Financial Inclusion Policy

In response to the efforts of the United Nations to promote financial inclusion and provide basic financial services to disadvantaged groups, the Group has launched tailor-made financial products and services that meet the needs of all sectors of society and different ethnic groups, ensuring that people from different backgrounds are all entitled to fair and reasonable financial services or resources. To implement financial inclusion and promote financial inclusion services, the Company has enacted the “Financial Inclusion Policy” .

Promoting Urban Renewal

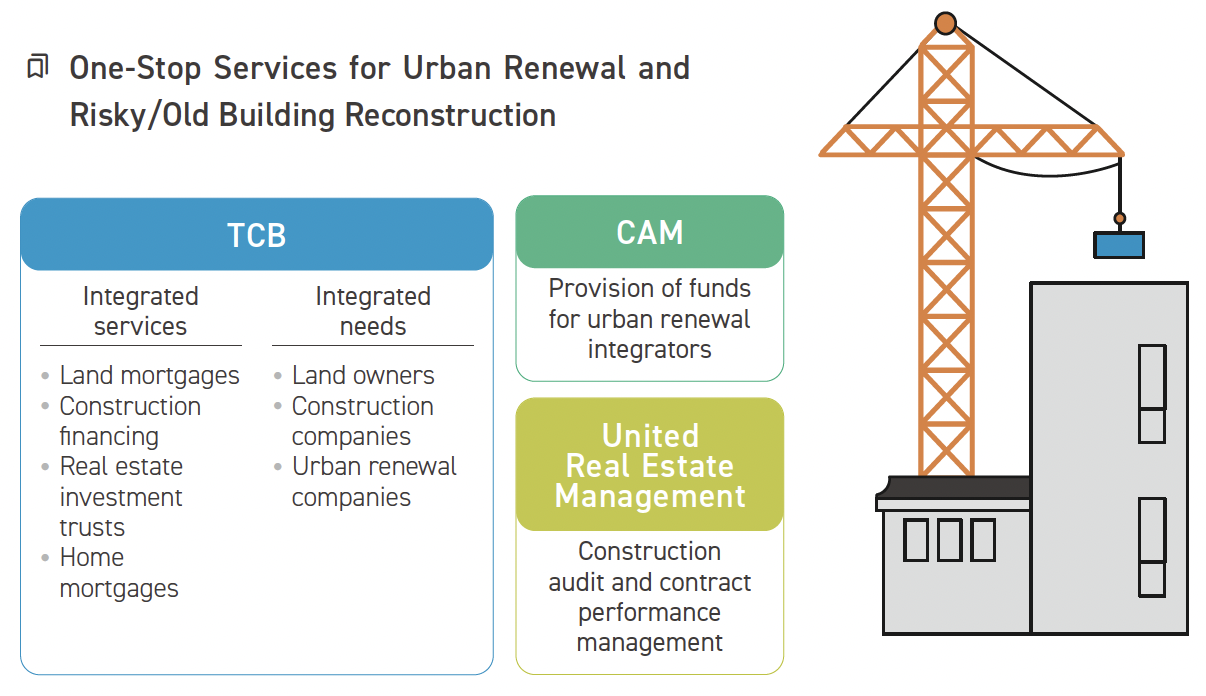

The Group has established the “Urban Renewal and Risky/Old Building Reconstruction Promotion Taskforce” and launched the “Advance Payment for Urban Renewal and Risky/Old Building Reconstruction” program, which incorporates real estate trust, construction fund trust, and financing plans. Services are provided through a partnership with United Real Estate Management to assist urban project integrators in acquiring working capital, conducting construction audits, and managing contract performance, thereby providing customers with one-stop innovative financial services. As of the end of 2024, the total number of TCB’s “Urban Renewal and Risky/Old Building Reconstruction Loans” being undertaken was 291, totaling NT$227.902billion.

