Principles for Treating Customers Fairly

To effectively protect the rights and interests of financial consumers, TCB established the "Consumer Protection and Fair Customer Treatment Promotion Committee" in 2019, with CEO who serves as a convener. The committee is composed of an executive vice president, an E.V.P & Chief Compliance Officer, and 22 supervisors from the business management units of the headquarters as the committee members. They are responsible for formulating the policies and strategies concerning principles of treating customers fairly, handling significant consumer disputes, and reviewing the progress of promoting fair customer treatment and the evaluation results. They also periodically compile customer complaints and Financial Ombudsman Institution (FOI) cases as well as reflections upon and improvements made regarding respective cases and submit them to the Board of Directors.

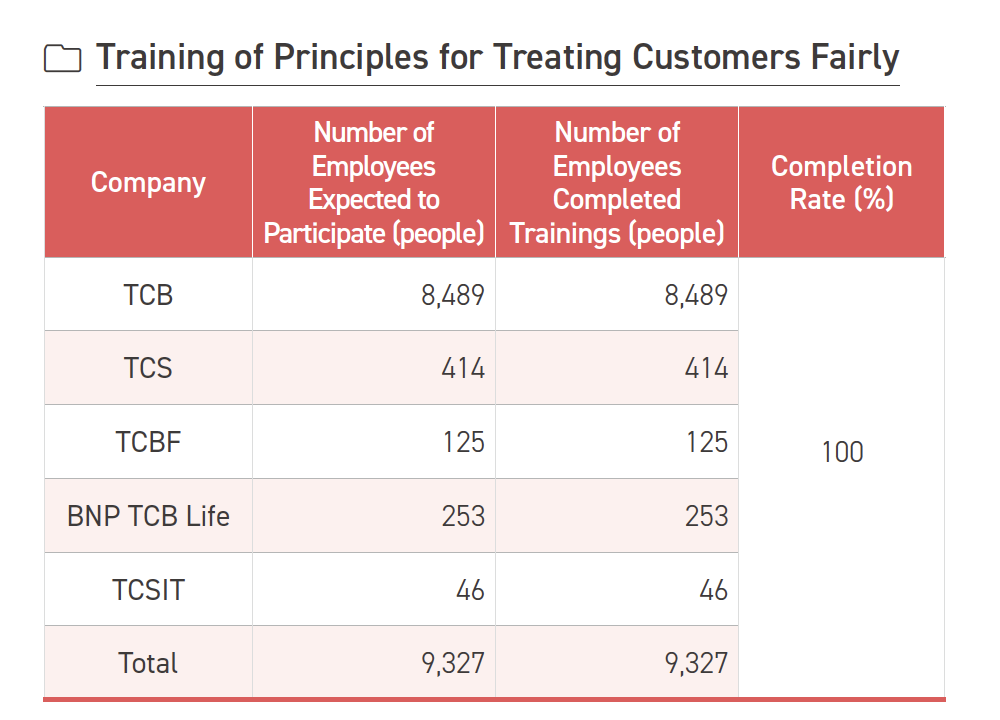

TCB, TCS, BNP TCB Life, and TCB all have established policies and implementation regulations relevant to the Principles for Treating Customers Fairly and added friendly financial service regulations and coordinated the implementations of relevant departments. A dedicated unit centrally manages implementation and compiles how they are enforced before reporting to the Board of Directors so that colleagues honor the principles of being honest and truthful in respective aspects, namely, distribution of products and services, advertising and soliciting, protection of the right to complain, and professionalism of salespersons and abide by the "Ethical Corporate Management Best Practice Principles", "Financial Consumer Protection Act", and "Financial Service Industry Principles for Treating Customers Fairly". We also require our financial consultants to sign the "Code of Behavior for Wealth Management Employees" before on board or performing business to ensure the rights and interests of customers, and conduct annual credit audits on the financial consultants.

In order to implement the principle of friendly financial services, TCB regularly reviews the reasons for the occurrence and subsequent handling methods of the cases involving messages left by seniors and disabled customers. TCB continues to optimize the operating system for messages and the webpage of the website’s mailbox for the public to ensure its products and services meet the needs of customers and protect financial consumers’ rights. The "Advance Workshop on the Principles for Treating Customers Fairly" was held in September 2023. Members of the FOI were invited to share and discuss financial laws and regulations and cases with high-ranking managers such as directors, the vice presidents, the E.V.P. & Chief Compliance Officer, the E.V.P. & General Auditor, and unit heads, such as "Insights of Reviewed Cases", "Financially-Friendly Services", and "Convention on the Rights of Persons with Disabilities" (CRPD) in order to strengthen and consolidate the protection of customer rights.

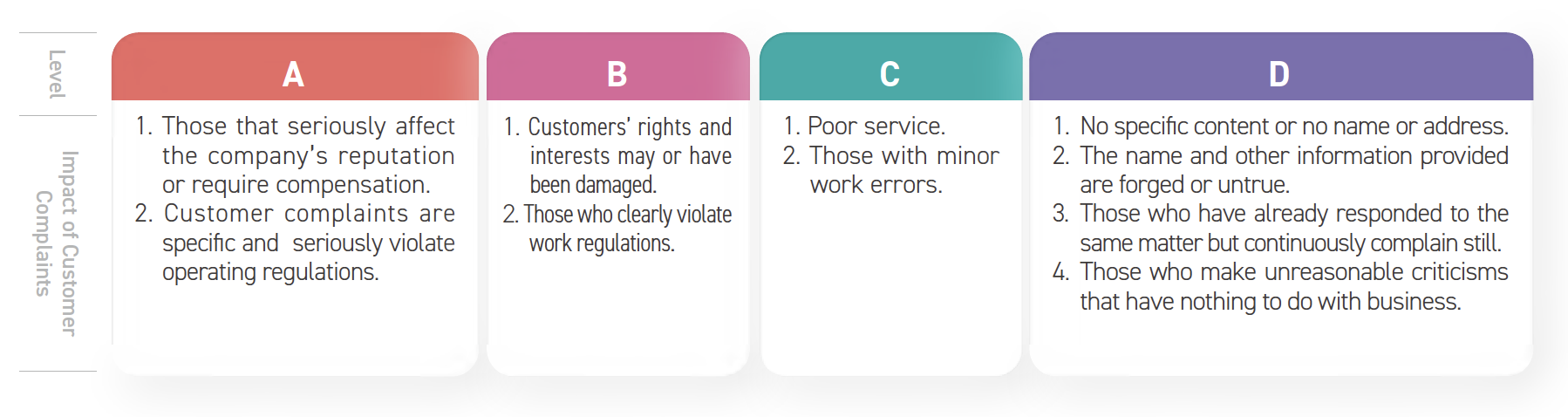

The subsidiaries also regularly organize employee education and training and internal evaluations, or initiate secret customer testing to achieve the purpose of understanding the implementation of the Principles for Treating Customers Fairly and formulating improvement measures. In 2023, there are no major deficiencies in the internal assessment results and no significant customer complaint cases above level B.

