Amid the rapid growth of the digital economy, financial products are becoming increasingly diverse and complex. Meanwhile, Internet entrepreneurs and technology companies are venturing into digital finance sector, bringing both opportunities and challenges. The Group values user experience-oriented design. To develop more friendly financial products, boost service efficiency, accessibility, usefulness, and quality, and build professional financial services that transcend time and location constraints, the Group utilizes digital technology capabilities combined with business innovation to help customers keep track of their account activities fund flows anytime, maximizing the benefits of digital financial services.

Innovative Digital Financial Products and Services

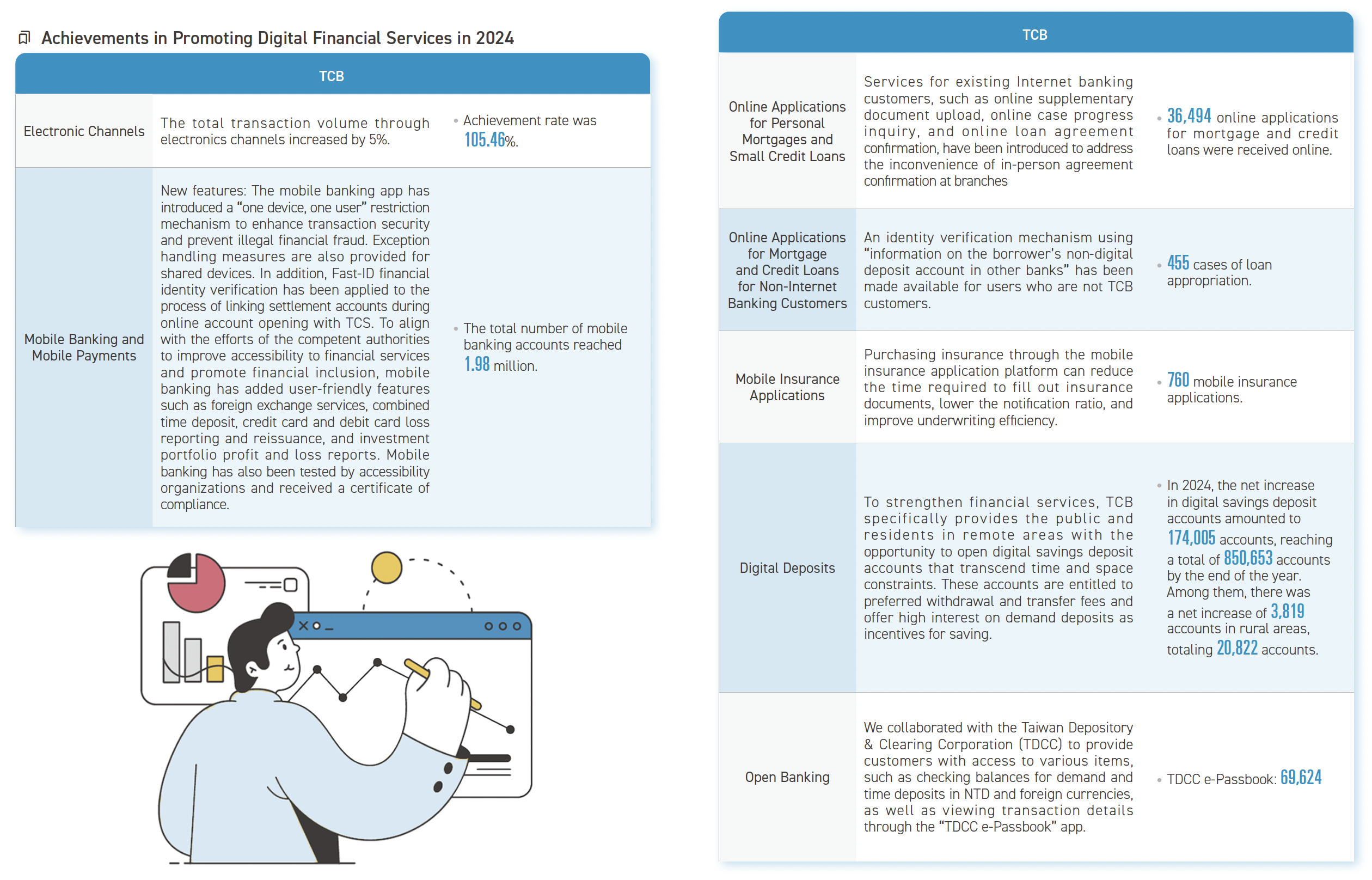

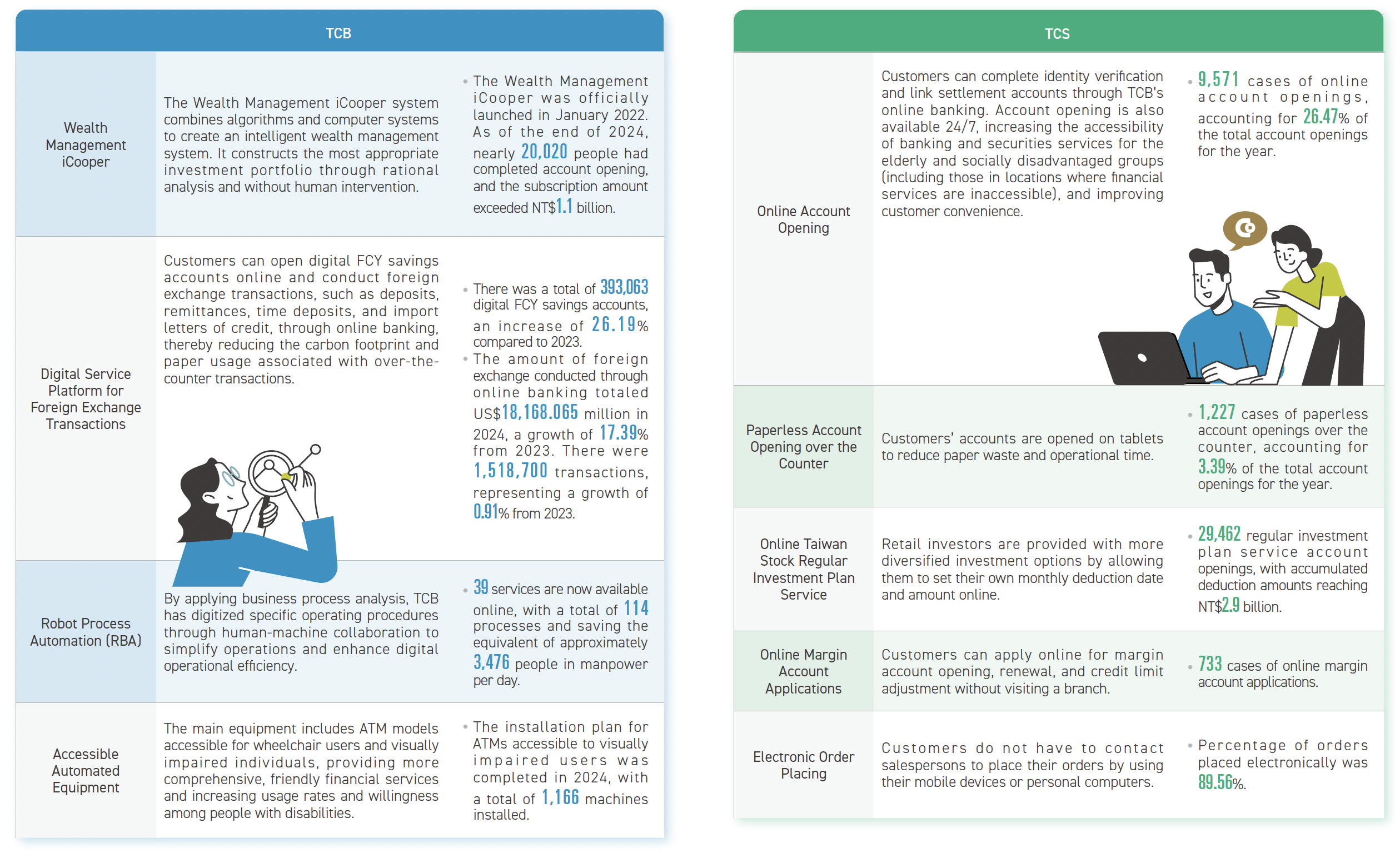

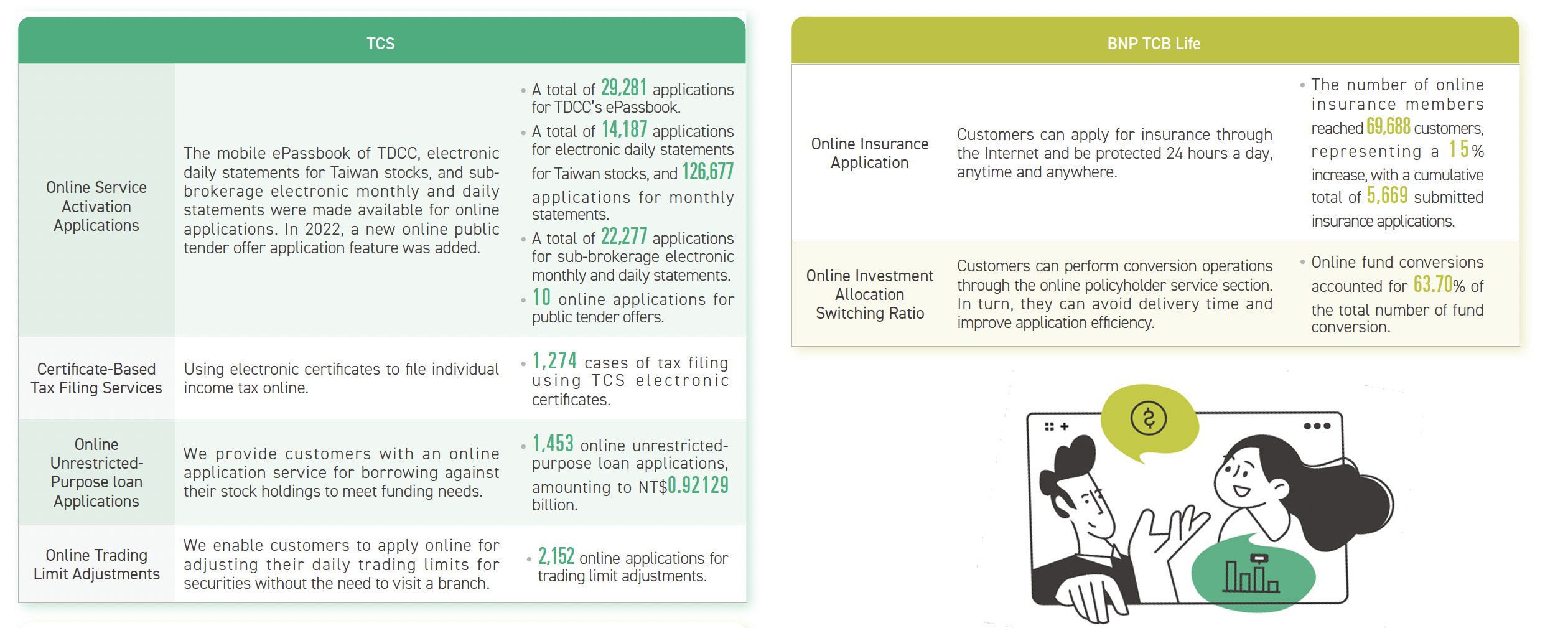

The Group has been actively promoting innovative digital finance. Our efforts include optimizing the customer experience through data-driven decision-making and the use of big data analysis, robotic process automation (RPA), customer feedback, AI technology, and the integration of automatic procedures to provide comprehensive digital financial services and make financial products and services closer to everyday life.