Debt Negotiation

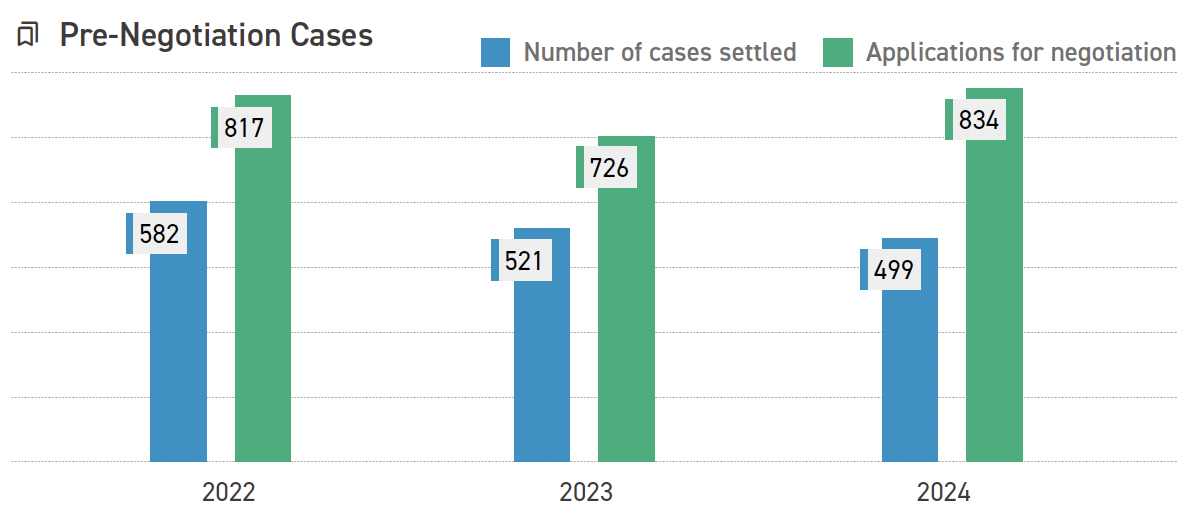

The Group has provided several of solutions to assist consumers in clearing their debts, including debt negotiation, enforcement of agreements reached in pre-negotiation, re-negotiated debt repayment schemes, or allowing debtors who failed to reach a pre-negotiation agreement to request pre-mediation, revival, or clearance through the court. We endeavor to provide measures that help effectively mitigate the economic burden on debtors and support them in repaying their debts. In 2024, TCB completed 496 pre-negotiation cases, and TCS completed 3 signings. The institutions agreed with defaulting customers to repay in installments and assisted them in clearing their debts.

For economically disadvantaged groups with unsecured consumer debt overdue for more than 3 months, including low-income households, individuals with severe illnesses, those with moderate or severe disabilities, victims of major natural disasters, and individuals experiencing involuntary unemployment for over 3 months, TCB offers the “Debt Extension Program for Financially Vulnerable Borrowers with Unsecured Consumer Loans”. This initiative aims to help stabilize their lives and facilitate debt repayment.

