According to the World Economic Forum’s (WEF) Global Risks Report 2025, nature-related risks such as “biodiversity loss and ecosystem collapse”, “critical changes to Earth systems”, and “natural resource shortages” are ranked 2nd to 4th among the top 10 global risks over the next decade. This highlights that, beyond climate risks, nature-related risks as a whole are becoming increasingly significant. In light of risk-based management awareness, the Group is gradually incorporating nature-related risks into its overall risk management framework.

Analysis of Nature Dependencies, Impacts, and Nature-Sensitive Areas

To assess the Group’s dependency on and impact toward natural capital across its operations and investment/financing portfolio, the following process has been adopted:

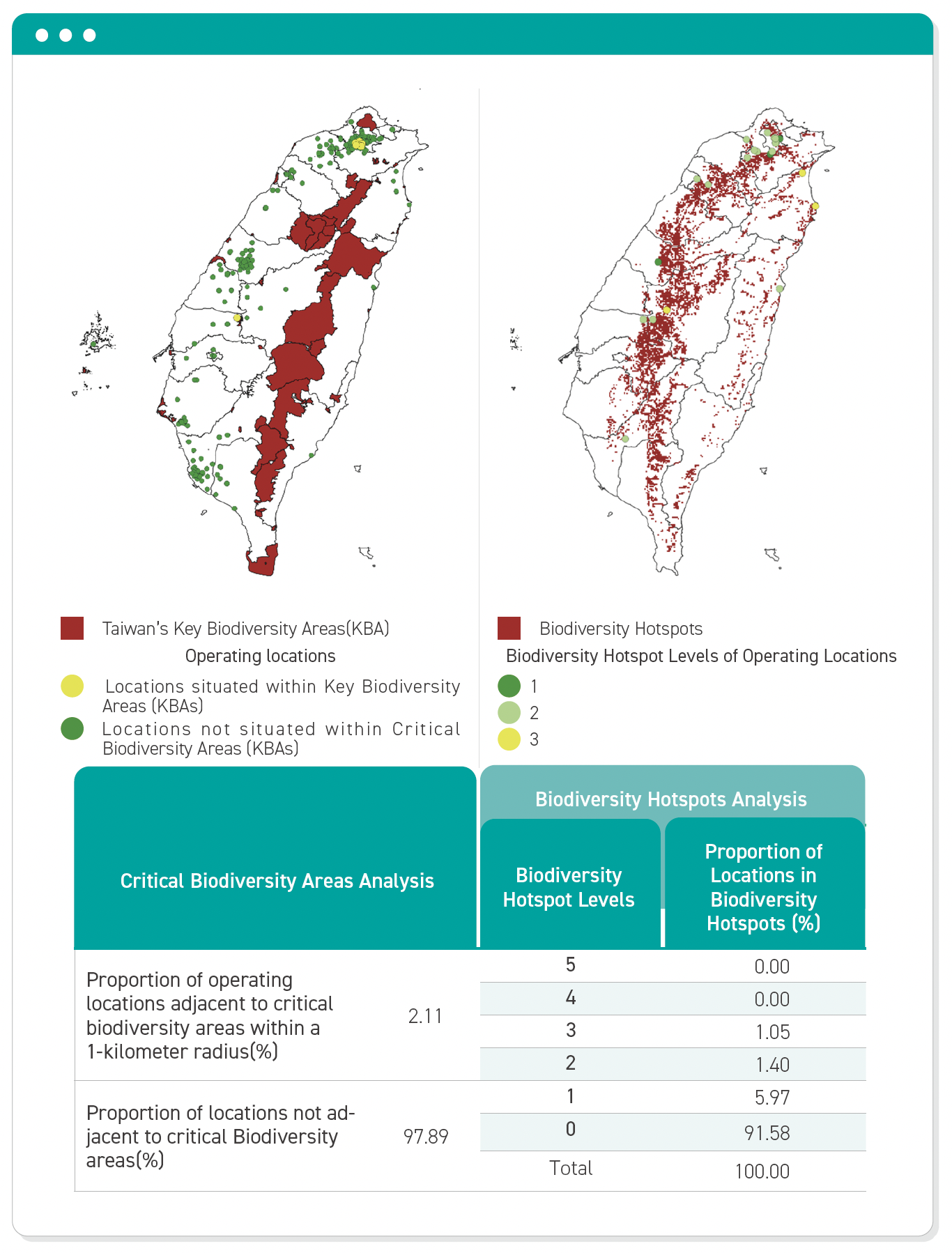

This analysis utilizes biodiversity hotspot data from the Forestry and Nature Conservation Agency of Taiwan’s Ministry of Agriculture. Based on parameters such as species distribution data and species distribution models, the analysis covers biodiversity hotspots for mammals, birds, amphibians, reptiles, and butterflies. The dataset calculates hotspots for animal species in forests, open habitats, streams, or wetlands, defining grids within the top 5% species counts as hotspots. Hotspots are categorized into five levels from highest (5) to lowest (1).

