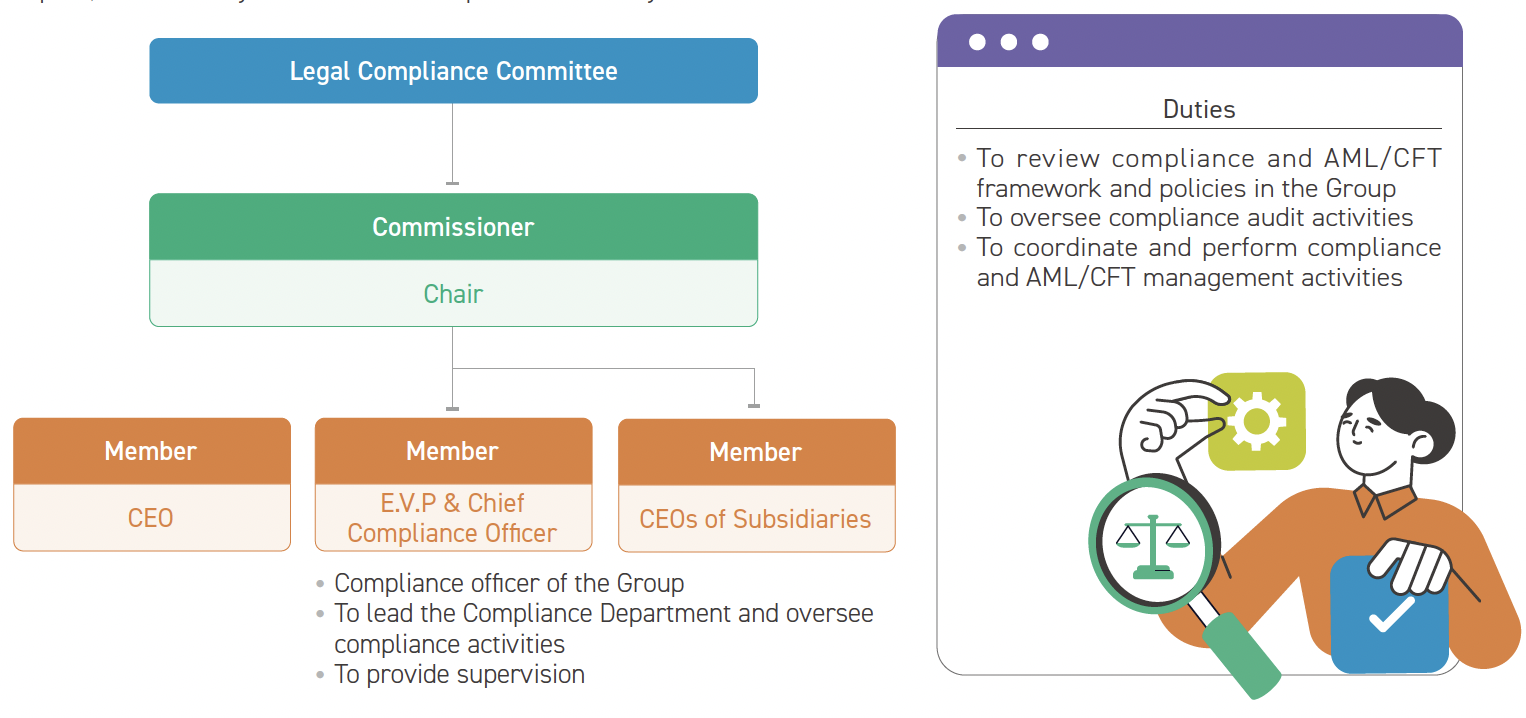

TCFHC has established the “Rules for Implementation of Regulatory Compliance System” according to the “Implementation Rules of Internal Audit and Internal Control System of financial Holding Companies and Banking Industries”. The “Legal Compliance Committee” has also been put in place to devise relevant organizational structures, rules, and regulations in order to monitor regulatory compliance.