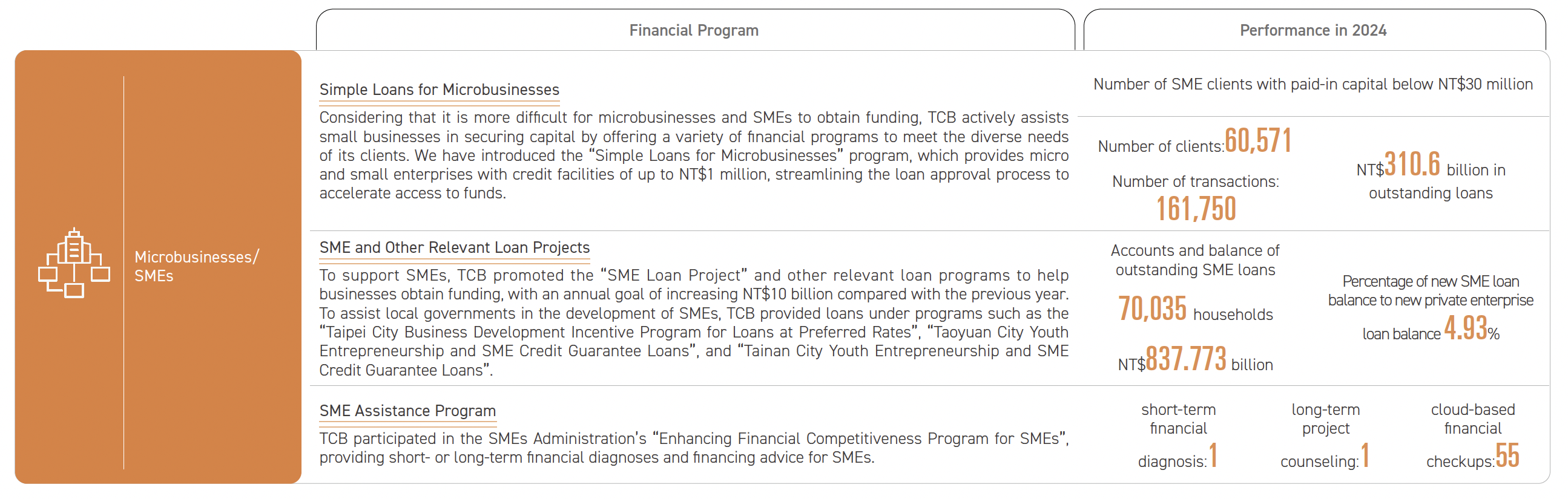

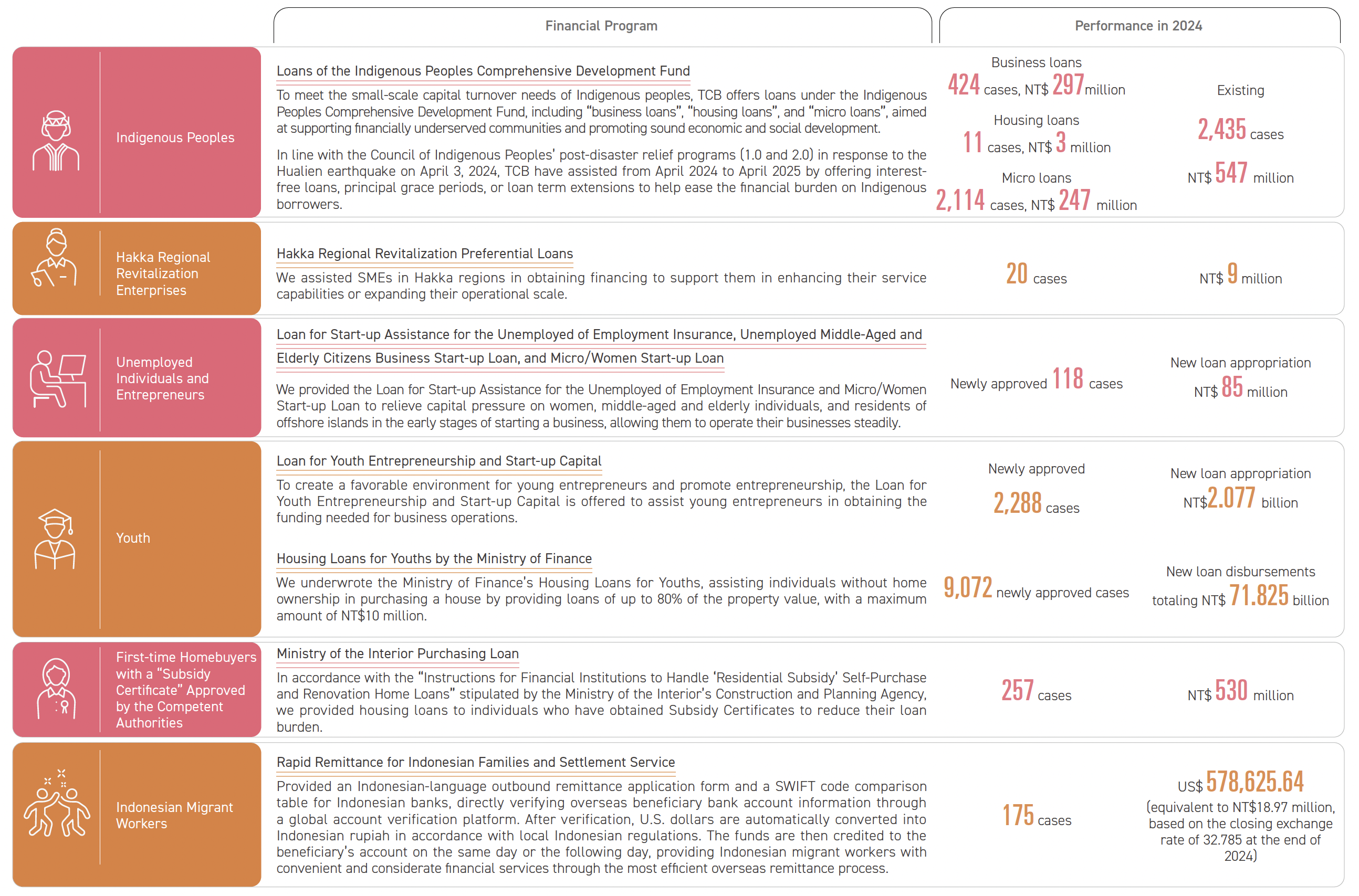

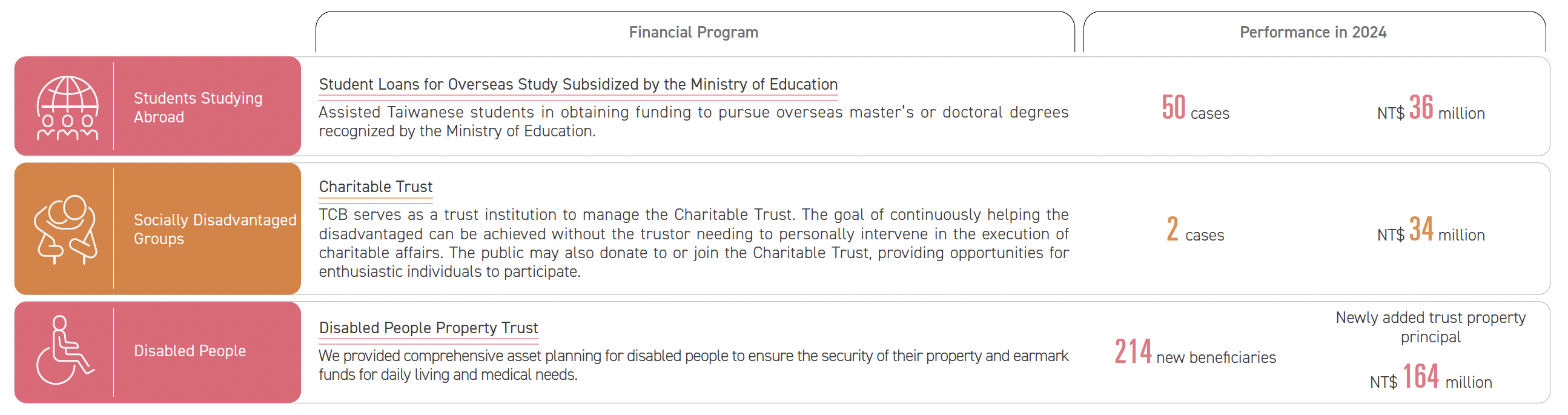

Cultivating the Financial Power of Diverse Groups

The Group integrated resources to provide diversified financial programs to meet the different needs of customers and achieve the common good in society. TCB has underwritten project loans to stimulate the development of small enterprises and local communities, totaling NT$54.043 billion. Those exceeding NT$5 billion include urban renewal loans (NT$33.701 billion), agricultural and fishery loans (NT$11.739 billion), and youth loans (NT$8.594 billion). The total amount of the 986 overdue loan cases accounted for 0.28% of the total relevant project loans earmarked for stimulating the development of small enterprises and local communities.

