According to the "Global Risks Report 2023" of the World Economic Forum (WEF), "biodiversity loss and ecosystem collapse" is among the Top 5 of the "10 major risks around the world in the coming 10 years". Out of risk-oriented management awareness, the Group is gradually including the nature risk as part of its risk management. The Group applied to become a member of the Task Force on Nature-related Financial Disclosures (TNFD) Forum in 2023 and will continue to disclose its nature-related risk management under the 14 requirements of the TNFD framework in the future.

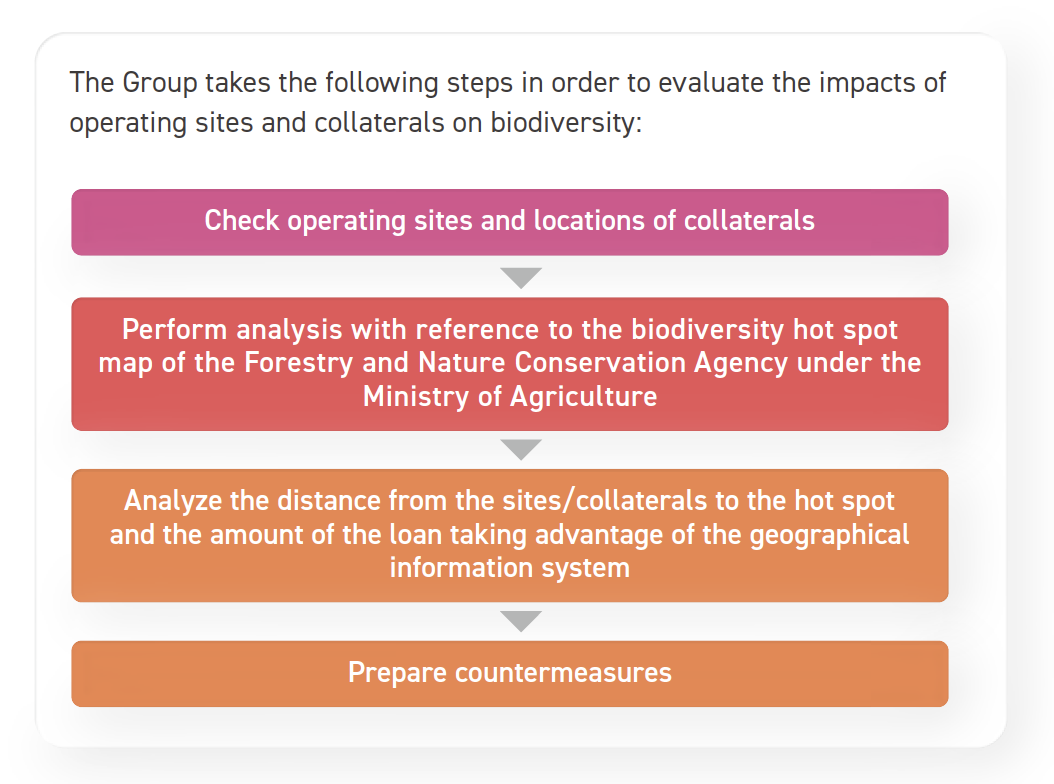

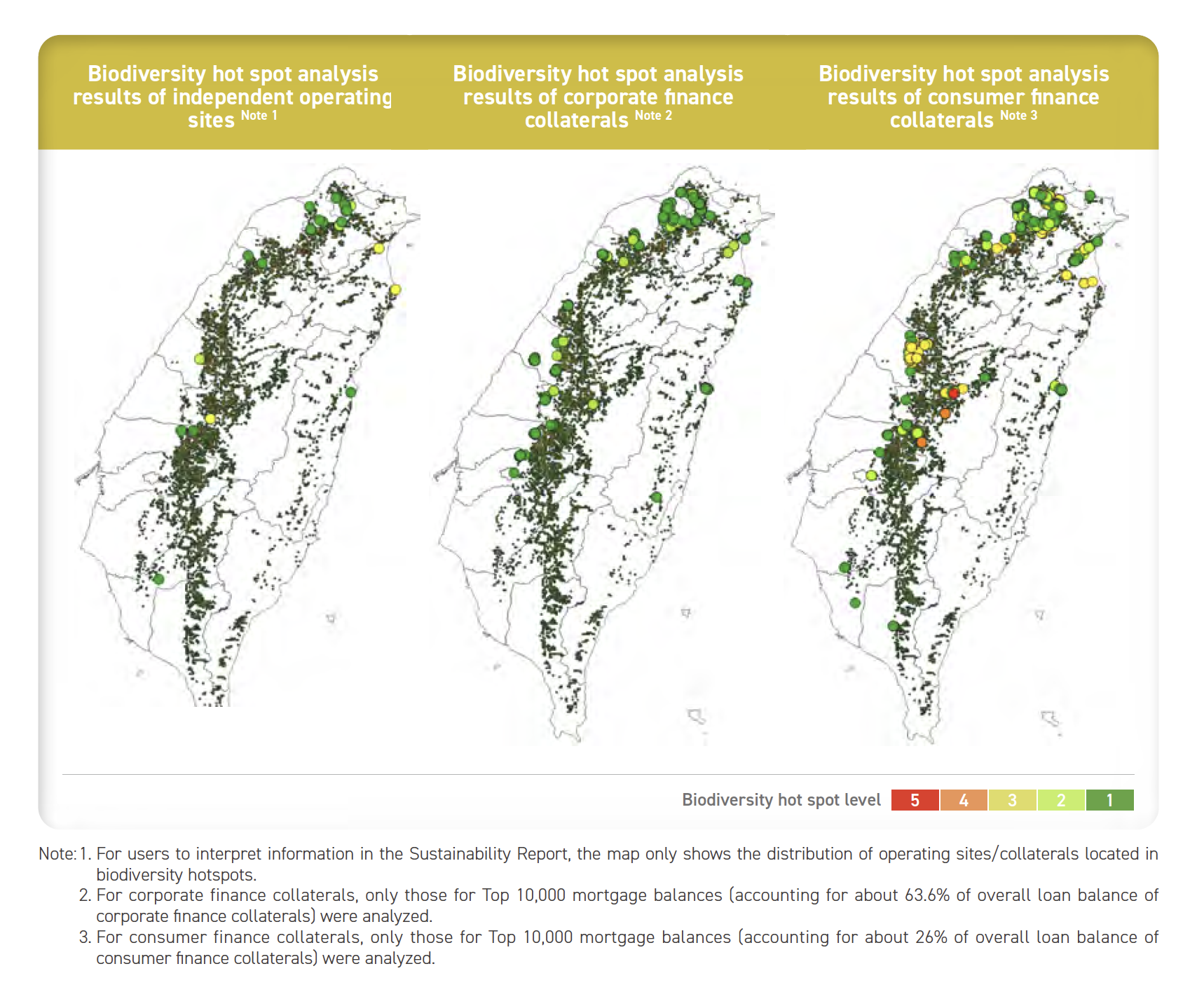

Analysis of Biodiversity Hot Spot Impacts

This analysis takes advantage of the biodiversity hot spot map of the Forestry and Nature Conservation Agency under the Ministry of Agriculture. The map is based on the estimated distribution of 42 species of mammals, 110 species of birds and other species, and is divided into 5 levels. Level 5 is the hottest spot.

An overview of the analysis result shows that most of the Group’s operating sites and collaterals are not located in highly hot spots in terms of biodiversity (Level 4 ~ 5). 91.1% of the TCB’s branches and areas within 1 km radius of them are not biodiversity hot spots and 90.2% of corporate finance collaterals are not within the hot spot, either. Only 0.1% of consumer finance collaterals are located in Level 4 and 5 diversity hot spots and a majority of them are in low-risk hot spots.