Innovative Patent R&D and Management

TCFHC formulated its “Intellectual Property Management Program” in 2020 to promote the integration and coordination of intellectual property management jointly with its subsidiaries. TCB introduced the “Taiwan Intellectual Property Management System” (TIPS) for the 1st time that year to enhance its management of intellectual property by adopting the “Plan-Do-Check-Act (PDCA)” cycle, and became the 1st state-owned bank in the country having to be certified as TIPS Class A 3 times, demonstrating outstanding results in creating and protecting intellectual property.

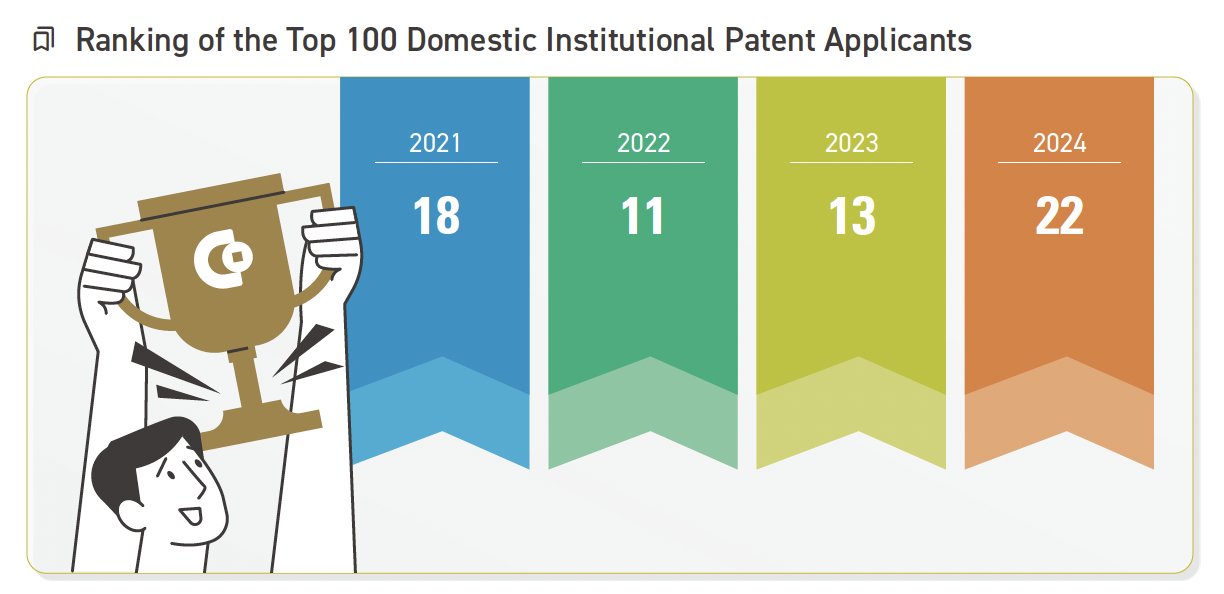

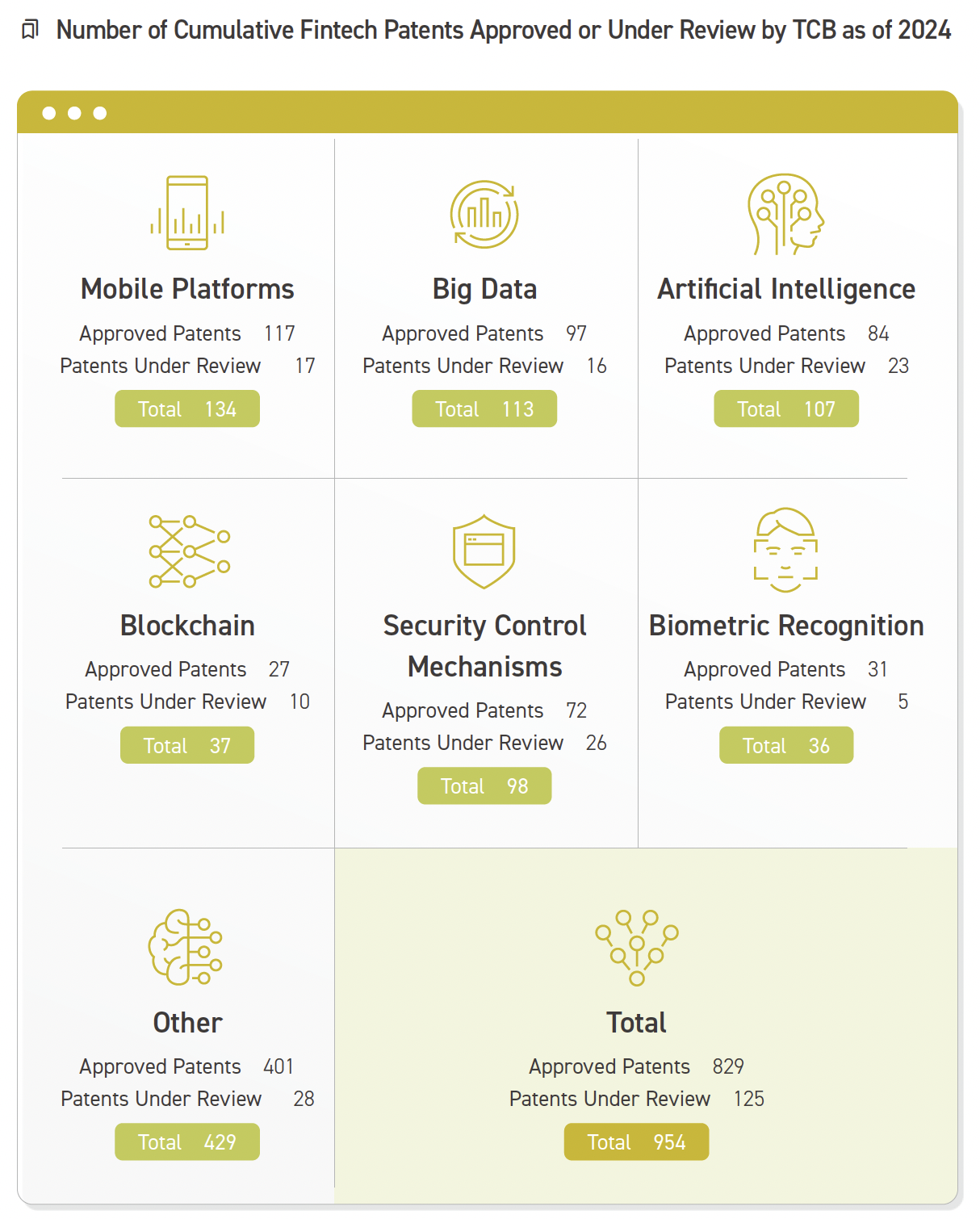

In conjunction with the FSC’s promotion of FinTech Development and Corporate Governance 3.0, TCB continues to hold intellectual property-related cognitive education and training courses each year to enhance employees’ awareness of and appreciation for intellectual property, and to strengthen risk management and internal controls to ensure security and legitimate use. Meanwhile, a patent incentive system is in place to encourage proactive research and development of innovative technologies among employees. As of 2024, more than 800 patent certificates had been issued by the Intellectual Property Office, Ministry of Economic Affairs, and had been actually applied in areas such as credit and loans, debt management, foreign exchange, business and marketing, anti-money laundering, and electronic finance, leading to improved operational efficiency and reduced operational risk.

Since 2018, TBC has ranked among the top 100 domestic institutional patent applicants for 7 consecutive years. In 2024 alone, it filed 152 patent applications covering various areas such as big data, mobile platforms, AI, and security control mechanisms, demonstrating its commitment to developing innovative applications across all business areas.