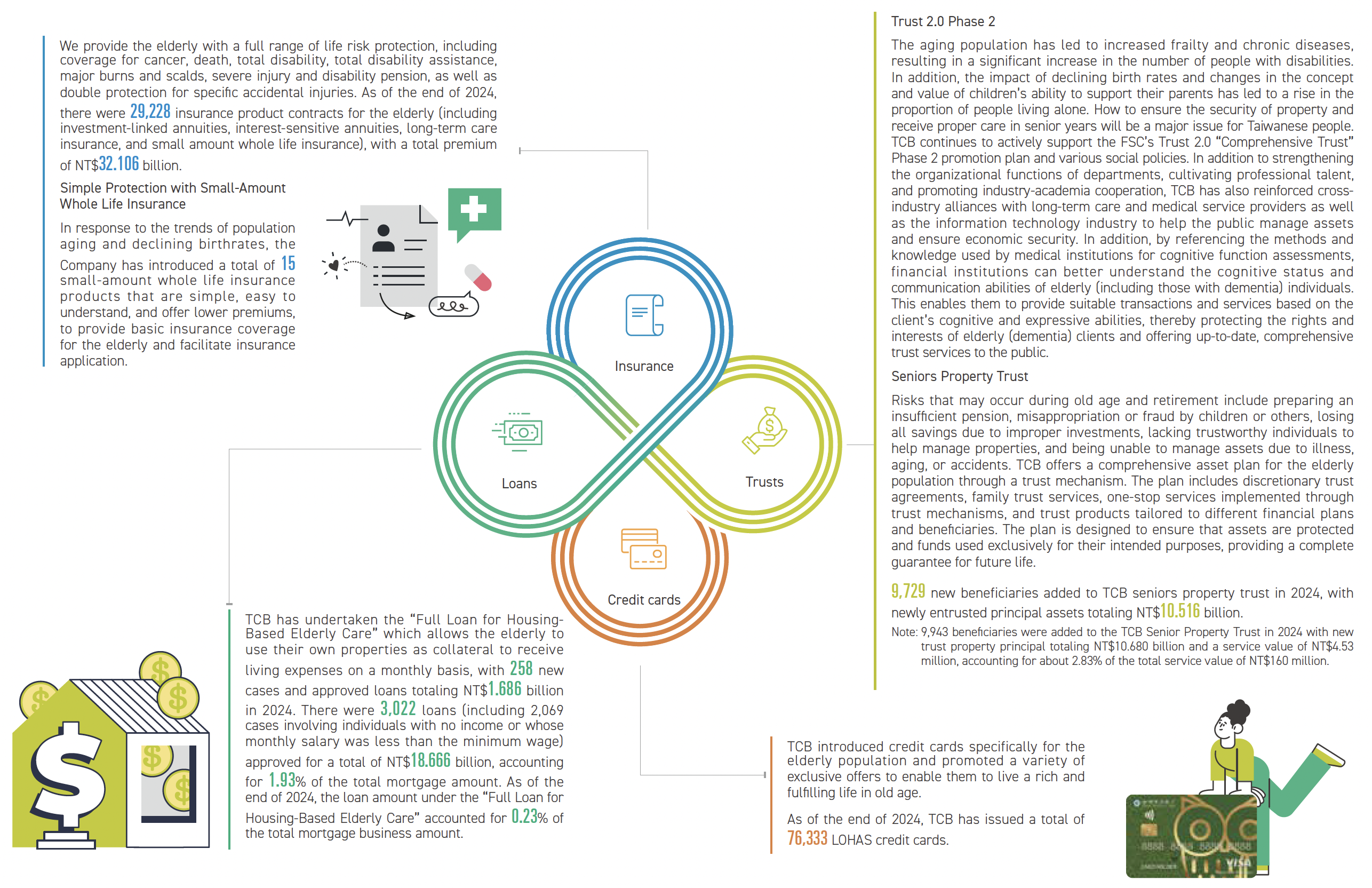

Guarding LOHAS and Elder Care

In support of the government’s efforts in building a nationwide long-term care system, as well as an environment for the development of the healthcare industry in the context of an aging society, the Group has continuously integrated various resources to offer a variety of innovative and inclusive financial products and services to the elderly, with the aim of becoming the number one brand of “LOHAS and elder care”.

Talent Cultivation for Products for the Elderly

In line with its core strategy, TCB collaborated with the Taiwan Association of Family Caregivers in 2020 to launch the “Seed Staff of Long-Term Care Services” training program. Leveraging its extensive network of 262 branches, TCB has built a more compassionate service network, offering comprehensive support from product offerings to the promotion of long-term care services, fully assisting customers in utilizing social resources to overcome caregiving challenges.

In addition, starting in 2021, TCB began cultivating “eldercare financial planning consultants”, becoming the 1st bank to have more than 100 “eldercare financial planning consultants” dedicated to helping customers with trust planning and providing LOHAS retirement consultations services. Moreover, the “Family Trust Planning Consultant Certification System”, launched in 2022, is also one of the professional competency certifications promoted under the Trust 2.0 project. By the end of 2024, 848 employees had obtained the “eldercare financial planning consultant” certification, and 195 employees had obtained the “family trust planning consultant” certificate.

TCS provides the “eldercare financial planning consultant” courses and subsidizes examination fees to encourage employees to obtain certifications. It also hires external lecturers to conduct education and training on the protection of the rights and interests of the elderly and people with disabilities, dementia prevention, and relevant cases and guidelines in a super-aged society. This aims to improve employees’ service quality for the elderly. As of the end of 2024, 3 employees have obtained the “eldercare financial planning consultant” certification.

Financial Products for the Elderly

Creating a Friendly Financial Environment