Natural Risk Management for Portfolio Activities

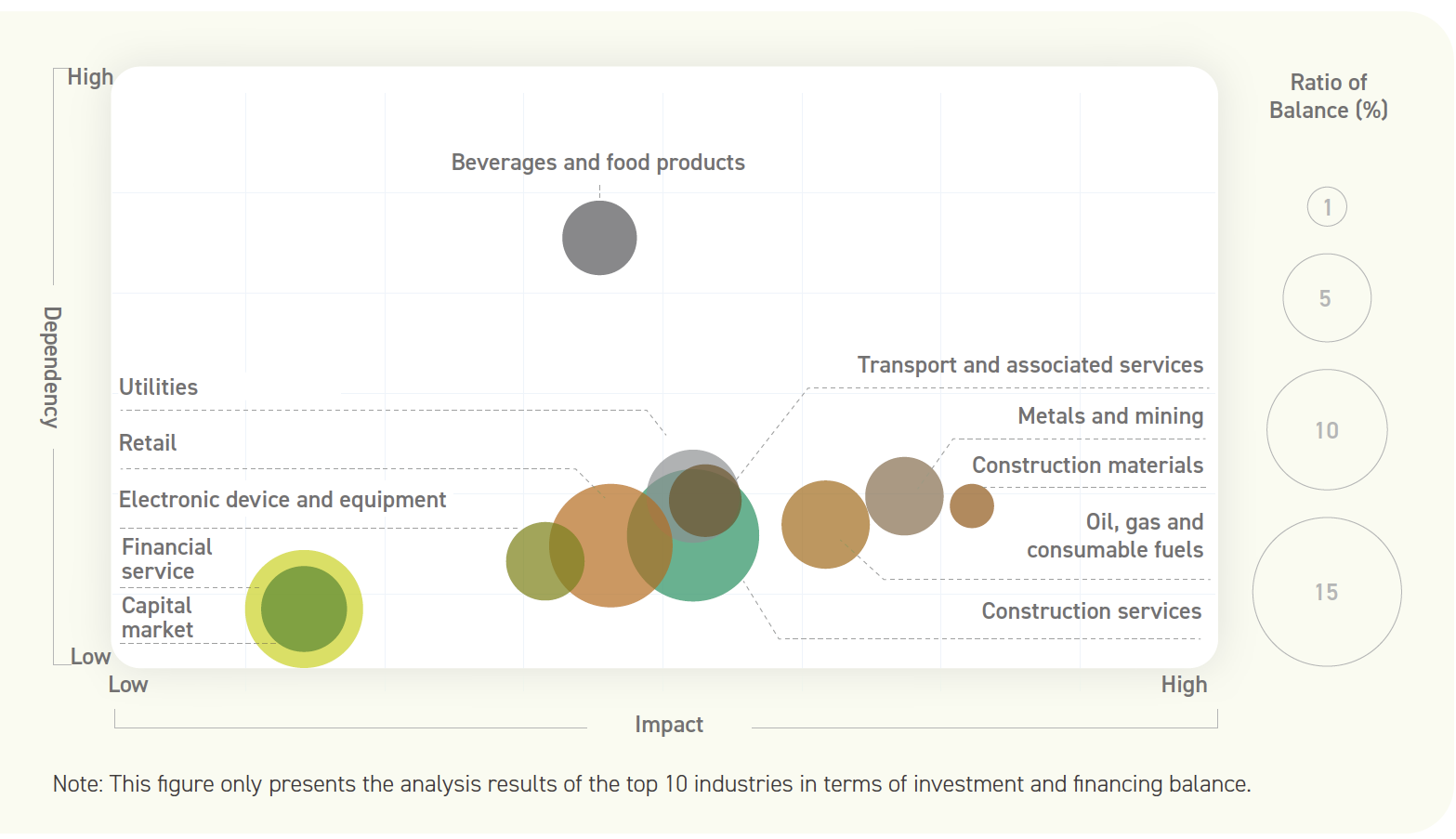

In order to properly evaluate the dependencies and impacts of the investment and financing portfolio on natural resources, the Group follows TNFD suggestions by applying the "ENCORE" tool to the analysis and evaluation.

Investment and financing portfolio are divided by the industry and weighted according to the dependencies and impacts of respective industries in order to quantify the risk of exposure for the natural capital such as utilization of land, freshwater resources, marine environment, mining, and biodiversity while identify high-risk prioritized industries that require advanced rating and countermeasures.

Analysis results show that 43.16% of the Group’s investment and financing positions belong to highly nature-sensitive industries (16 sensitive industries that are highly dependent on or impacting natural capital according to TNFD suggestions). The food industry, in particular, relies the most on natural capital, accounting for about 3.06% of the overall investment and financing balance while the construction materials industry and the metals and mining industry have a greater impact on natural capital, accounting for 1.11% and 5.99% of the total investment and financing balance, respectively. In the current investment and financing portfolio, there are no sectors that are extremely dependent on or impacting natural capital.

In the future, the Group will continue to deepen the evaluation of dependence and impacts on natural resources of industries to accordingly perfect its risk identification and management mechanism and to provide more thorough information to refer to upon decision-making.