Corporate governance is the 1 st step to corporate sustainability and a key benchmark for measuring sustainable development. Sound corporate governance is embodied by the Board of Directors and the management operating in the context of the best interests of the company and stakeholders, providing effective oversight and assistance to the company’s management and operations to achieve business goals. Meanwhile, it also encourages the company to utilize resources and become more efficient, thereby strengthening competitiveness of the company and wellbeing of the population as a whole.

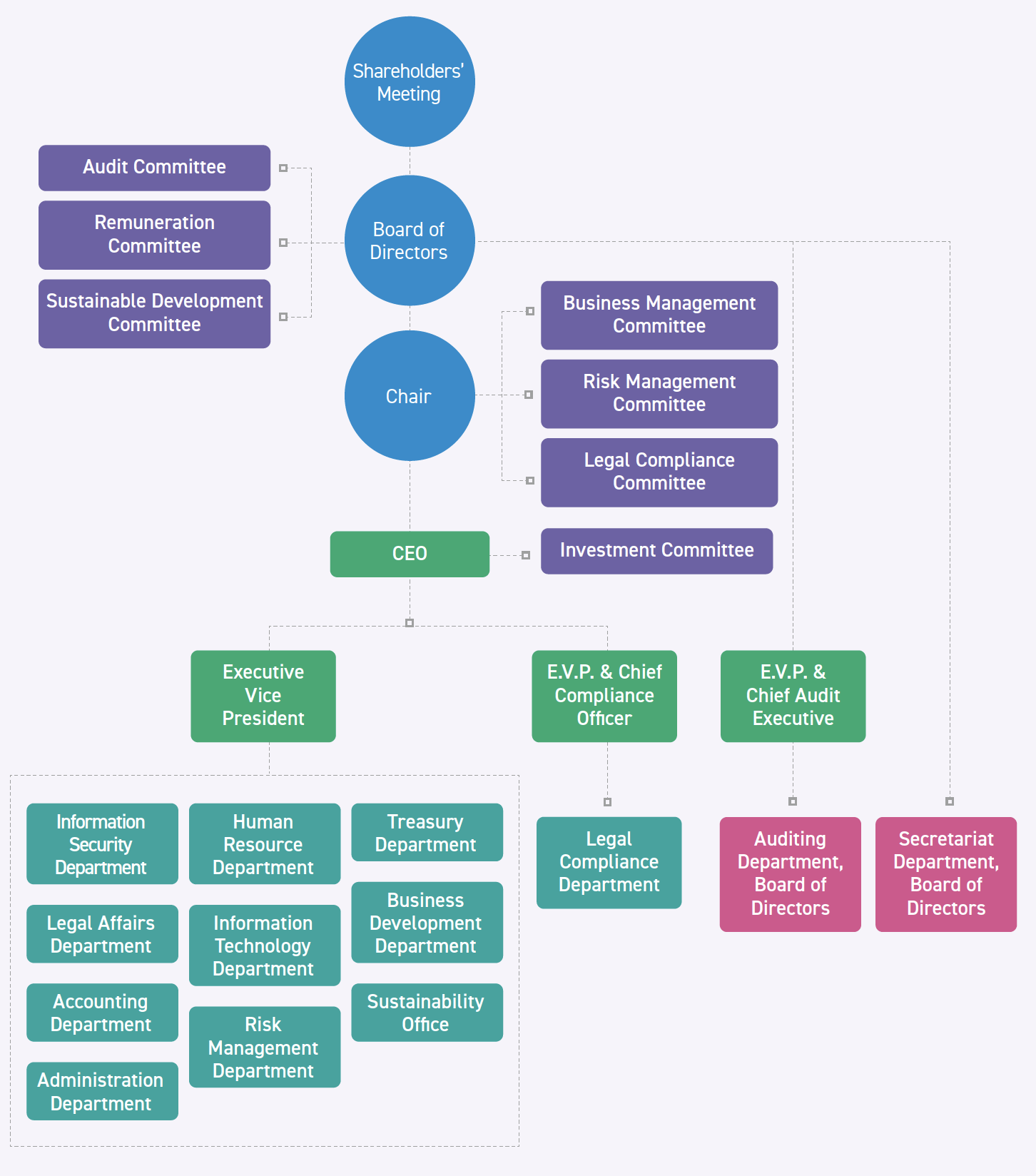

Corporate Governance Framework

TCFHC follows the FSC "Corporate Governance 3.0 - Sustainable Development Roadmap" and the TWSE and SFI "Corporate Governance Evaluation of TWSE/TPEx-Listed Companies" while enforcing corporate governance in order to effectively promote corporate governance and business results, to boost organizational operation, and to protect the rights of shareholders, employees, customers, and other stakeholders.