Creating a Culture of Innovation – CoLAB

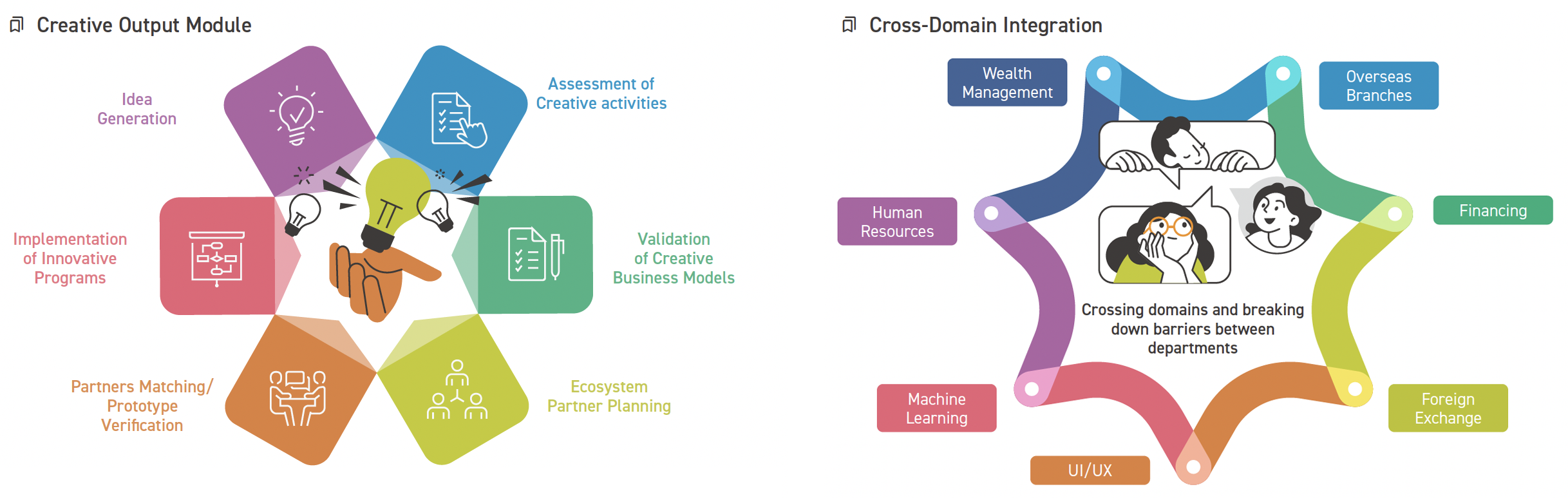

To maintain the momentum of driving innovation and developing innovative managerial capabilities, and to achieve the long-term goal of forming a culture where innovations are shared and sustained, TCB established its collaborative innovation lab (CoLAB) in 2019 to help nurture seed staff. A cross-departmental collaborative and innovative business model was created to facilitate ongoing collaboration with external consultants and the sharing and exchange of business experience among various internal and external teams, in order to generate creative output and maximize potential financial applications that address market trends and business needs.