Prevent Financial Fraud

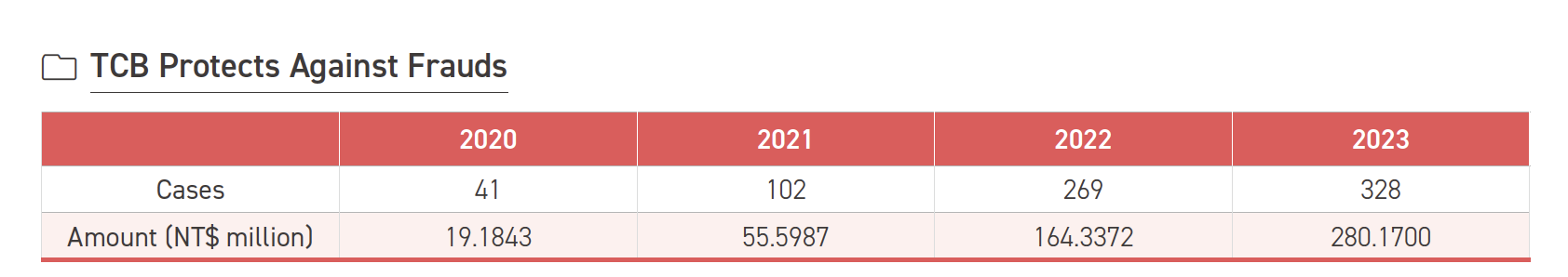

In light of the rampage of fraud syndicates and their constantly changing approaches over the past few years, for the sake of protecting people’s properties, TCB defined the "Precautions for Suspicious Illegitimate or Obvious Abnormal Transactions of Savings Accounts" and the requirements for "Caring Questions for Customers Seeking Counter Service", that is, asking customers caring questions while they make deposits, withdrawals, or remittances at the counter and notifying the police to provide assistance if necessary and protect them against frauds. Given the rampage of novel frauds and the younger victims over the past few years, when a natural person aged 55 and above comes to the counter for depositing, withdrawing, remittance, time deposit termination (including early termination) or sell-back of gold in gold passbook, the system will have a pop-up window to remind clerks of asking further caring questions. In addition, when a natural person withdraws from his/her NTD savings account an amount exceeding 1 million, the SMS will send out notice in real time to help protect the rights of the customer. Moreover, for reinforced deterring effects, besides education and training provided to clerks on anti-fraud caring questions, cases communicated by law enforcement are utilized and made known to the public on FACEBOOK, official website, and the multi-media system in the hall of operating sites of TCB in order to boost people’s awareness against frauds.

From July 18 to 20, 2023, TCB held 3 sessions of the " Strengthen On-the-counter Care and Questioning to Help Prevent Fraud Courses" in the northern, central, and southern regions, respectively. Police officers from the Criminal Investigation Bureau were invited to share key points in the prevention against frauds while staffs at branches shared their experience and accomplishments in the prevention against frauds, with a total of 500 people attended. On the other hand, financial fraud disputes that have occurred over the past few years are included in the existing deposit and exchange business class to help boost awareness against frauds among first-line deposit and exchange colleagues. 4 sessions were held in 2023, with up to 200 participants in total.

Between March and December 2023, TCB held a total of 14 educational training sessions on financial fraud disputes over the past few years and anti-fraud awareness and also proactively took part in FSC campaign of "Communicating Financial Knowledge to Campuses and Communities" by having professional lecturers from inside TCB to visit other places and communicate financial knowledge and empower the general public in identifying frauds by sharing practical financial experience. The audience covered schools, communities, senior people, people with disabilities, national armies, correctional institutions, and social welfare groups, etc. 56 events were held in total throughout 2023, with a headcount of around 3,500 participants.

In order to inspire colleagues and protect the general public against frauds as well as build a friendly and caring financial service environment, TCB has established reward incentives for staffs. Reflective of the amount involved, money or merits will be available as rewards for the specific clerk. Throughout 2023, a total of 328 frauds were intercepted, amounting to about NT$280 million. 102 clerks were awarded awards, and a bonus of NT$678 thousand was issued.

Maintenance of Customer Relations

To improve the quality of customer services, TCB, TCS, and BNP TCB Life engages with the consumers every year, listen attentively and understand their opinions on the financial products and services. TCFHC Group has set up smooth communications and appealing channels, including hotline and email. As soon as the Group receives an appealing case, the case will be registered and handled through customer complaint operational procedure. The entire processing of any case is handled based on "Personal Information Protection Act" for protecting customer’s privacy. The process of the handling and the resulted improvement measures would then be reported to CEO to ensure the refinement of customer service. In 2023, the total customer complaint cases that TCFHC Group received were 292, TCB has a total of 198 Cases are rated as Level C, all of which were dealt and closed.

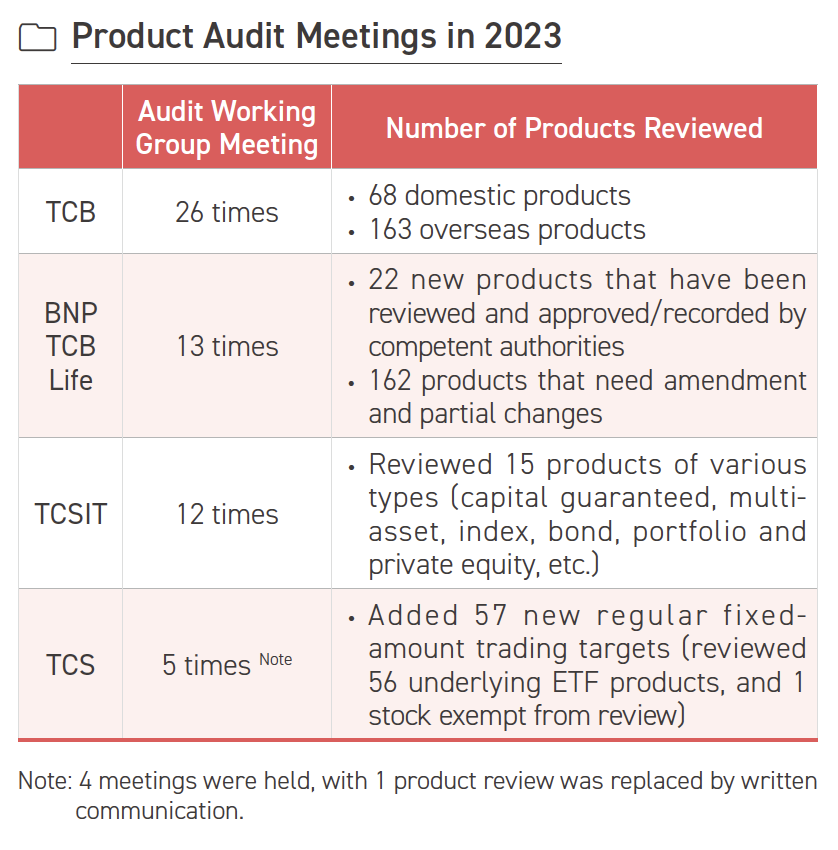

Procedures of Product Review

All of the financial products or services introduced by the Group, including design and planning, promotion, marketing, fulfillment of contract requirements, service consultation, handling of customer complaints, and financial consumption disputes, take into consideration the needs of customers in order to have customers treated fairly and reasonably. Besides compliance with the Financial Consumer Protection Act and the regulatory requirements defined for the specific type of business, internal reviews are required to ensure absence of improper contents, untruthful statements, and other conditions that are misleading to consumers or violating applicable laws and self-regulatory rules associated with the products. If the said products require approval from competent authorities before they are made available for sale, they shall still be adequately examined for appropriateness reflective of the actual sales of financial products, feedback from consumers, and applicable laws. Before the Group enters into a contract to provide financial products or services with customers, it adheres to the principles of fairness, reasonableness, equality, reciprocity and good faith, fully explains the important contents of the financial products, services and contracts, and fully discloses risks.