Board Structure and Operating Mechanism

TCFHC has a well-defined corporate structure and complies with governance related regulations including "Articles of Incorporation", "Corporate Governance Best Practice Principles", "Ethical Corporate Management Best Practice Principles", and "Sustainability Development Best Practice Principles", based on which the Board of Directors is entrusted with the highest authority in corporate governance to be responsible for sustainable development decisions on economic, social, and environmental aspects.

Since 2021, the directors and independent directors are elected following the candidate nomination system by shareholders from the list of candidates for directors and independent directors and serve a term of 3 years.

In 2023, 17 Board of Directors meetings were held and the attendance rate of all 5 th directors was 95%.

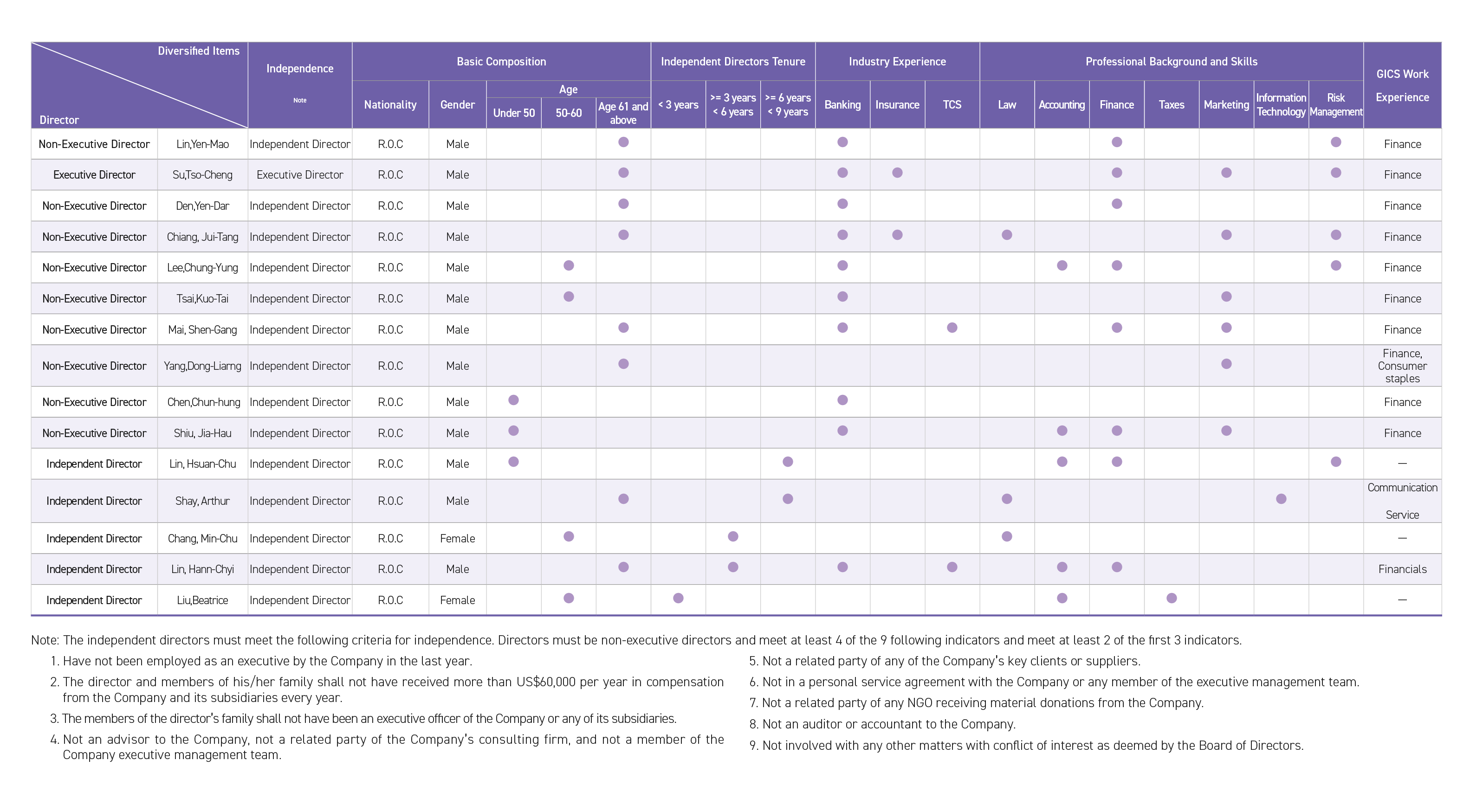

The Board of Directors have 15 directors, consisting of 1 executive director, 5 independent directors, and 9 non-executive directors. The Chair of the Board and CEO are not the same person, spouses, or close relatives within the 1 st degree of kinship. The relationships between the directors are not spousal or familial relationships within the 2nd degree of kinship, and independent directors serve a maximum of 3 consecutive terms. All these ensure the independence of the Company’s Board of Directors.

The members of the Company’s 5 th Board of Directors possess rich experience and expertise in various fields, including business management, leadership and decision-making, knowledge of the industry, international perspectives, financial accounting and taxes, and law. Among them, 1 independent director have served for less than 3 years, while 2 independent directors have served for more than 3 years but less than 6 years, 2 independent directors have served for more than 6 years but less than 9 years, the average tenure of 5th Board members is 3 years. Currently, 3 directors in the Company are employees (including employees from affiliates). The number of directors concurrently serving as the Company’s manager does not exceed one-third of the total number of directors. The age distribution of the directors is diverse,with 3 directors below the age of 50, 4 directors aged between 50 and 60, and 8 directors aged 61 or above,as of August 14, 2024. In terms of gender, there are 13 male directors (86.67%) and 2 female directors (13.33%). Regarding industry experience, 71.43% of the directors have relevant Global Industry Classification Standard (GICS) financial work experience (Tso-Cheng Su is an executive director and therefore not included in this calculation). Gender equality has been equally weighted by TCFHC with having at least two female members in the Board being set as the goal. At present, the number of female members in the Board of Directors in this term is two, which has achieved the goal. The relevant implementations are listed as follows:

Critical Concerns

Each responsible unit of the Company reports critical concerns to the Board of Directors in accordance with practical operations or regulatory requirements to facilitate the Board of Directors to be aware of and communicate with them in real time. There are a total of 33 events in 2023. For relevant information, please refer to the official website .