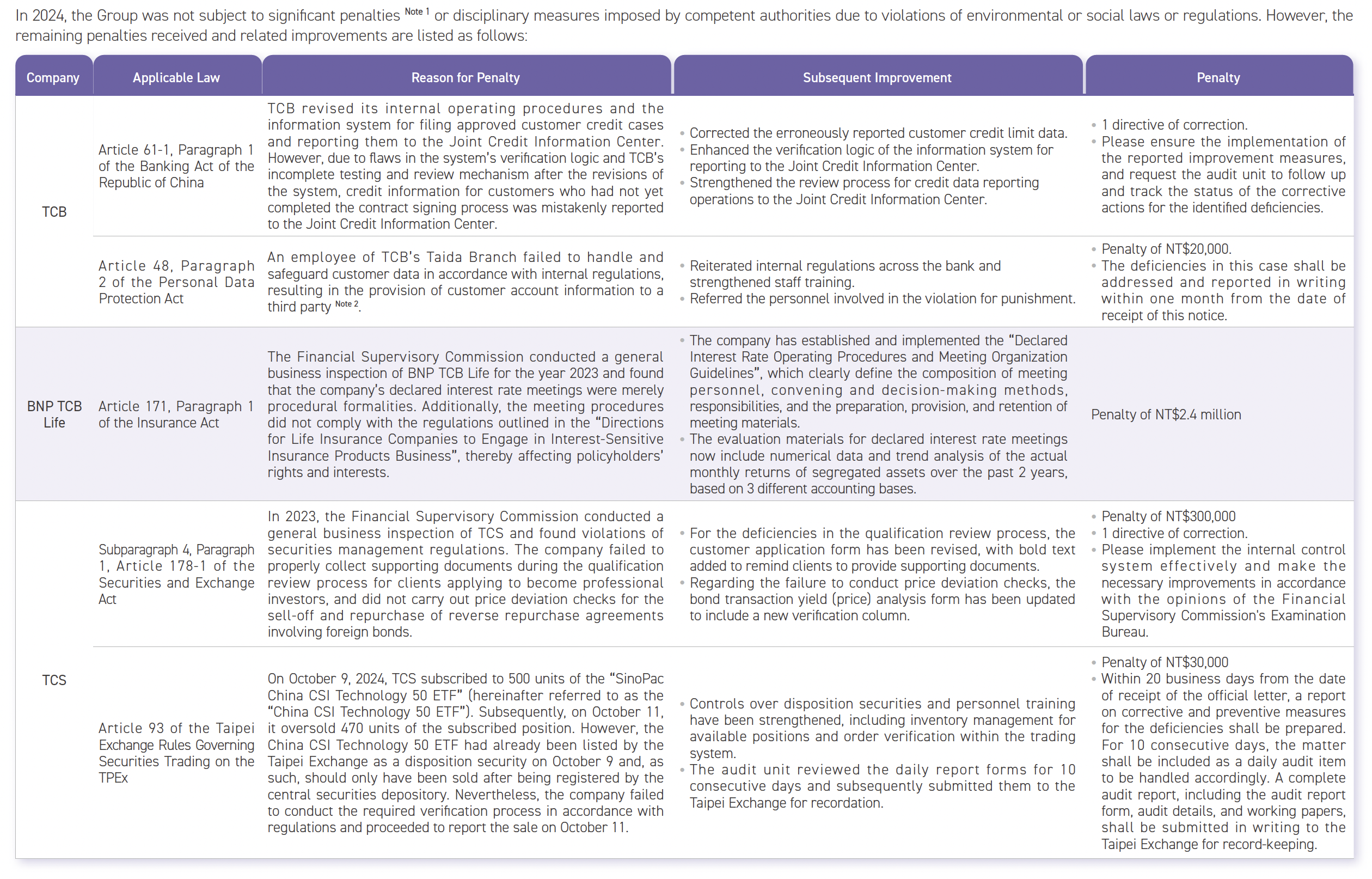

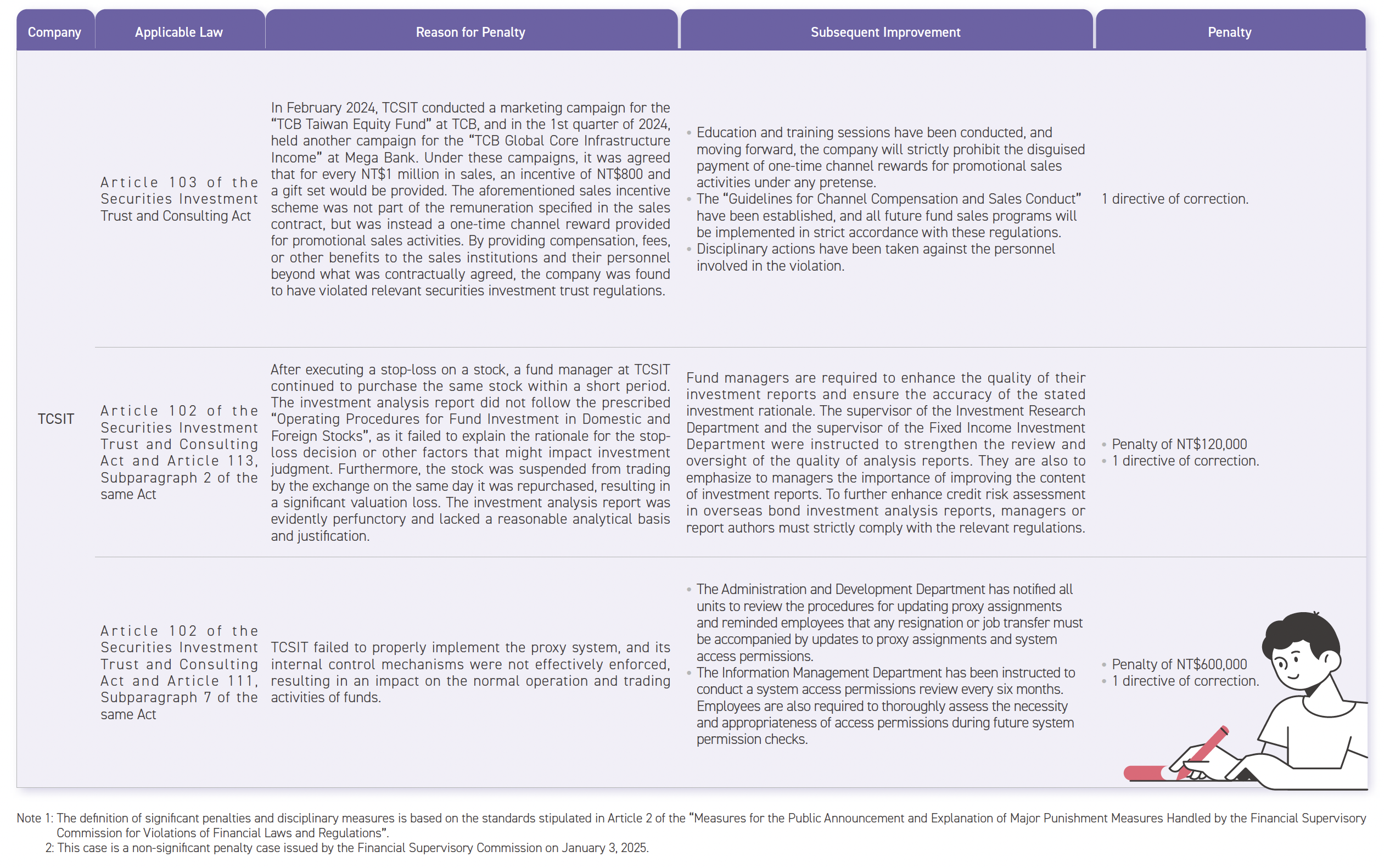

Regarding compliance audits by the Financial Supervisory Commission and regulators of affiliated business units, all penalties should be reported immediately to the relevant departments to ensure an appropriate response and prevent recurrence or further losses. TCFHC has set up a “consistent and real time intercommunications” mechanism, which requires each subsidiary to report to TCFHC’s Legal Compliance Department a full account of audits on legal compliance and AML/CFT throughout the entire course, from the inception of the audit to the completion of the draft report, if audited by the financial competent authority.