Barrier-Free Friendly Service Environment

All 262 branches of TCB across Taiwan have various types of barrier-free facilities or measures in place, including a barrier-free slope to enable physically or mentally impaired individuals or other disadvantaged groups to enter, tactile floor tiles and a service bell, barrier-free service counters and ATMs, and designated service staff to assist with financial services. Moreover, we collaborate with the Taiwan Association of Sign Language Interpreters to provide sign language interpretation services. For people with disabilities to enjoy more friendly financial services, TCB waives interbank ATM cash withdrawal fees specifically for account holders with disabilities. This benefit may be applied for at the counter, by mail, or online. In order to serve areas with low population density (not exceeding 300 people per square kilometer) or economically disadvantaged areas (counties and cities in the bottom 1/3 of economic and employability rankings), TCB has set up 33 branches and installed 129 ATMs in Changhua, Pingtung, Nantou, Yunlin, and Chiayi counties, as well as in Keelung City, enabling these areas to access the same services as other regions. TCB also offers a variety of channels, such as intelligent customer service, live chat customer services, Internet, app, voice calls, and telephone service representatives, allowing users to choose a suitable way to inquire about services or express their opinions.

All of TCS’s business locations received the “Dementia Friends Label” from the Ministry of Health and Welfare in 2022. In addition to setting up elderly- and barrier-free service areas for seniors and people with disabilities at all business locations in Taiwan, TCS deploys qualified first aid personnel, provides elderly customers with reading glasses and blood pressure monitors, and actively cares for seniors and customers with disabilities when providing over-the-counter services. TCS has planned the height of its service counters to accommodate elderly customers who use wheelchairs when filling out account opening-related documents. It also provides various consulting services to elderly customers, such as calling a taxi or borrowing a wheelchair, and assigns dedicated personnel to assist.