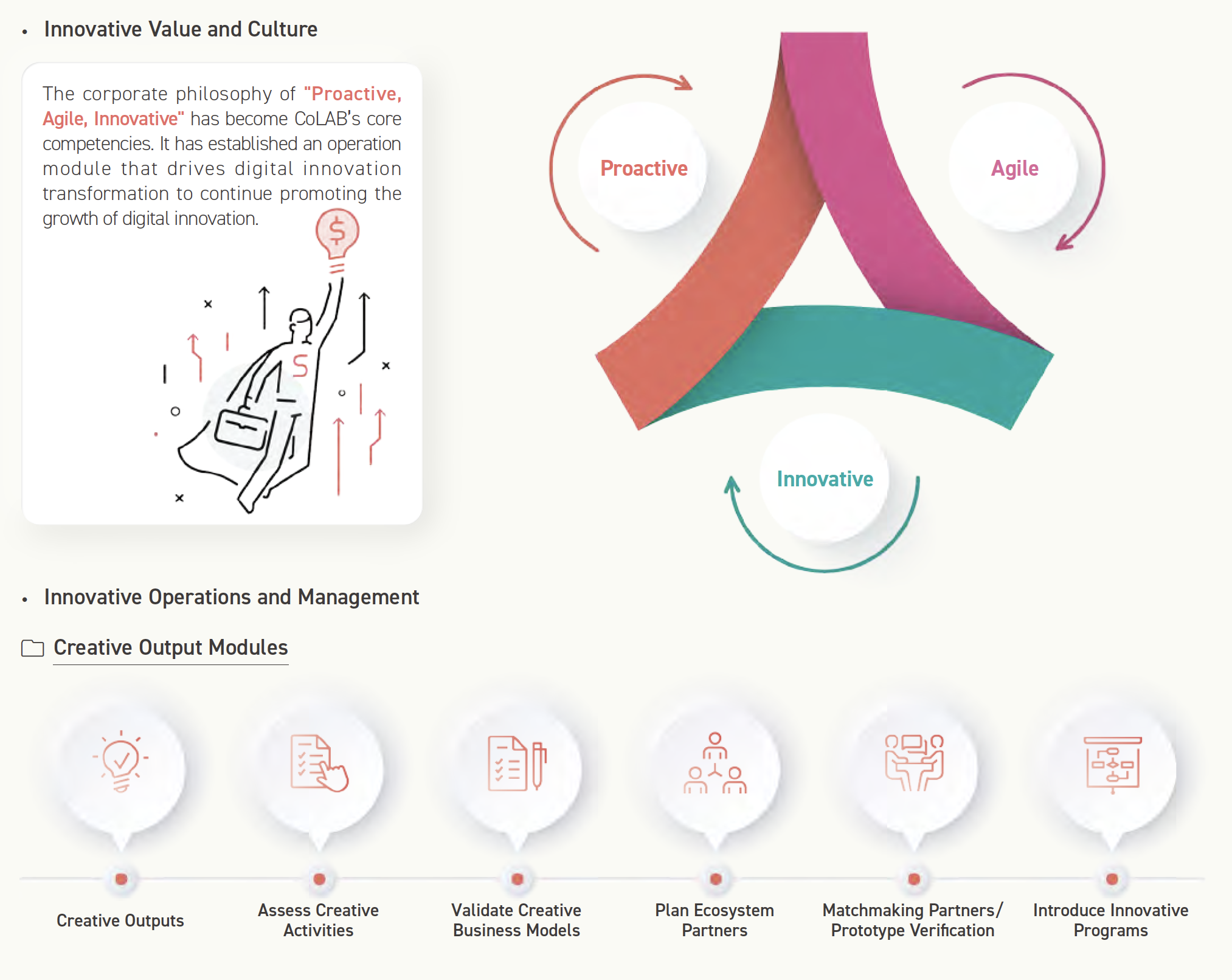

Under constantly-growing trend of digital economy, financial products are getting increasingly diverse and complex. Meanwhile, it attracts Internet entrepreneurs and technology companies to get involved in digital finance with opportunities and challenges. The Group values user experience-oriented design. In order to come up with more friendly financial products, to boost service efficiency, accessibility, usefulness, and quality, and to build professional financial service transcending time and venue restrictions, the Group utilizes digital technology to combine with business innovation to help customers keep track of account activities and where their funds go for maximized efficacy in digital application of financial services.

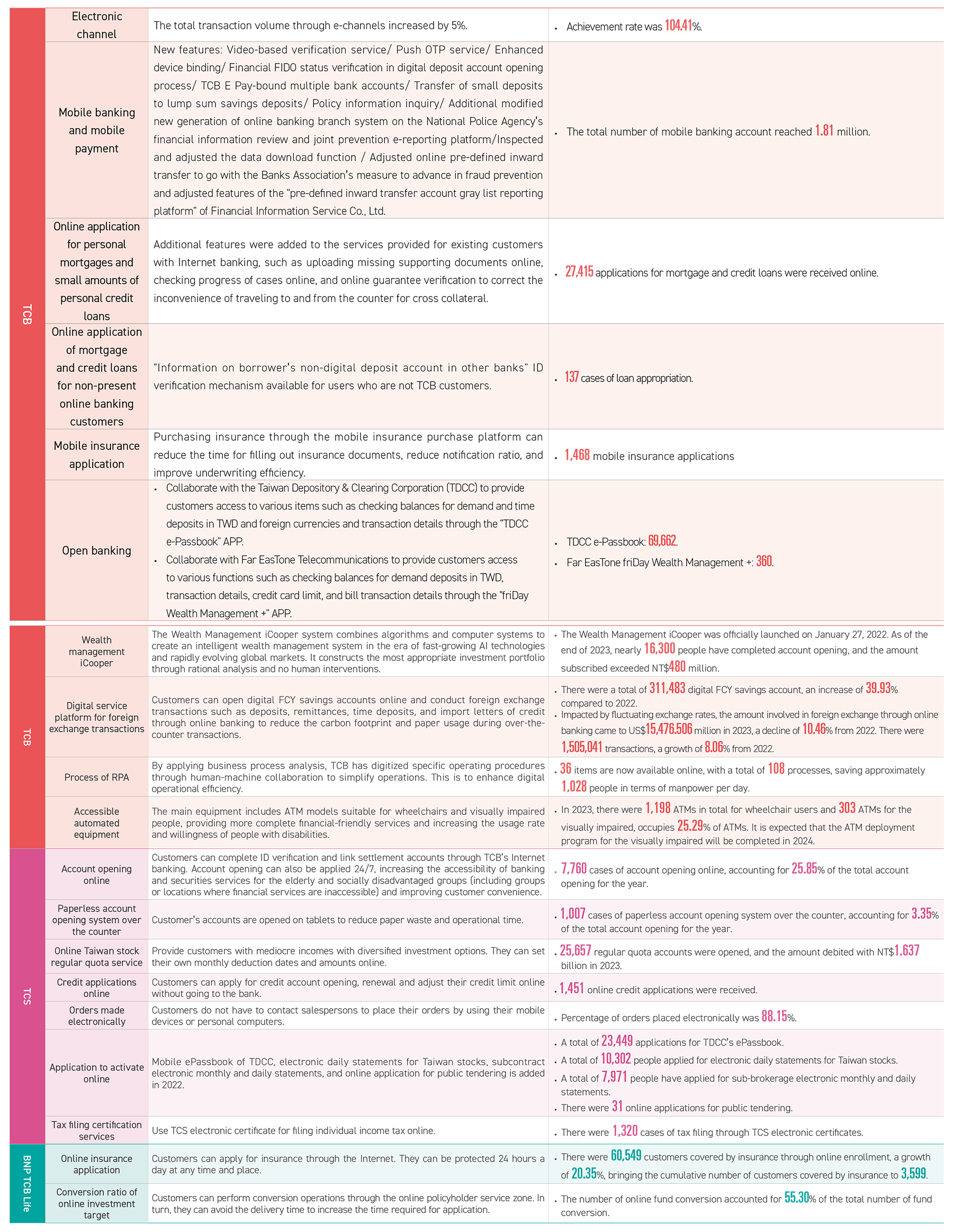

Innovative Digital Financial Products and Services

The Group has been actively promoting innovative digital finance. Our efforts include optimizing customer experience through data driven decisions and using big data analysis, robotic process automation (RPA), customer feedback information and AI technology to link automatic procedures. Our efforts aimed to provide comprehensive digital financial services and make financial products and services more approachable in the real life.