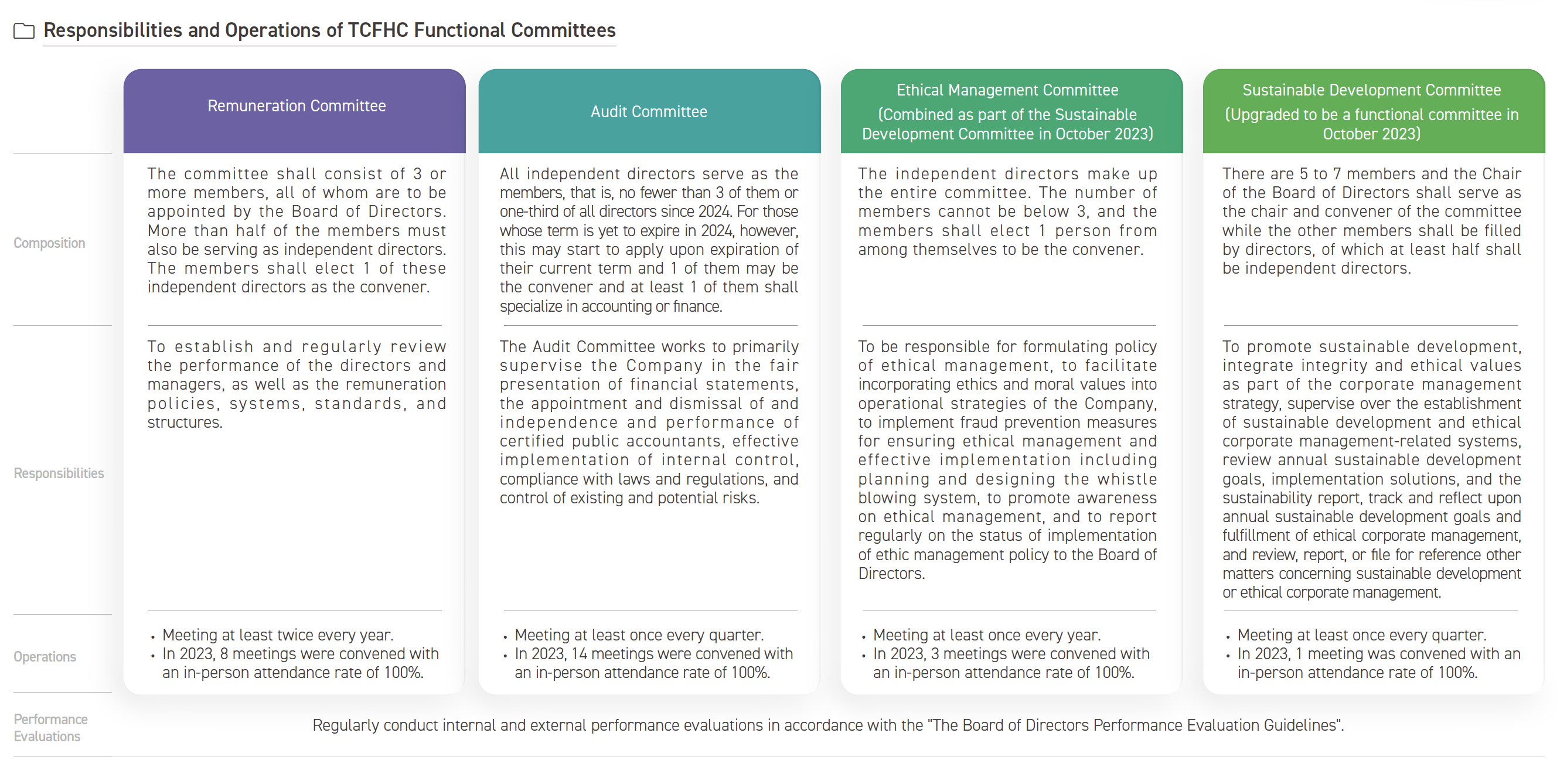

Functional Committees

To leverage the roles and strengthen independence of the Board of Directors, the Company has established 3 functional committees under the Board of Directors which are Remuneration Committee, Audit Committee, and Sustainable Development Committee. In addition, special committees have been established under the Chair to enhance corporate governance and improve risk management and legal compliance systems.

Performance Evaluation of Board of Directors

The "Board of Directors Performance Evaluation Guidelines" are established to enhance the operating efficacy of the TCFHC’s Board of Directors. The Board of Directors and functional committees shall conduct internal performance evaluations each year according to the regulation. They shall also commission external professional independent institutions or teams of external experts and scholars to evaluate at least once every 3 years. The results of both internal and external performance evaluations shall be reported to the Board of Directors by the end of March of the following year. The result of such evaluations is taken as reference for appointing or nominating directors, whereas the result of each individual director’s evaluation is taken as reference for arranging each of their individual remuneration.