Innovative Value and Culture

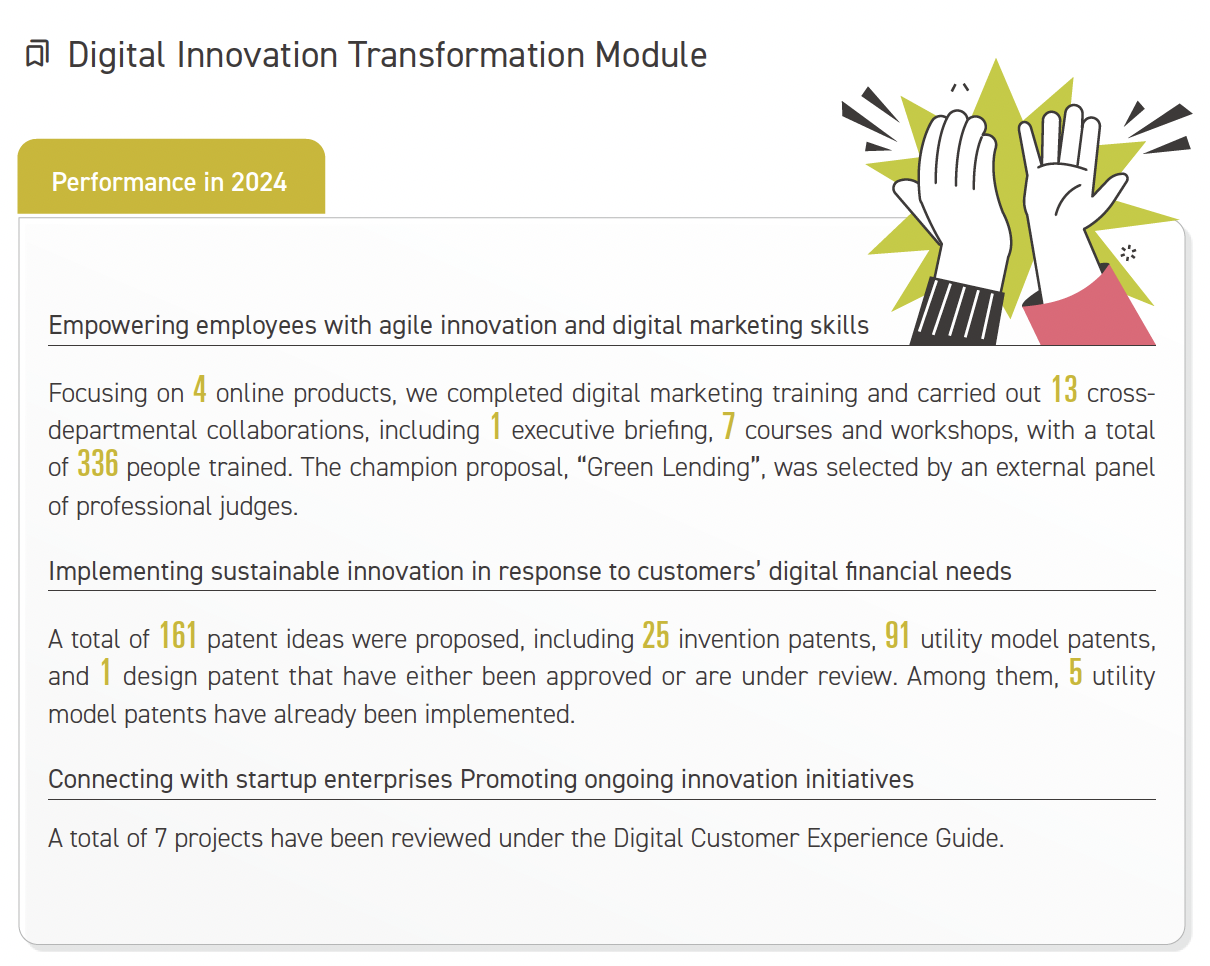

CoLAB has transformed the corporate philosophy of “Proactive, Agile, Innovative” into its core competencies and established operational modules that drive digital innovation and transformation, continuously promoting the growth of digital innovation.

Innovation Benefits and Maintenance

In 2024, CoLAB assisted the Digital Development Committee in promoting 8 major projects related to

corporate banking, consumer banking, and technology infrastructure, as well as 28 digital initiatives serving individual and corporate customers. These efforts were complemented by the implementation of “Digital Customer Experience Guide” to further accelerate the enhancement of positive digital experiences for customers.

In 2024, new projects included the review of the “Corporate Client Service Portal – SME and Microenterprise Loan Application Platform” (digital service or functionality delivery testing) and the optimization of foreign exchange features in personal online banking. Starting in June 2024, collaboration began on designing the customer experience content for the “Personal Mortgage Loan Application Platform”.

The AI strategic blueprint and training program was launched in August 2024. As of the end of December, a total of 1,404 participants had been trained. Moving forward, the AI strategic blueprint will be progressively refined as planned, with efforts to expand AI application scenarios and business opportunities.