Innovative Patent R&D and Management

TCFHC defined its "Intellectual Property Management Program" in 2020 in an effort to promote integration and coordination of intellectual property management jointly with its subsidiaries. TCB introduced the " Taiwan Intellectual Property Management System" (TIPS) for the 1st time that year to perfect its management of intellectual properties applying the management cycle of "Plan-Do-Check-Act (PDCA)" and became one of the few financial institutions in the country having been certified as TIPS Class A for 4 years in a row, demonstrating outstanding results in creating and protecting intellectual properties.

In conjunction with the FSC’s promotion of Fintech and corporate governance 3.0, TCB continues to hold intellectual property-related cognitive education and training courses every year to enhance employees’ awareness and value of intellectual properties and strengthen risk management and internal control so as to ensure security and legitimate use. Meanwhile, the patent incentive system is enforced to encourage proactive research and development of innovative technologies among its people. As of 2023, more than 600 patent certificates had been issued by the Intellectual Property Office, Ministry of Economic Affairs and had been actually utilized in credit and loans, debt management, foreign exchange, business and marketing, anti-money laundering, and electronic finance, with improved operational efficiency and reduced operational risk.

TCB has been on the list of the top 100 domestic legal entities for patent applications for 6 consecutive years since 2018, and the number of cases has hit new highs. It ranked 13th in 2023. Although it fell slightly by 2 places from 2022, it still ranked the first in the financial industry for 2 consecutive years. TCB has successfully obtained 223 patents in 2023, covering various aspects such as big data, mobile platforms, AI and security control mechanisms, and is actively applied to all levels of business.