2024 Penalty Status and Improvement Measures

Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT)

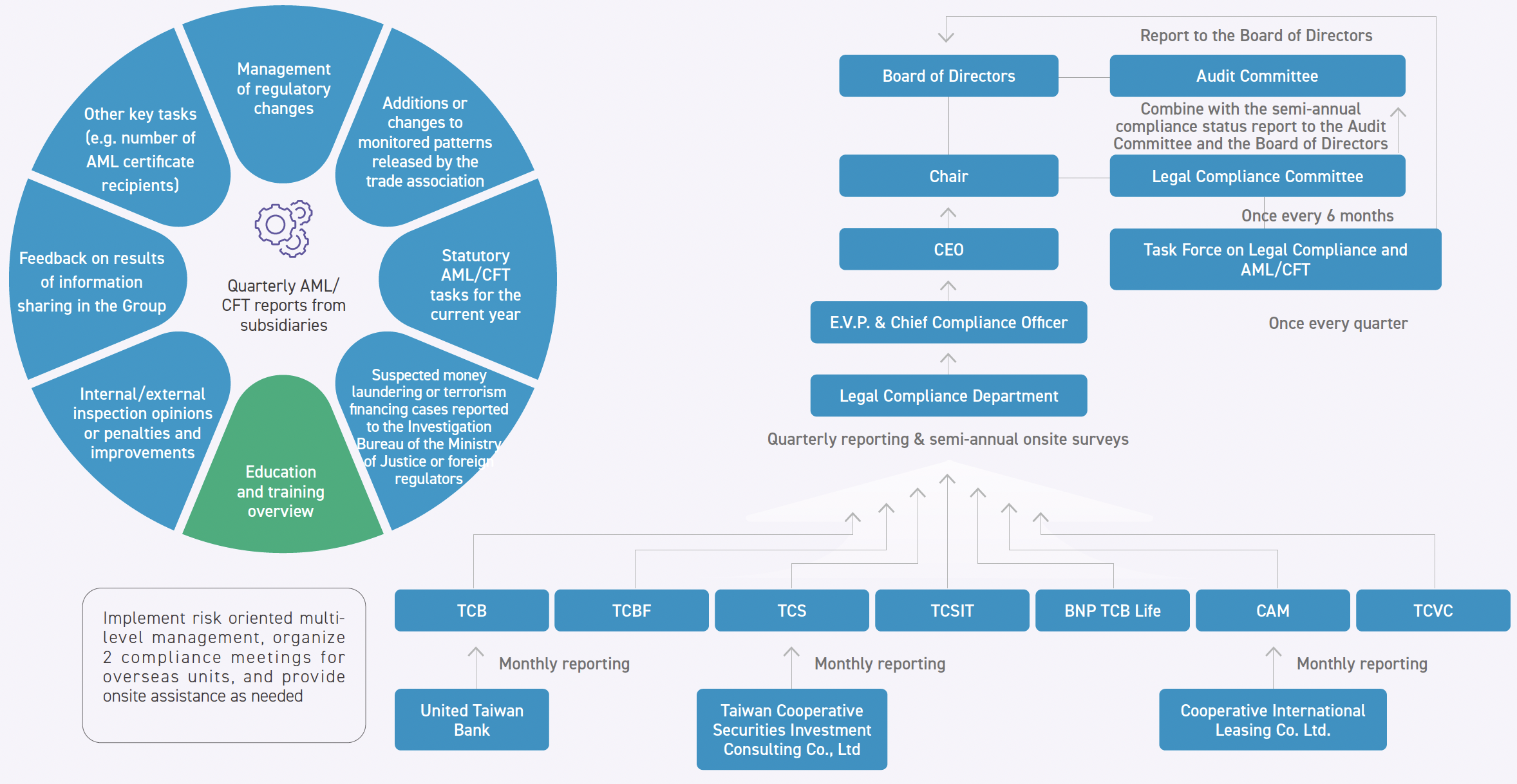

AML/CFT Management Framework

In order to properly implement anti-money laundering and combating the financing of terrorism (AML/CFT), the Company has formulated the “TCFHC Group Anti-Money Laundering and Combating the Financing of Terrorism Policy Framework”. The content includes indicators of Group-level risk appetite, the Group’s framework for coherent risk assessment, and the Group’s procedures for information sharing. The framework clearly specifies the principles for the identification, evaluation, and management of money laundering and terrorism financing risks to ensure compliance. Each subsidiary has also established relevant policies and procedures under the framework for money laundering and terrorism financing risk assessment. They regularly conduct comprehensive assessments of such risks and report to the Board of Directors. Risk assessment reports are also submitted to the Financial Supervisory Commission for reference. In addition, the “Legal Compliance and AML/CFT Taskforce” was established, with the chief compliance officer serving as the convener, responsible for supervising and coordinating the implementation of legal compliance and AML/CFT tasks by the respective subsidiaries and submitting the implementation status of each subsidiary to the president on a quarterly basis.

Contents of AML/CFT Regulations

Each subsidiary also works to optimize its information system for anti-money laundering and combating the financing of terrorism, with databases being linked, analyzed, and monitored to ensure the effectiveness of risk control and management related to money laundering and terrorism financing. The content of anti-money laundering and combating the financing of terrorism regulations for each subsidiary includes but is not limited to the following:

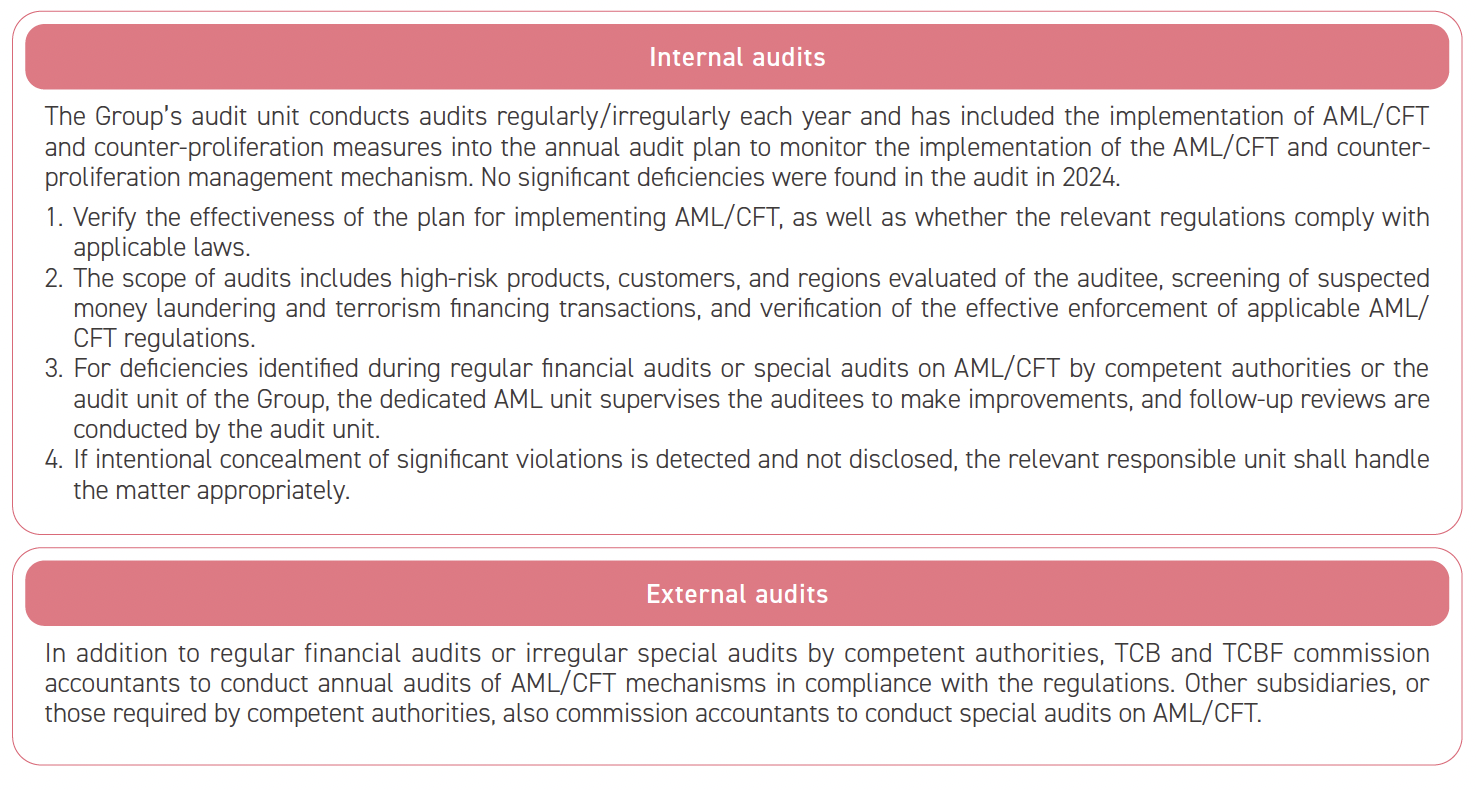

AML/CFT Independent Audit Mechanism

Strengthening AML/CFT Capabilities

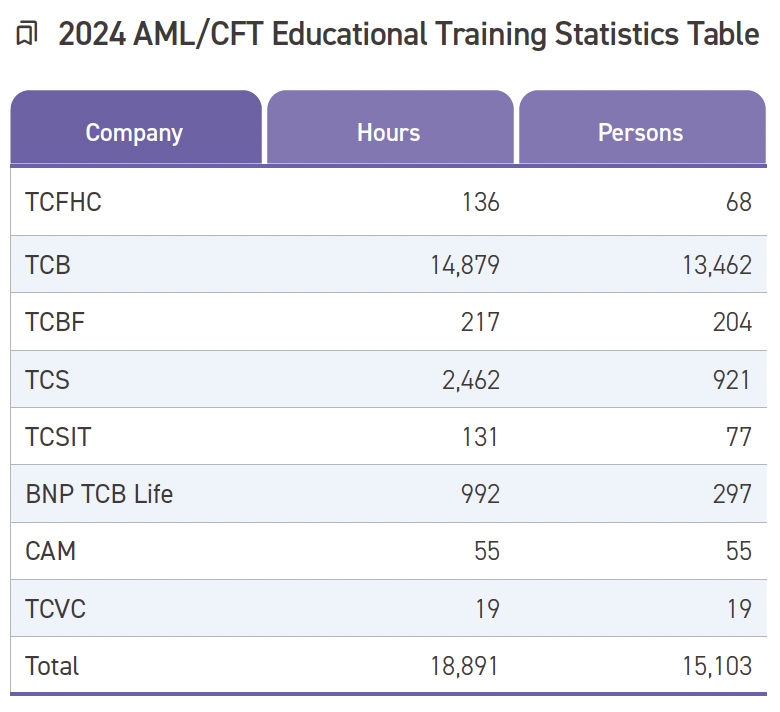

In order to further increase awareness of the regulatory framework on anti-money laundering and combating the financing of terrorism among employees, the relevant educational trainings that the Group organized in 2024 received a total of 15,103 participants, with a total training length of 18,891 hours. Additional trainings on anti-money laundering and combating the financing of terrorism for directors, supervisors, senior management, and employees are also held every year. The group also encourages employees to obtain the Certified Anti-Money Laundering Specialist (CAMS) certification and domestic AML/CFT professional certifications. As of the end of 2024, 6,865 employees, or 77.12% of the Group’s workforce, had obtained such certifications.