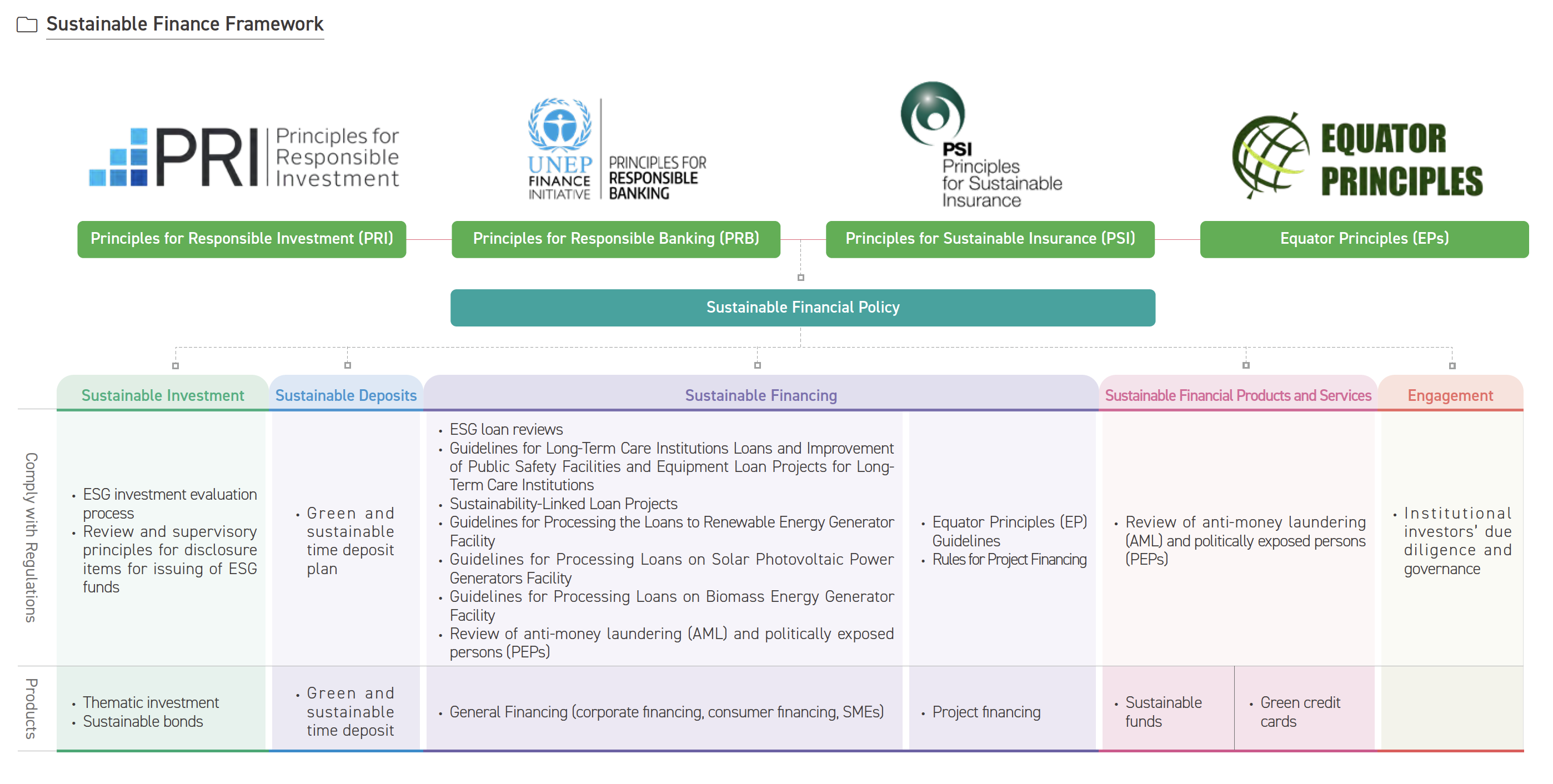

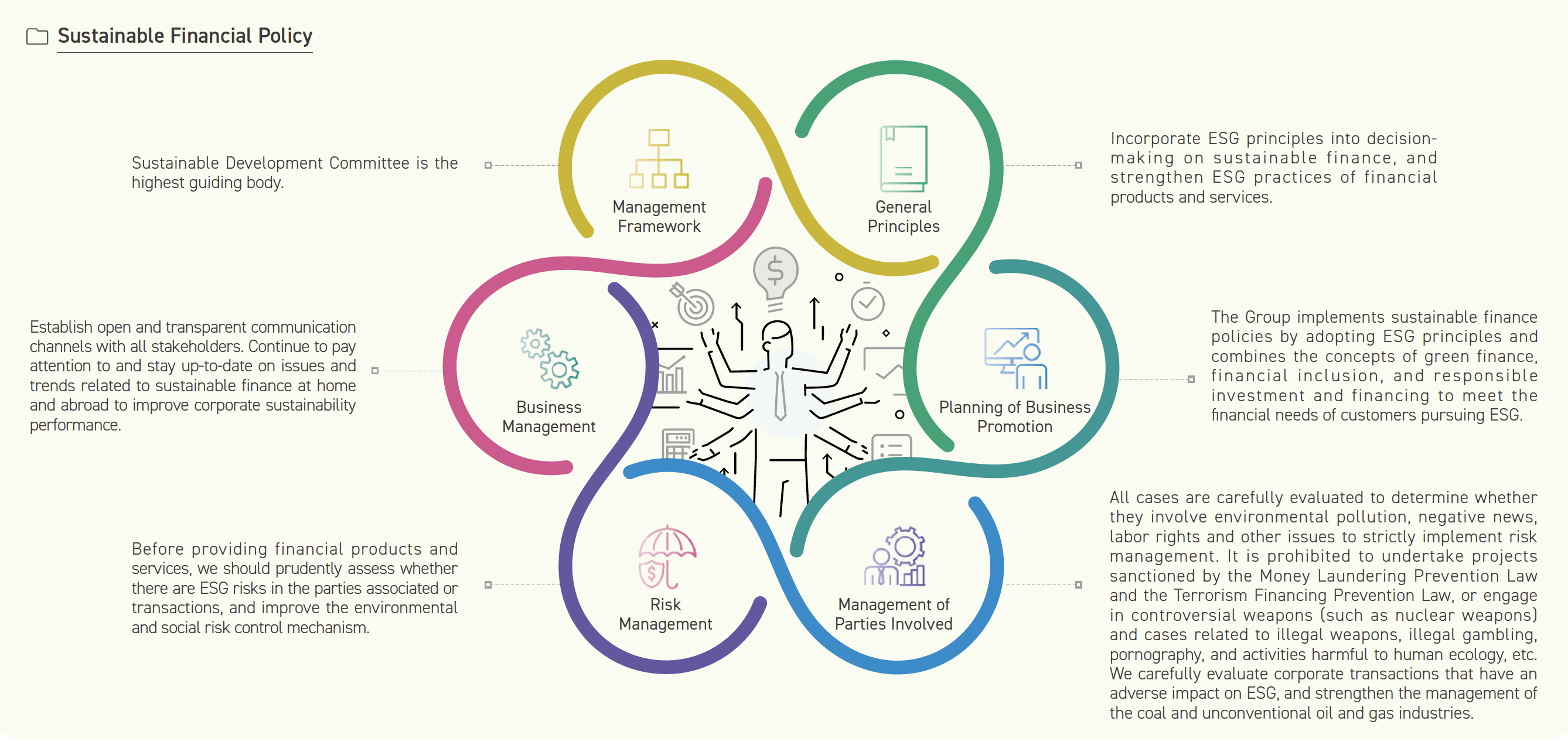

Financial institutions can use the power of investment and financing to guide the transformation of enterprises on the net-zero path. To exercise the core influence in the financial industry, the Group actively integrates international norms to promote sustainable finance, follows the standards or guidelines of the Principles for Responsible Investment (PRI), the Principles for Responsible Banking (PRB), and the Principles of Perpetual Insurance (PSI), and signed the Equator Principles (EPs) at the end of March 2022. In July of the same year, it signed to join the Science-Based Carbon Reduction Target Initiative (SBTi). In December, it completed setting medium- carbon reduction targets and submitted them for SBTi review, and passed the target review in August 2023. Following the mentioned international standards or initiative, the Company has formulated the "Sustainable Financial Policy" and incorporated ESG factors into the development strategies and operating procedures of core businesses such as investment, financing, underwriting, and insurance to achieve the Group’s long-term goals of low-carbon transitions for investments and finance.