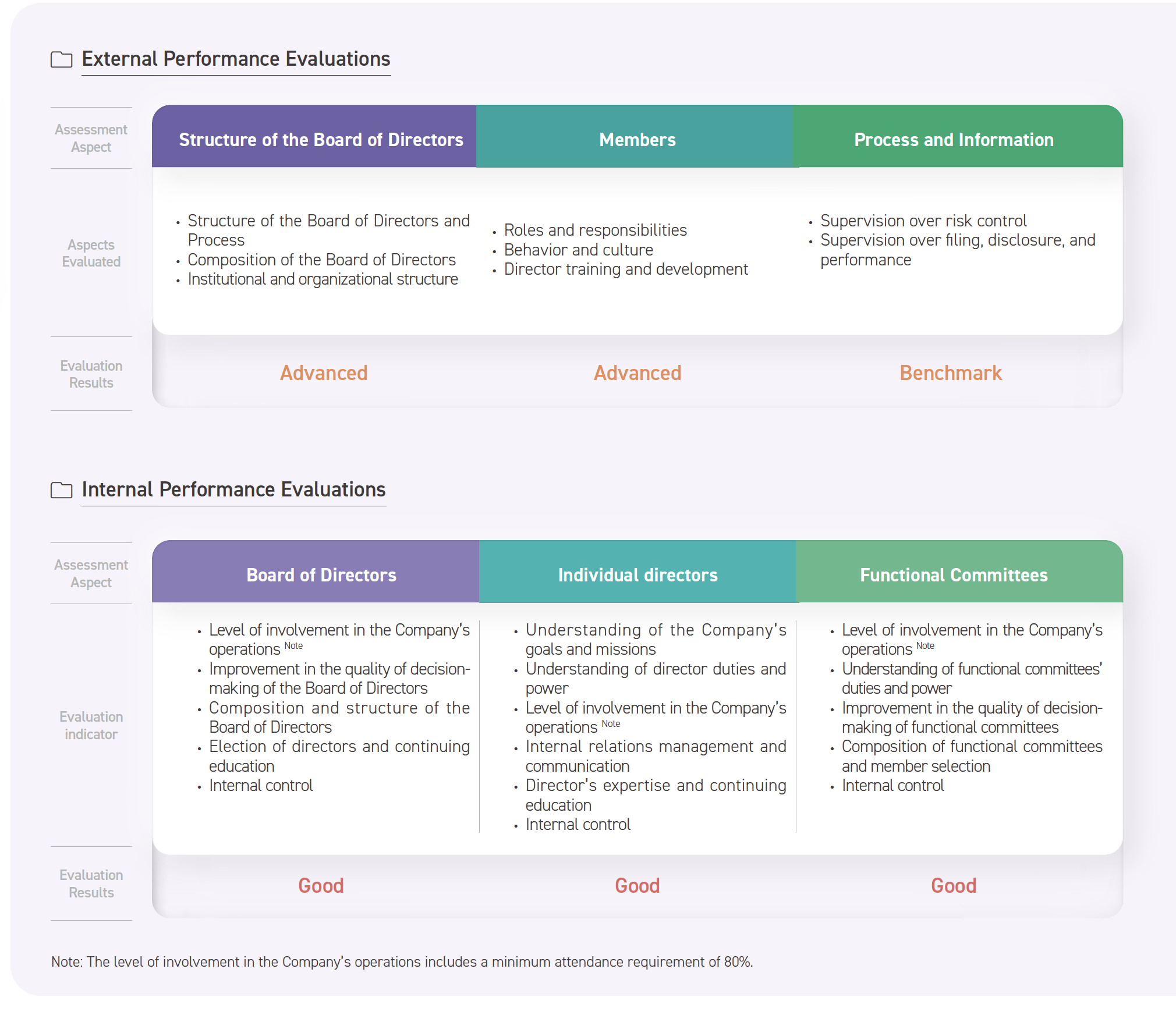

In 2023, the Company authorized a third-party institution to evaluate the external performance of the Board of Directors; the overall performance in 3 major aspects, namely, "Structure", "People", and "Process and Information" were rated "Advanced", "Advanced", and "Benchmark", respectively. The scope of the Board of Directors’ internal evaluation for 2023 included the Board, individual members of the Board, and functional committees. Evaluation methods were internal self-assessment and director/member self-assessment. All evaluation results were classified into "good." The evaluation cycle, evaluation period, evaluation scope, evaluation method, and evaluation results of the performance of TCFHC’s Board of Directors are all announced on the Company’s official website .

Continuing Education for Directors

TCFHC followed the "Directions for the Implementation of Continuing Education for Directors and Supervisors of TWSE Listed and TPEx Listed Companies" and arranged trainings for directors to reinforce their professional capabilities so as to empower corporate governance in the company.

In 2023, the directors completed a total of 214.6 hours of training encompassing corporate governance, FinTech, IT Security, anti-money laundering, risk management, and internal control and audit. In addition, to enable directors to effectively keep abreast of ESG issues and development trends, each director participated in 1 or more ESG-related courses. For details of courses that the TCFHC directors have participated, please visit the website of TWSE’s Market Observation Post System for inquiry .

Remuneration of Directors and Senior Management

The remuneration of the directors of the Company includes monthly remuneration, subsidies for health examinations (reimbursement based on actual expenses), and director remuneration. The Board of Directors is authorized to formulate the monthly remuneration for directors (excluding the Chair) according to the recommendations of the Remuneration Committee. The Board not only considers their involvement in the Company’s operation and value of their contributions but also the Company’s business performance and standard generally adhered by other industries of the same trade. In addition, regular internal and external performance evaluations of directors’ are conducted, and the evaluation results are reported to the Remuneration Committee as a reference for the Remuneration Committee to evaluate regularly and formulate the director remuneration. The director remuneration is based on the profit pre-tax before deducting employee remuneration and director remuneration in the current year, allocating a maximum of 1% of the amount recommended by the Remuneration Committee. The remuneration is submitted to the Board of Directors for review and reported at the shareholders’ meeting. The remuneration of the Chair is 1.25 times the total remuneration received by CEO.