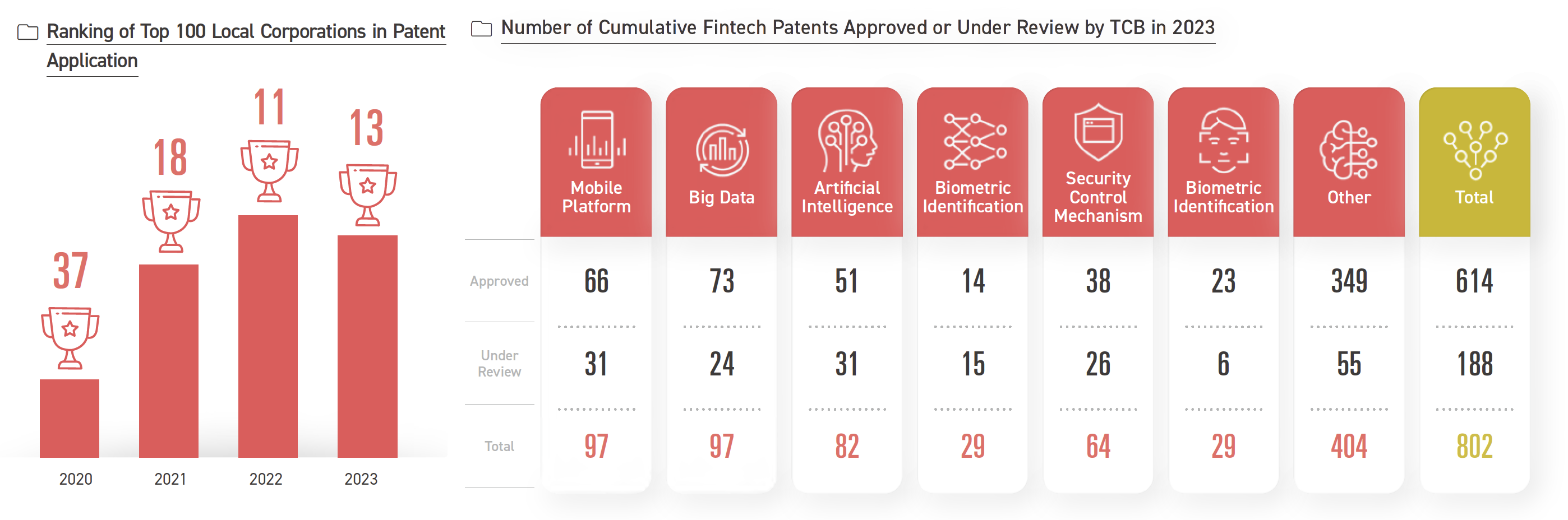

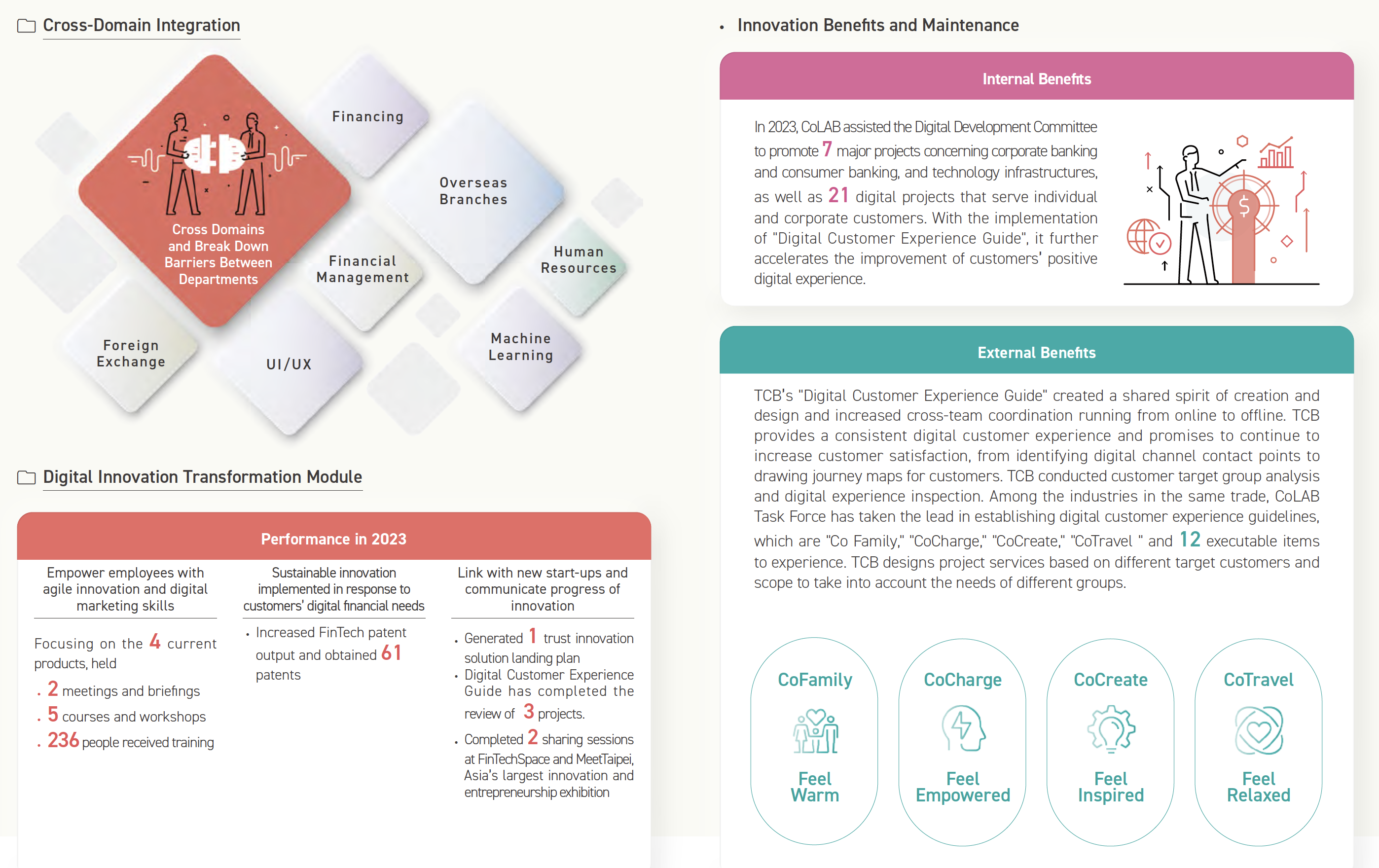

TCB CoLAB

In order to continue with the momentum to drive innovation and to develop innovative managerial capabilities as well as for the long-term goal of forming a culture where innovations are shared and sustained, TCB established the CoLAB in 2019 to help nurture seed staff. A cross-departmental collaborating innovative business model was created to facilitate constant collaboration with external consultants, sharing and exchange of business experience with different internal and external teams to fulfill creative output and maximize possible financial applications so that market trends as well as business needs are addressed.

Financial Inclusion Policy

In response to the sustainable development goals of the United Nations to promote financial inclusion and provide basic financial services to disadvantaged groups, the Group has launched tailor-made financial products and services that meet the needs of all sectors of society or different ethnic groups to make people with different backgrounds all entitled to fair and reasonable financial services or resources. In order to implement financial inclusion and promote financial inclusion services, the Company has enacted "Financial Inclusion Policy".

Promote Digital Savings Deposit Accounts

In order to strengthen financial services, TCB particularly provides the general public, residents in remote areas with the opportunity to open digital savings deposit accounts transcending time and space restrictions. The accounts are entitled to preferred withdrawal and transfer charges and high interests for demand deposits as incentives for savings.

In 2023, the net increase in digital savings deposit accounts amounted to 188,534 accounts, reaching a total of 676,648 accounts by the end of 2023. Among them, there was a net increase of 4,814 accounts in rural areas, totaling 17,003 accounts.

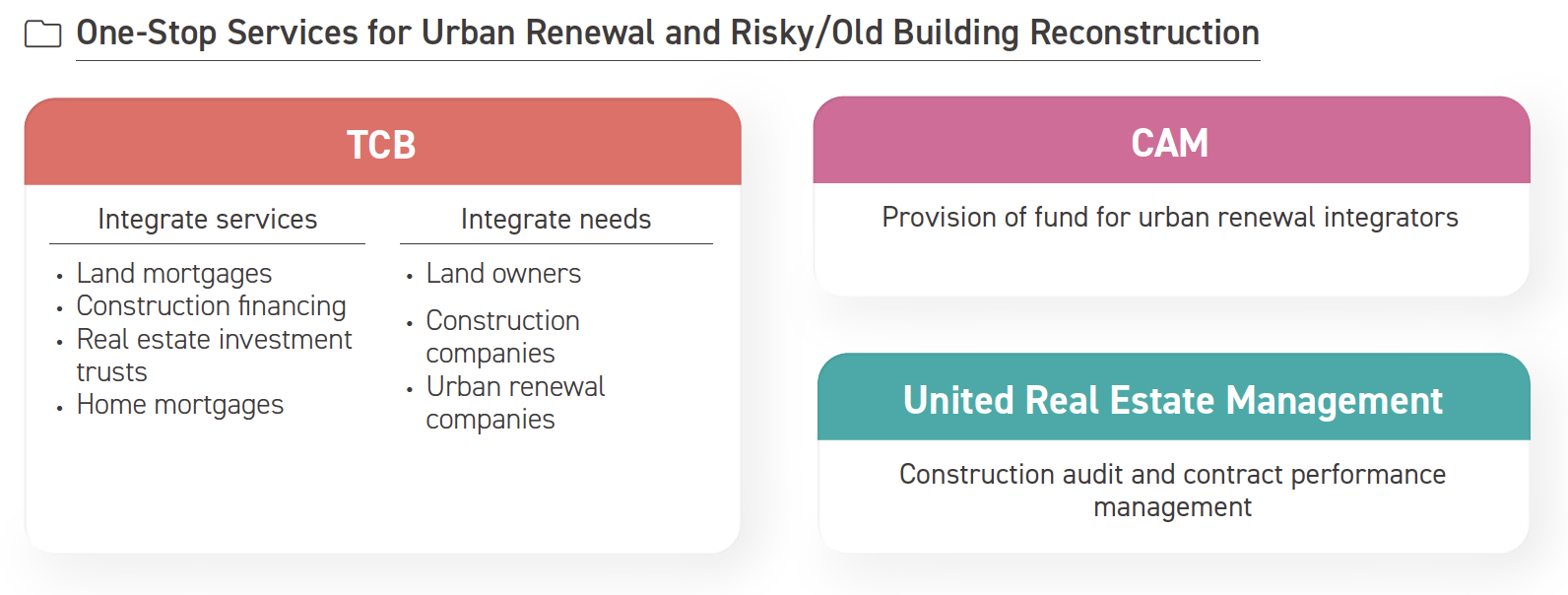

Promoting Urban Renewal

The Group has set up "Urban Renewal and Time-worn Buildings Reconstruction Task Force" and launched "Advance Payment for Urban Renewal and Time-worn Buildings Reconstruction" with real estate trust, construction fund trust, and financing plan. Integrated services are provided through partnering with United Real Estate Management to assist urban project integrators in acquiring working capital, construction audit, and management of contract enforcement and provide customers with one-stop innovative financial services. As of the end of 2023, the total number of TCB urban renewal and time-worn building reconstruction financing projects being undertaken was 242 totaling NT$174.19 billion.