Upon reviewing the Group’s biodiversity hotspot impact analysis results, none of the bank’s operating locations are adjacent to biodiversity hotspots at level 5 or 4 within a 1-kilometer radius. Branch locations situated in level 3, 2, and 1 hotspots account for 1.05%, 1.4%, and 5.97% of total locations, respectively. Approximately 91.58% of branches are not located within biodiversity hotspot areas.

For this year’s newly identified critical biodiversity areas, 2.11% of bank operating locations are adjacent to these critical biodiversity areas within a 1-kilometer radius, while 97.89% of locations are not near critical biodiversity areas.

Analysis of Dependencies and Impacts on Investment and Financing Targets

To properly assess the dependency and impact of the investment and financing portfolio on natural resources, the Group follows the recommendations of the TNFD and utilizes the ENCORE tool for analysis and evaluation.

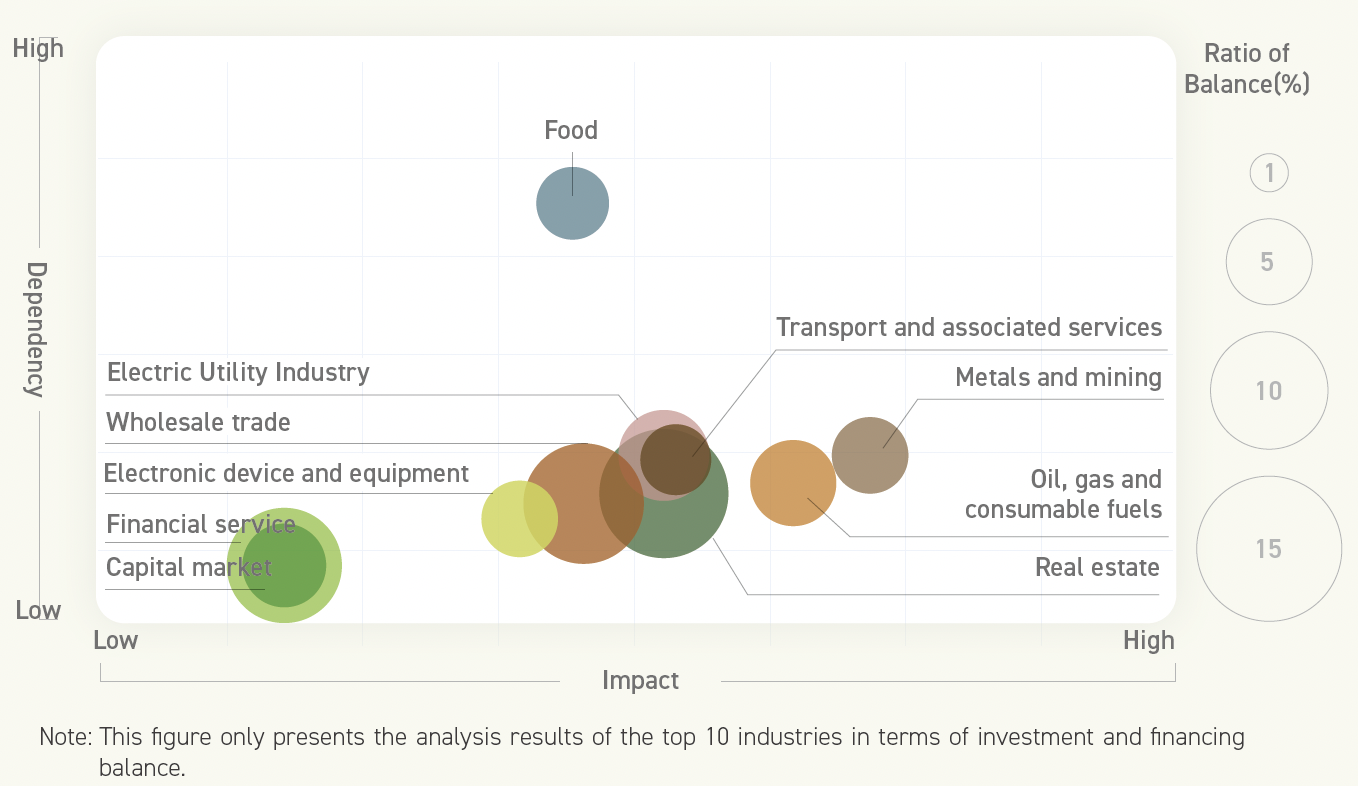

In 2023, the Group conducted an assessment of the dependencies and impacts of various industries within its investment and financing positions. There were no significant changes in the investment and financing positions between 2023 and 2024. Analysis of the industries accounting for the top 90% of investment and financing balances revealed that the food industry has a relatively high dependency on natural resources, with exposure accounting for approximately 3.06% of the total investment and financing balance. Industries with higher impact on natural resources include real estate and the metals and mining sectors, with exposure shares of 1.11% and 5.99%, respectively. The Group also reviewed the exposure proportions across industries, identifying the top 3 industries with the highest exposure as real estate, wholesale trade, and financial services. These industries exhibit moderate to low levels of dependency and impact on natural resources.

This year, a further analysis of dependency and impact factors was conducted for the food industry, which shows higher dependency and impact within the investment and financing portfolio. For full disclosure, please refer to Sections 5.2 to 5.3 of the 2024 TCFD &TNFD Report .