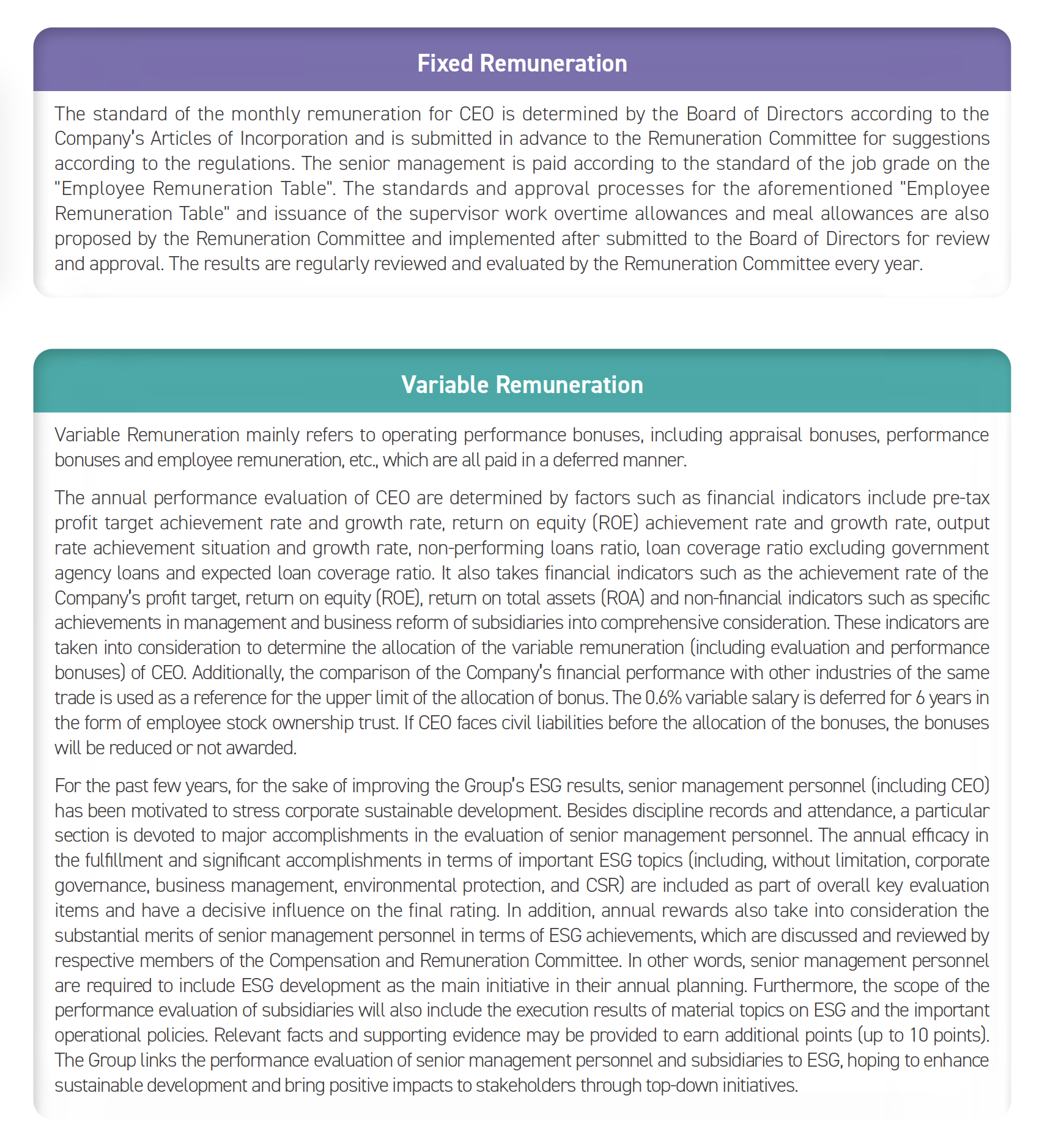

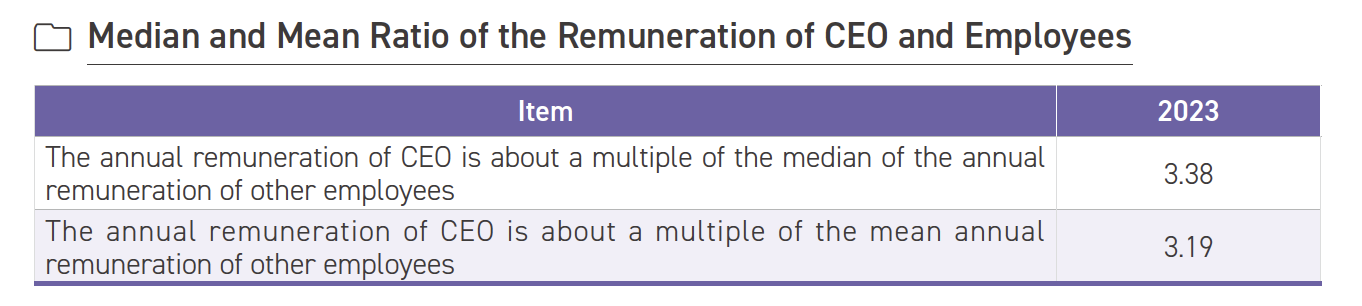

Senior management (including CEO) remuneration can be divided into fixed and variable remuneration, including basic salary, supervisor work overtime allowance, meal allowance, health examination subsidy (reimbursed based on actual expenses), bonuses, and employee remuneration. However, CEO does not receive employee remuneration in accordance with the regulations.

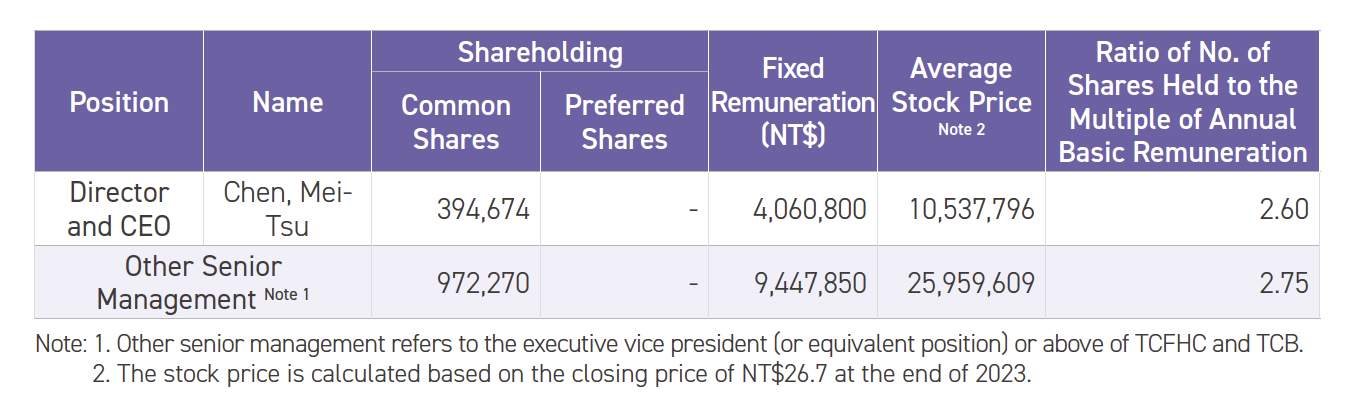

Shareholding

Although the Group has not currently stipulated relevant regulations for the shareholding of senior management, it has currently included the Company’s financial achievement as an evaluation indicator for business performance bonuses. The Group also connects it to the employee’s performance evaluation and rewards, hoping the long-term interest of the management and the company will gradually become consistent. The shareholding of CEO and other senior management has gradually increased over the years. Furthermore, since 2020, TCB has launched an employee stock ownership trust and raised the maximum withholding amount for employees to NT$20,000 per month by the end of 2021. In addition, to live through and honor the essence of caring for its people, employee stock ownership trust was planned concurrently for the TCFHC and other subsidiaries in 2023 and was enforced comprehensively in January 2024 as proactive incentives for senior management personnel to purchase and hold shares of the Company during their service.