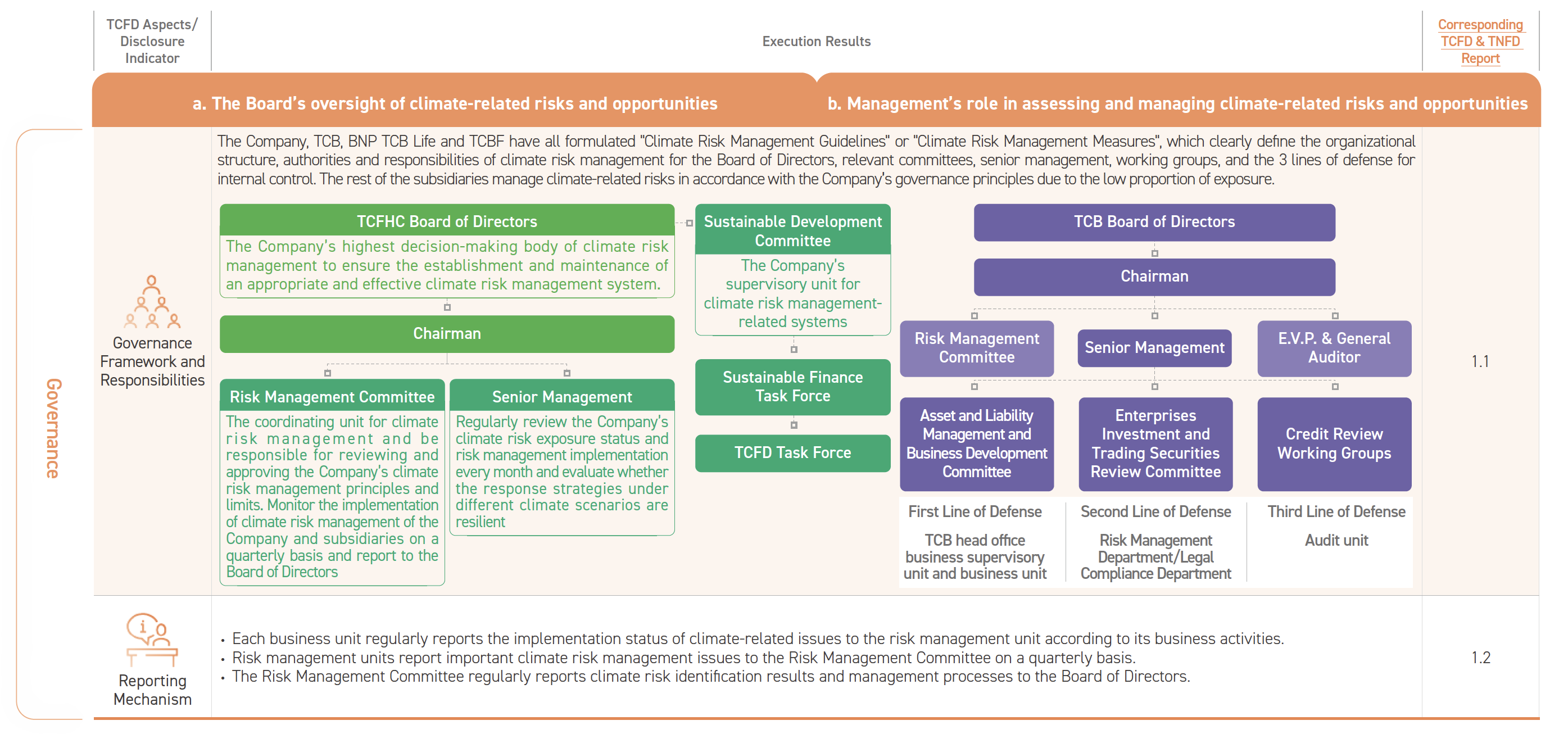

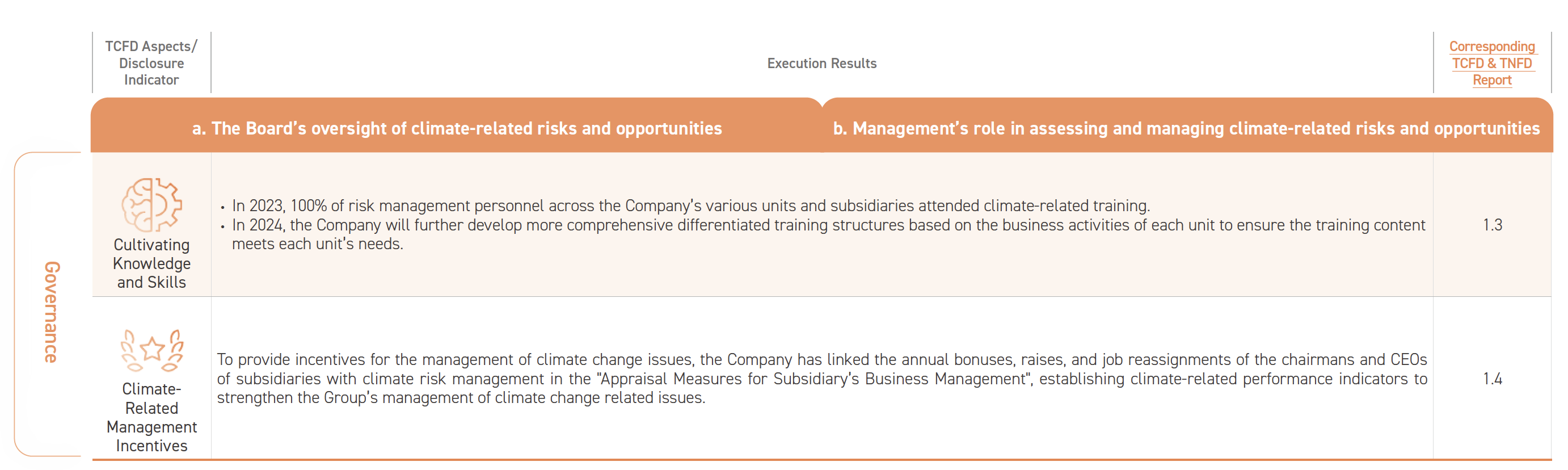

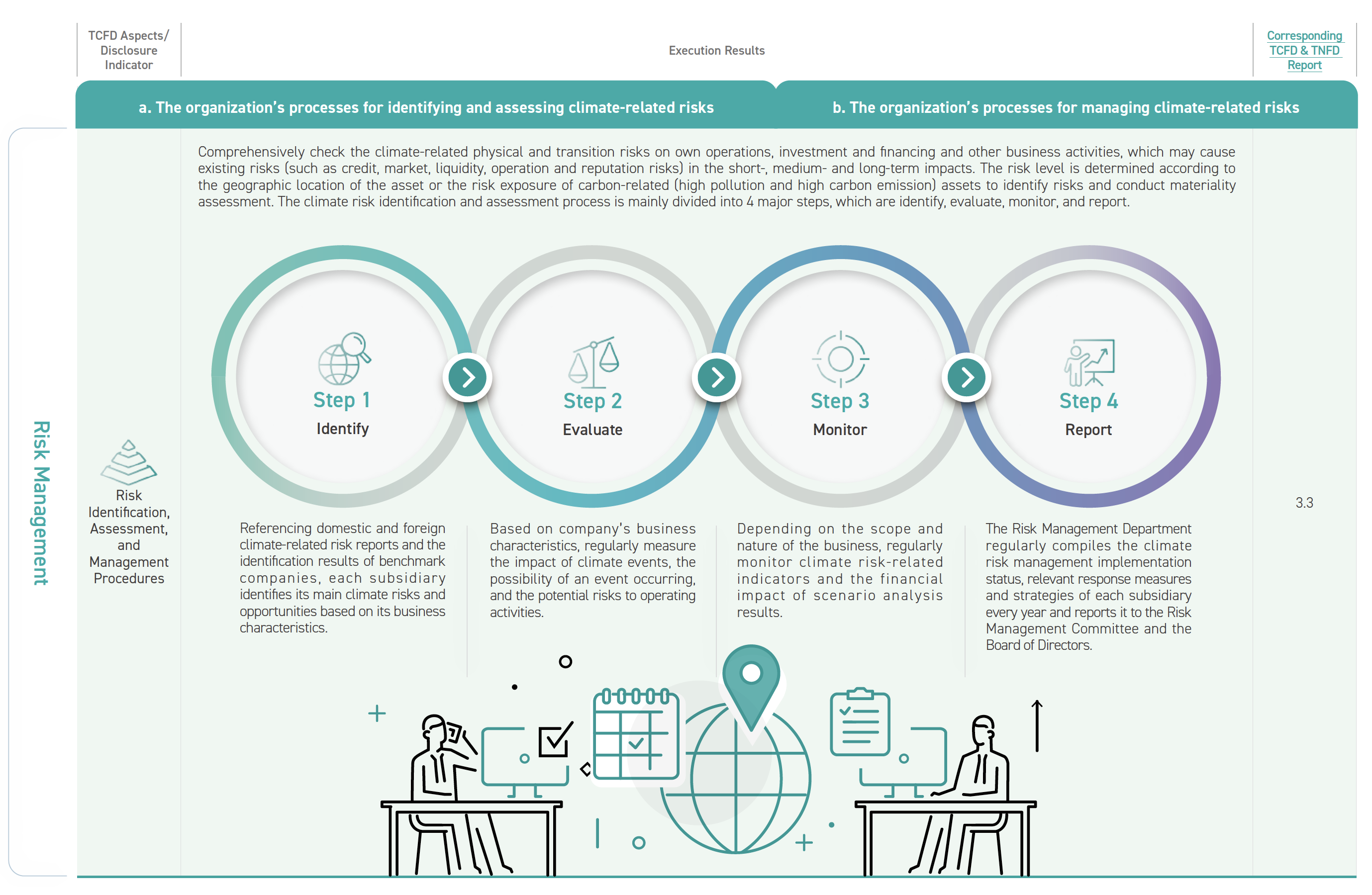

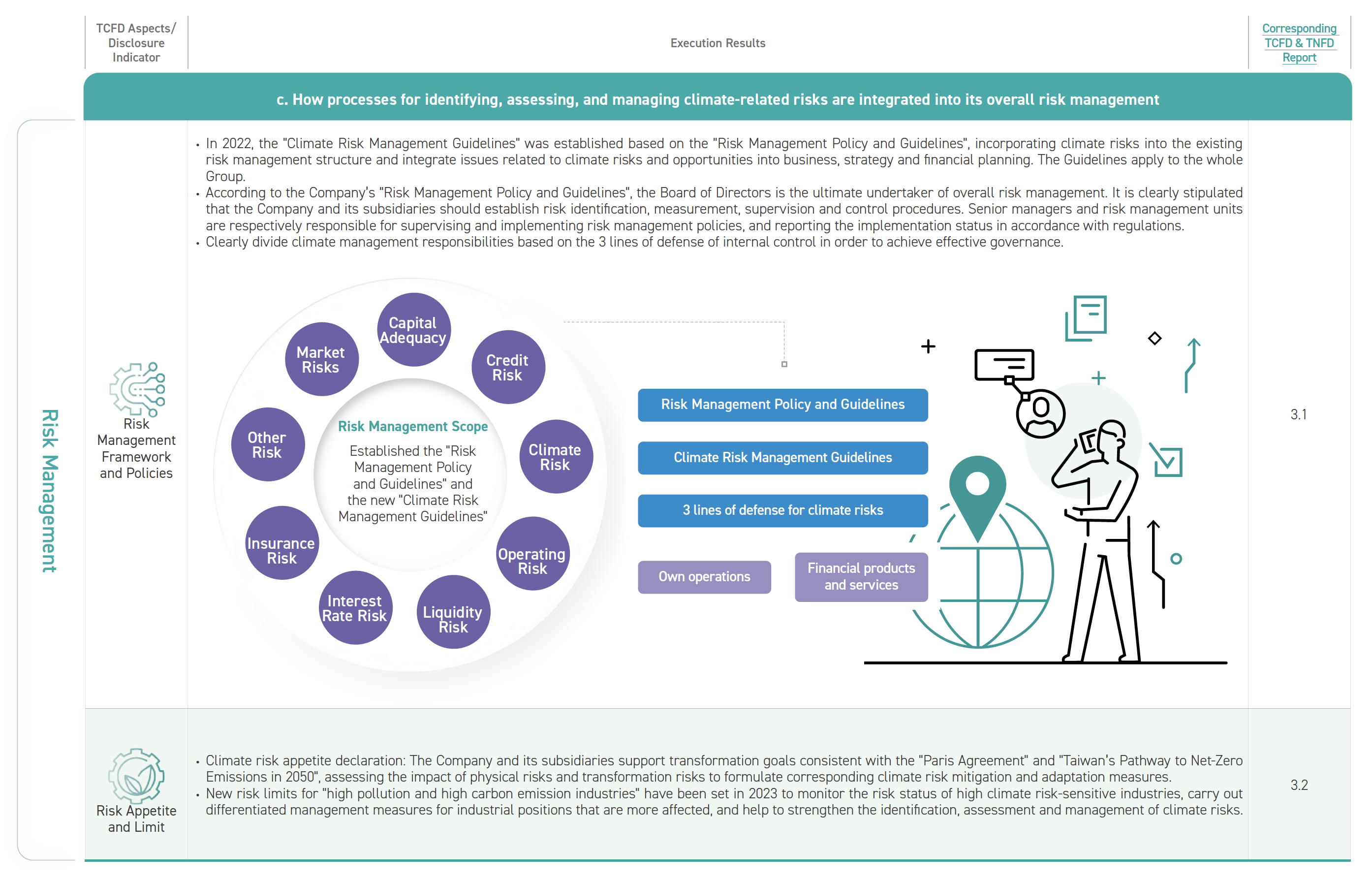

Climate change has become a global issue that cannot be ignored. As an important player in the capital market, the financial industry should become a leader in climate change management. The Company became a