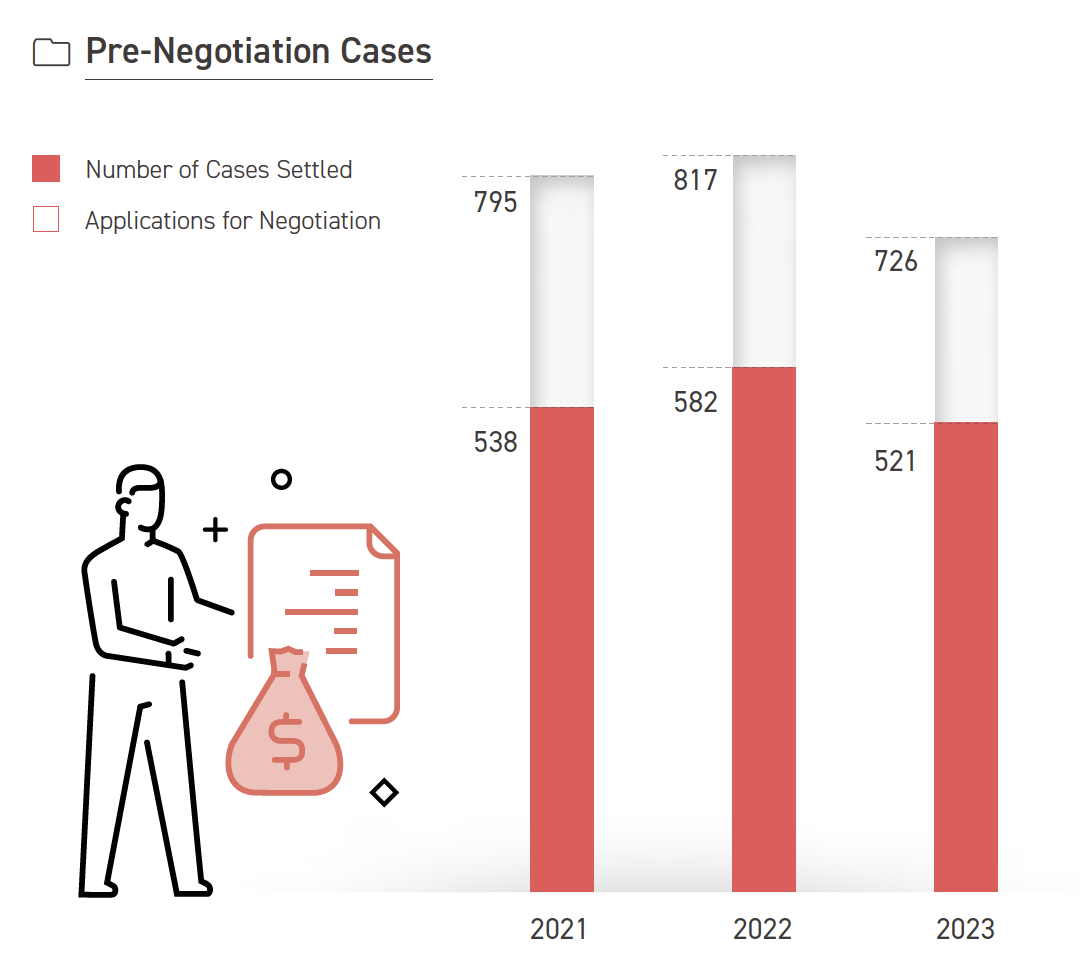

Debt Negotiation

The Group has provided a number of solutions to assist consumers in clearing their debts, including debt negotiation or enforcing the agreement reached in pre-negotiation, re-negotiated debt repayment scheme, or the debtors who failed to reach pre-negotiation agreement could request pre-mediation, revival, or clearance to the court. We endeavor to provide measures that could help mitigate the economic burden of debtors and repay their debts. In 2023, TCB completed 520 pre-negotiation cases and TCS completed 1 signing. They agreed with defaulting customers to repay in installments and assisted them in clearing their debts.

For the financially disadvantaged who have difficulties repaying their unsecured debts for 3 months or longer, such as low-income borrowers, borrowers with major illness, moderately disabled borrowers, victims of major natural disasters, and borrowers who have been involuntarily unemployed for 3 months or longer, TCB also offers "Project for Consumer Finance Unsecured Debt Extension for Financially Disadvantaged Borrowers" to help them to settle down and repay their debts.