TCFD Supporter in December 2020 and established a cross-subsidiary TCFD Task Force within the Group. The Company has gradually established the Group’s risks and opportunities identification, measurement, monitoring, reporting and other management procedures through education and training and task force meetings according to TCFD’s "Governance", "Strategy", "Risk Management", and "Metrics and Targets".

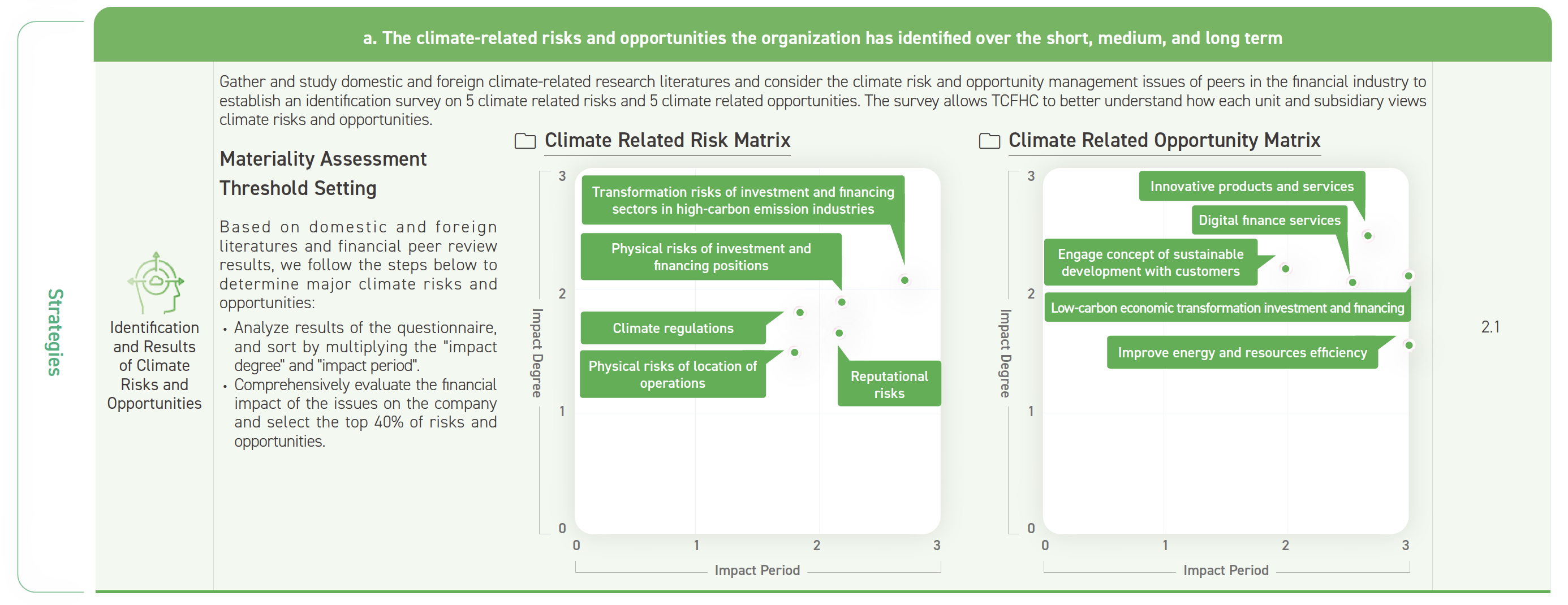

Following the "Task Force on Climate-Related Financial Disclosures"(TCFD) launched by the Financial Stability Board (FSB) in 2017, financial supervisory agencies around the world have gradually formulated climate risk management-related disclosure norms, including the "Climate Risk Financial Disclosure Guidelines for Domestic Banks" and "Climate Risk Financial Disclosure Guidelines for the Insurance Industry" issued by Taiwan’s FSC in 2021. The Company also follows the "comply or explain" principle when making disclosures. The summary of implementation results is as described hereunder. For complete contents of the disclosure, refer to the 2023 TCFD and TNFD Report for details.