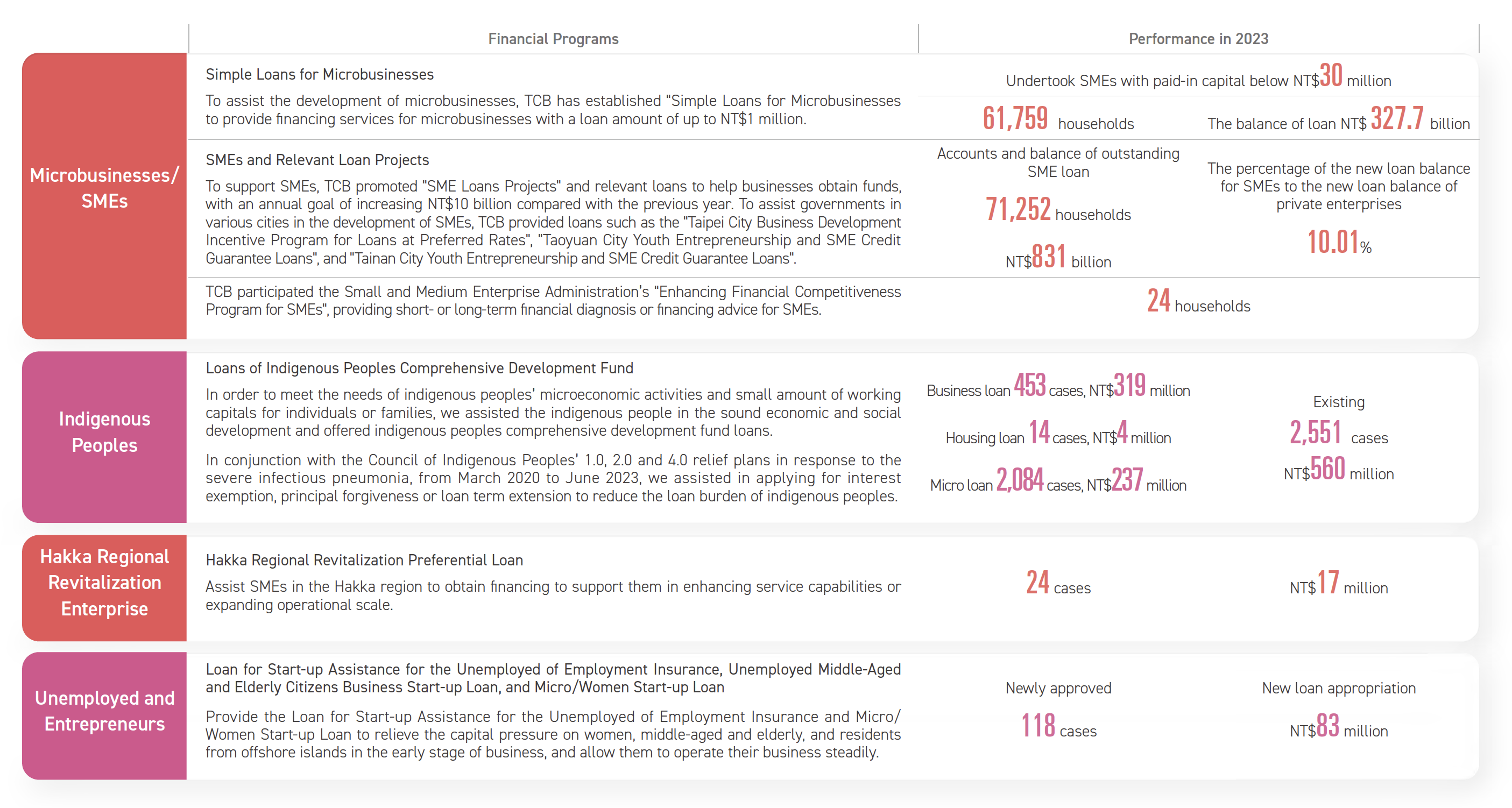

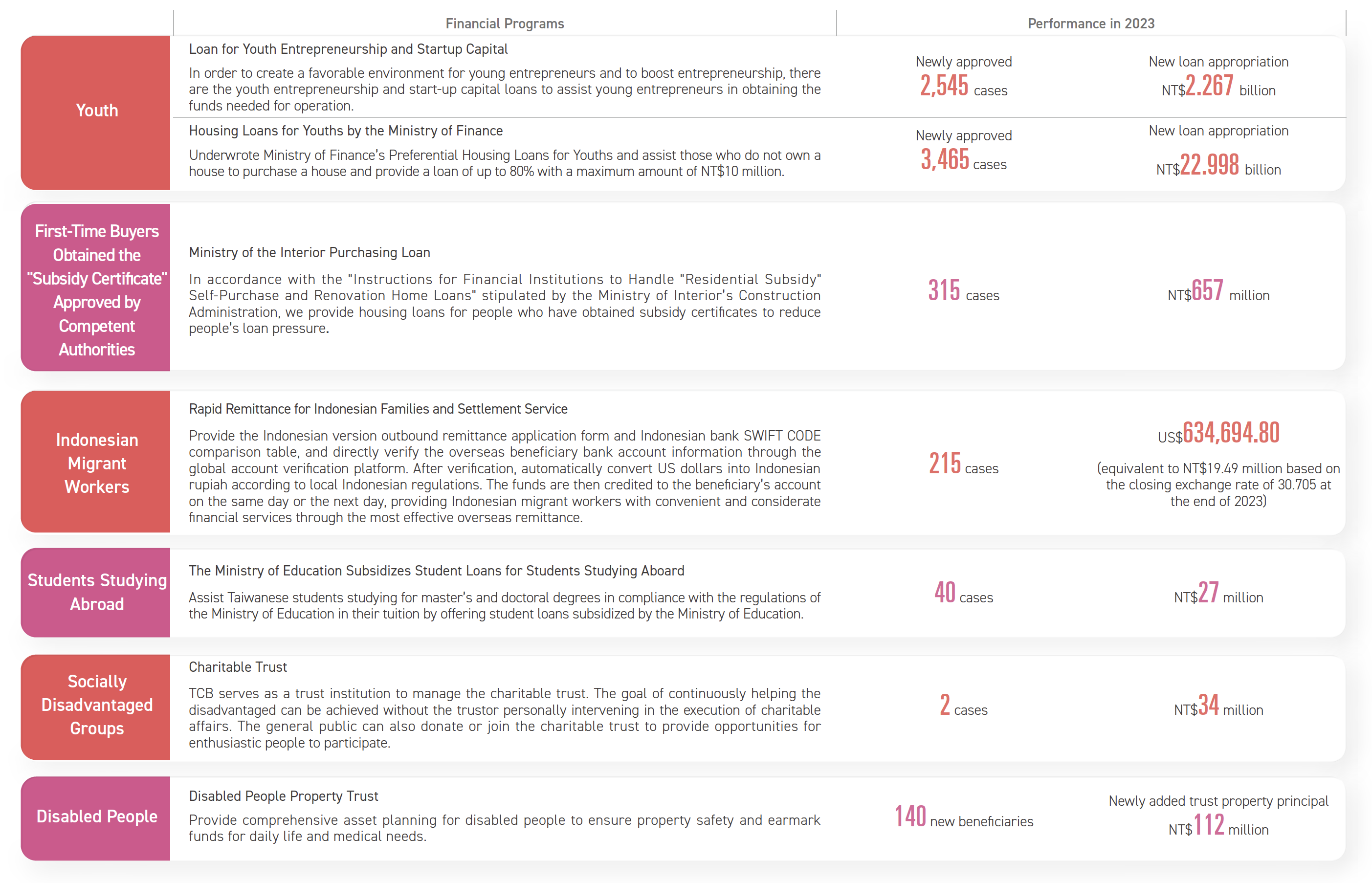

Cultivating the Financial Power of Diverse Groups

The Group integrated resources to provide diversified financial programs to meet the different needs of customers to achieve common good in the society. Of different project loans for stimulating the development of small enterprise and local community that TCB has underwritten, the ones with an amount exceeding NT$5 billion are urban renewal loans (NT$23.367 billion), agricultural and fishery loans (NT$13.167 billion) and youth loans (NT$14.108 billion). The total amount of the 657 cases of overdue loan accounted for 0.25% of the total relevant project loans earmarked for stimulating the development of small enterprise and local community.

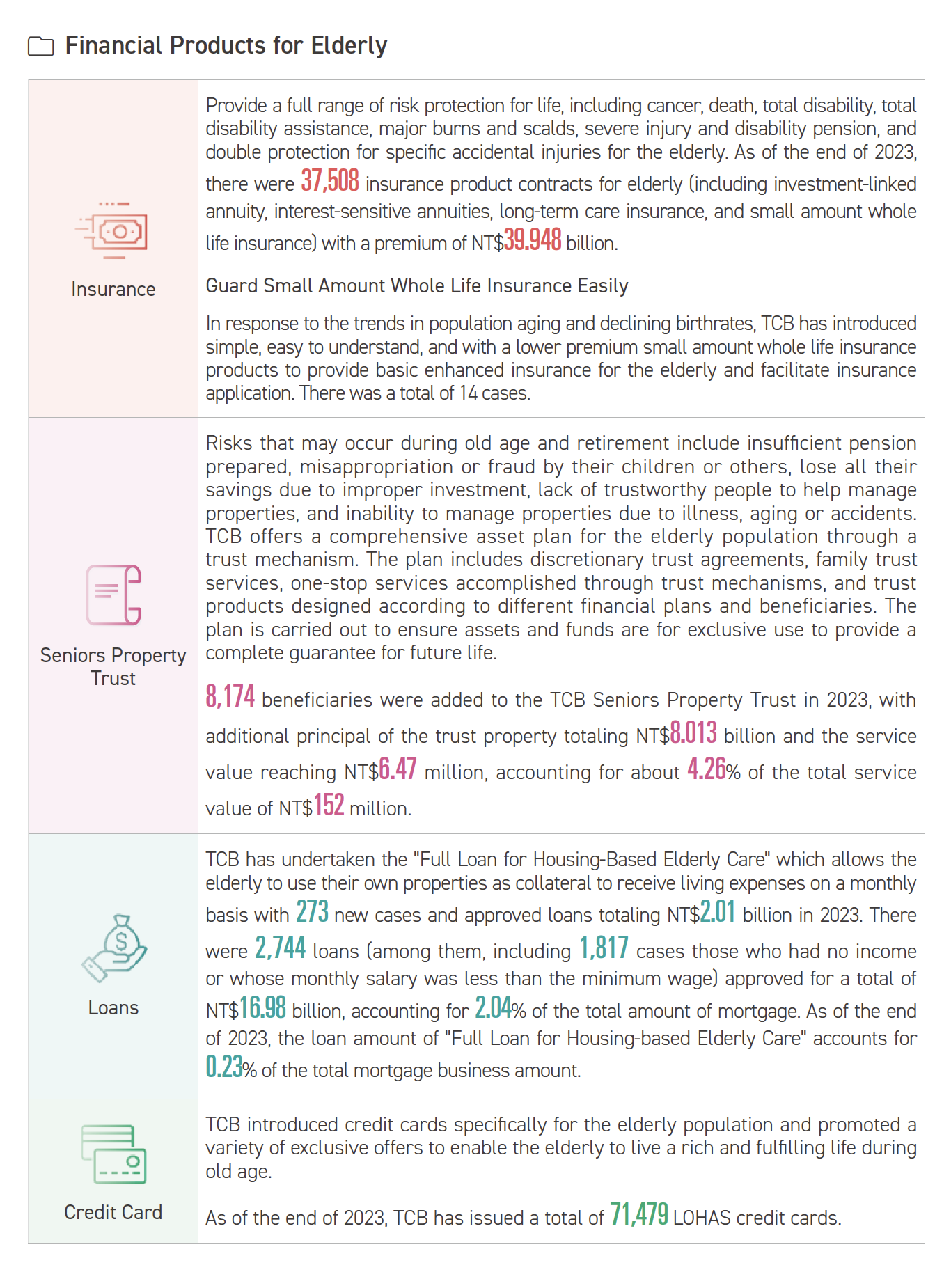

Guarding LOHAS and Elder Care

In support of the government’s efforts in building a nationwide long-term care system as well as an environment for development of healthcare industry in context of aging society, the Group has continuously integrated different resources to offer a variety of innovative and inclusive financial products and services to the elderly, with an aim of becoming the "No.1 brand in LOHAS and elder care" so as to leverage its influence as a member of financial industry.

Talent Cultivation for Products for Elderly

In 2020, TCB has partnered with Taiwan Association of Family Caregivers to launch "Seed Staff of Long-Term Care" training program by contributing its core competitiveness of 270 branches service network to create a warm and compressive product and long-term care services interlinked network to support customers at all aspects and tap into social resources to solve difficulties.

In addition, starting in 2021, TCB invested in training "Eldercare Financial Planning Consultants". TCB is the 1st bank to have more than 100 "Eldercare Financial Planning Consultants" dedicated to helping customers with trust planning and elderly care advice. In addition, the "Family Trust Planning Consultant Certification System" launched in 2022 is also one of the professional competency certifications promoted by the Trust 2.0 project. By the end of 2023, 630 employees have obtained the "Eldercare Financial Planning Consultant" certification, and 81 employees have obtained "Family Trust Planning Consultant" certificate.

TCS provides the "Eldercare Financial Planning Consultant" courses and subsidizes the examination fees to encourage employees to obtain certificates. It also hires external lecturers to conduct education and training on the protection of the rights and interests of the elders and people with disabilities, prevention of dementia, relevant cases and guidelines in the super-aging society. This is to improve the employees’ service quality for the elders.

Trust 2.0 Phase 2

The aging and chronic diseases resulting from the aging population have led to a significant increase in the number of people with disabilities. On the other hand, the impact of declining birth rates, changes in the concept and value of children’s ability to support their parents have led to a rise in the proportion of people living alone. How to ensure the security of property and receive proper care in senior years will be a major issue for Taiwanese people. To assist the public in managing assets and ensure financial security through trust mechanisms, TCB continues to actively support FSC’s Trust 2.0 "Comprehensive Trust" Phase 2 promotion plan and various social policies. In addition to strengthening organizational functions of departments, cultivating professional talents and industry-academia cooperation, TCB has also reinforced cross-industry alliances with long-term care and medical service providers and the industry of information technology. In addition, regarding measures adopted to treat elderly (dementia) customers friendly, the approaches and knowledge in terms of cognitive exams performed at healthcare facilities were referred to an effort to boost the knowledge of financial institutions about health conditions of elderly (dementia) people’s cognitive state and their ability to express themselves, among others and to provide suitable transactions and services reflective of their cognitive state and their ability to express themselves so that their rights are protected. TCB provides people up-to-date comprehensive trust services.

Ms. Liang is deaf and has 3 children. The eldest son went astray, have been imprisoned many times, and often asks her for money. Fortunately, the other two children are very filial, but they have already married and do not live with Ms. Liang.

Recently, the eldest son needed money and took Liang’s ATM card without her permission. She and her family are very troubled by the situation. They hence discussed with the neighborhood chief and TCB. TCB decided to set up the elderly care trust for Ms. Liang that prioritizes protection of assets and has the other 2 children to serve as the trust supervisors, in sufficient honor of the essence of property trusts to ensure property security and earmarked funds, and to enforce inclusive financing that aims to help financially vulnerable people enjoy their life while they grow old.

Create a Friendly Financial Environment

Barrier Free Friendly Service Environment

270 branches of TCB across Taiwan have all had different types of barrier-free facilities or measures in places, including a barrier-free slope for enabling physically or mentally impaired people or other disadvantaged to enter, tactile floor tiles and service bell, barrier-free service counter and ATM, and designated service staffs to assist with financial businesses. Moreover, we collaborate with the Taiwan Association of Sign Language Interpreters to provide sign language interpretation services. In order for disabled people to enjoy more friendly financial services, TCB waives interbank ATM cash withdrawal fees particularly for account holders with disabilities, which may be applied for at the counter, by mail, or online. In order to take care of areas with low population density (not exceeding 300 people per square kilometer) or economically disadvantaged areas (counties and cities in the bottom 1/3 of economic and employability rankings), TCB has set up 19 branches and installed 72 ATMs, providing the same services as other areas. TCB also offers a variety of channels, such as intelligent customer services, live chat customer services, Internet, APP, voice call, and telephone service representatives, to enable users to choose a suitable way to inquire about businesses or express their opinions.

All of TCS’s business locations received the "Dementia-Friendly Label" from the Ministry of Health and Welfare in 2022. In addition to setting up elderly and barrier-free service areas for the elders and people with disabilities at all business locations in Taiwan, TCS deploys qualified first aid personnel, provides elderly customers with reading glasses and blood pressure monitors, and actively cares for the elders and customers with disabilities when providing over-the-counter services at the same time. TCS has planned the height of its service counters to be suitable for elderly customers who use wheelchairs to fill out account opening-related documents. TCS also provides various consulting services to elders, such as calling a taxi or borrowing a wheelchair, and assigns dedicated personnel to assist.

Friendly Financial Services Section

TCB Internet Banking

In order to provide disabled people with better-quality and more convenient online financial services, except for the live chat customer service, official website, online ATM, and eATM with simple features of TCB are all rated "AA" according to the National Communications Commission (NCC) Website Accessibility Guidelines 2.1. The friendly personal online banking, in particular, is rated "AAA" according to the Accessibility Guidelines 2.1 to reflect the operational features needed for disabled customers and preferred ATM withdrawal processing fees up to 3 times may be applied for online. In addition, credit card application, card initiation, reporting of lost credit cards, and other services may be applied for through multiple channels such as online banking and mobile banking.

TCS Official Webs

To create a friendly and convenient investment environment for people with disabilities and commit to provide barrier free financial services, TCS’s friendly service section on its official website has obtained the "Accessibility Website Label-A Level" certification. TCS complies with friendly financial measures stipulated by competent authorities to provide diverse order placing and account opening services, such as phone, voice, and electronic ordering. TCS also integrate nondiscriminatory digital services to make it more intuitive and convenient for customers to operate. In addition, various online financial services can eliminate the inconvenience of visiting the counter, save time, and provide professional and complete electronic transaction services 24 hours a day.

Building a Bilingual Financial Service Environment

- TCB has established 131 bilingual service branches (accounting for 48.52% of the total number of domestic branches) by the end of 2023. by the end of 2023. Exclusive English service counters, document forms commonly used by foreigners, bilingual signs and ticket dispensers in the business lobby, and multi-language translation machines are provided to serve customers from non-native English-speaking countries. In addition, the branches in Nanjing East Road, Yuanshan, Zhongli, Taichung, and Kaohsiung where Japanese tourists frequently visit have added Japanese language services to enable foreign tourists to enjoy warm and friendly financial services.

- TCS has actively responded to the "Blueprint for Developing Taiwan into a Bilingual Nation by 2030" by setting up bilingual signs at its service locations and providing bilingual versions of commonly used application forms at its counters. Important business locations are staffed with personnel who are capable of providing services in English. In the future, TCS will continue to provide more bilingual services to meet the financial needs of foreigners and connect with the international community.