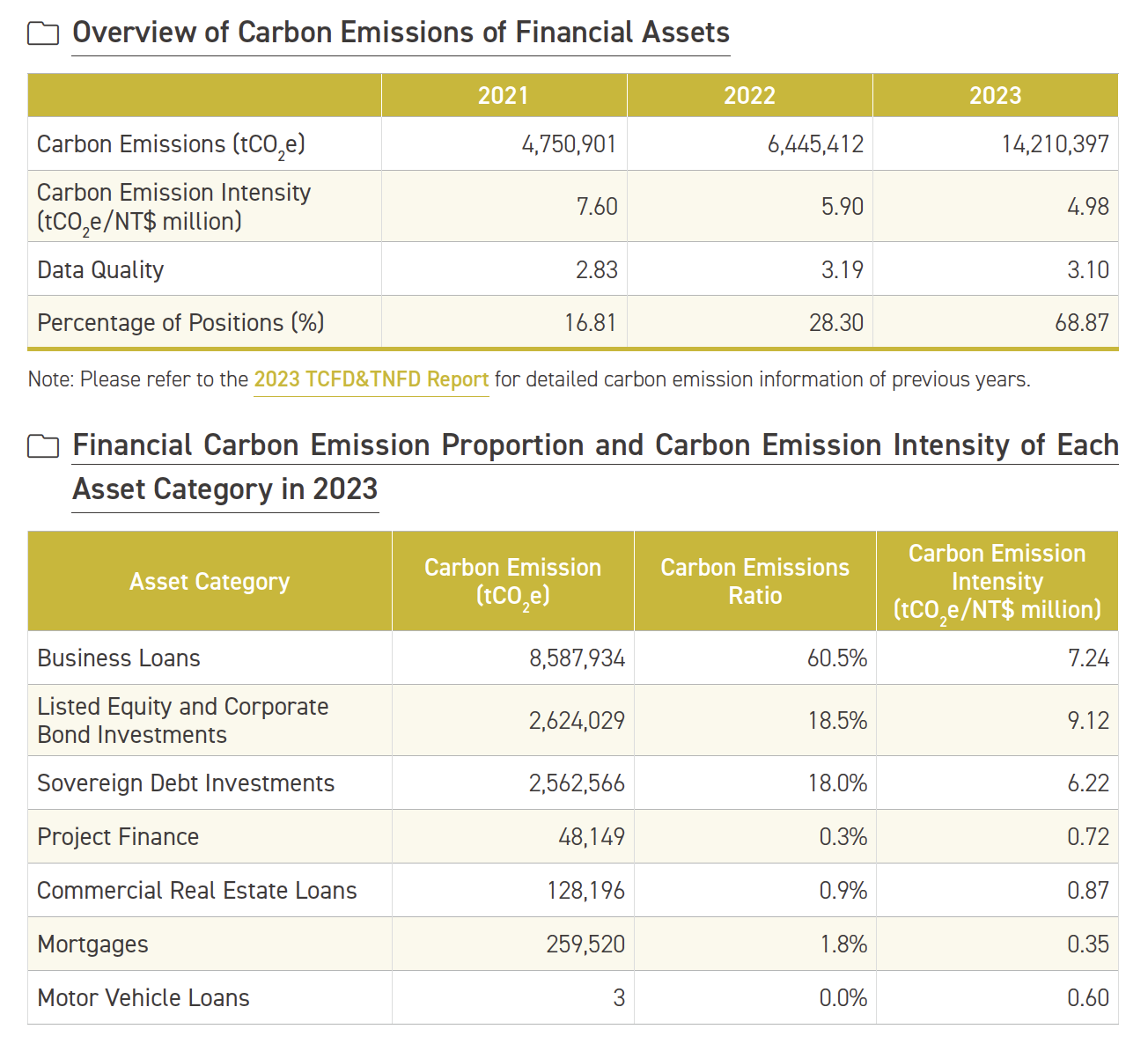

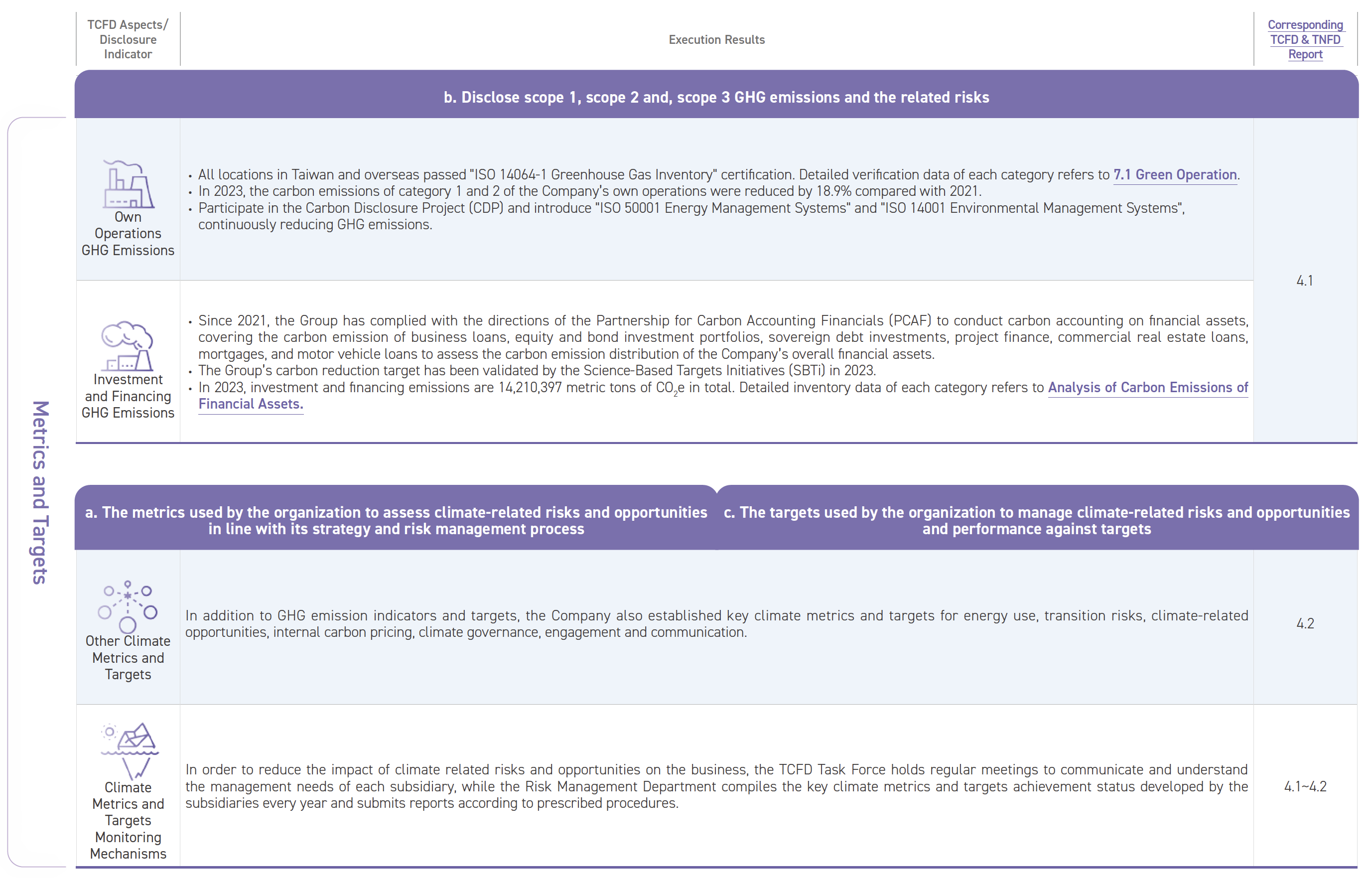

Analysis of Carbon Emissions of Financial Assets

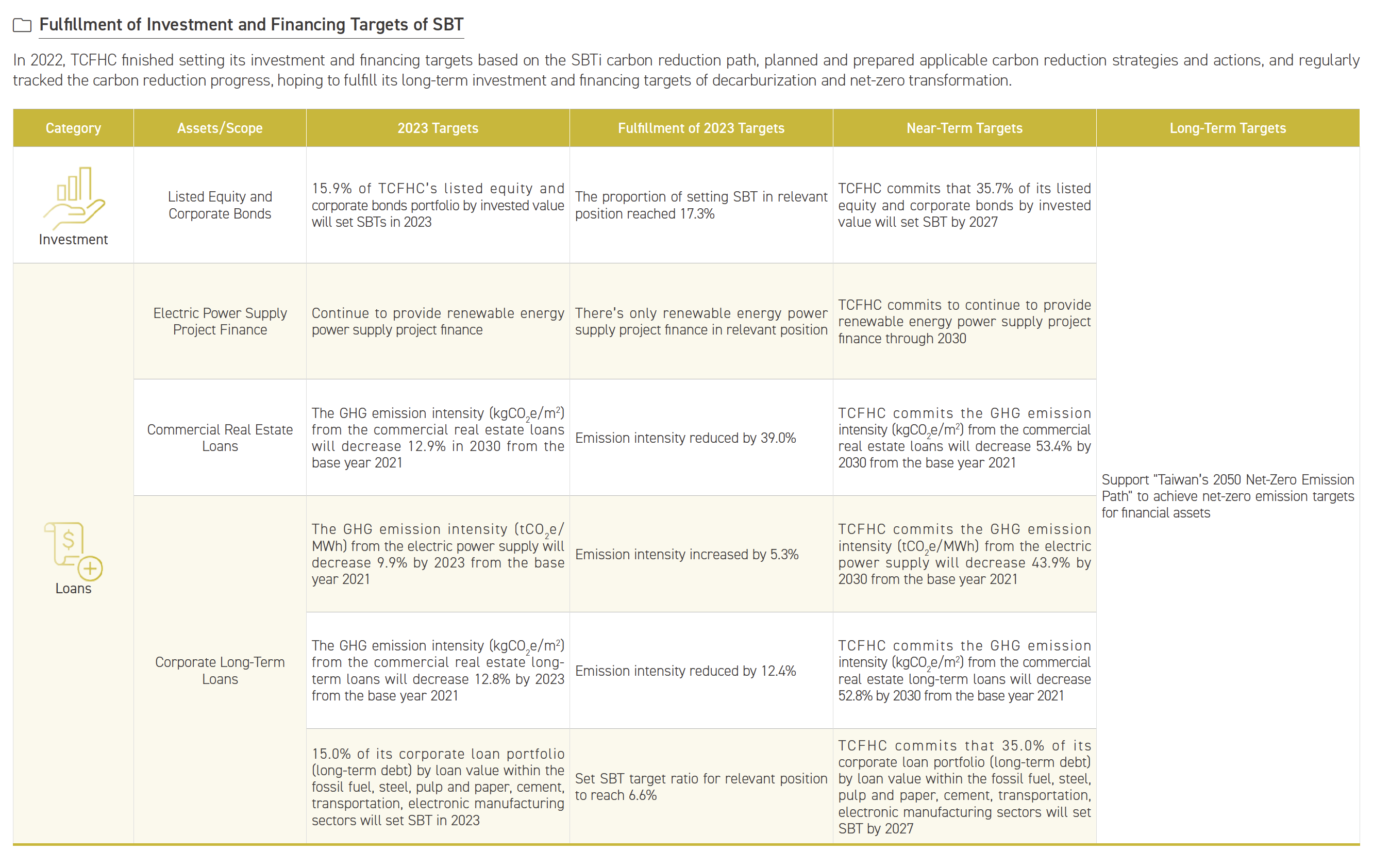

Since 2021, the Group has complied with the directions of PCAF to conduct carbon accounting on financial assets. In 2023, the scope of the inventory has been expanded to include business loans, equity and bond investment portfolios, sovereign debt investments, project finance, commercial real estate loans, mortgages, and motor vehicle loans. For long-term debts and equity and bond investment, we also analyze carbon emission intensity by industry to identify industries with higher carbon emissions, as a reference for strengthening negotiation and counseling transformation, and at the same time study the integration and application of carbon emission factors and investment and financing decision-making processes in order to optimize the overall climate risk management. Meanwhile, we introduce SBTi and refer to Taiwan’s net-zero path to assist the Group’s investment and financing decarbonization and net-zero transformation.